Mid to late-stage private markets in India are feeding from the valuations and corporate actions of the listed VC-backed cohort – the most prominent trend that we are seeing play out is increased interest in secondaries in companies that are a step away from IPOs.

We think this is the most attractive segment of the market both for the exiting sponsors and incoming investors seeking predictability of returns in quality assets. The valuation and degree of interest in these companies are increasingly being driven by the valuations of their listed peers.

While compiling the Q3 FY24 edition of the TRMG RainGauge Index- a market cap weighted index of venture backed companies that really matter, we came across some interesting learnings:

As expected, the VC-backed listed cohort reflects NASDAQ and S&P BSE mid-cap more than NIFTY50.

Data as on Feb 29, 2024. Performance (%) quoted is absolute return as on Feb 29, 2024. Data Source: FactSet.

Data as on Feb 29, 2024. Performance (%) quoted is absolute return as on Feb 29, 2024. Data Source: FactSet.

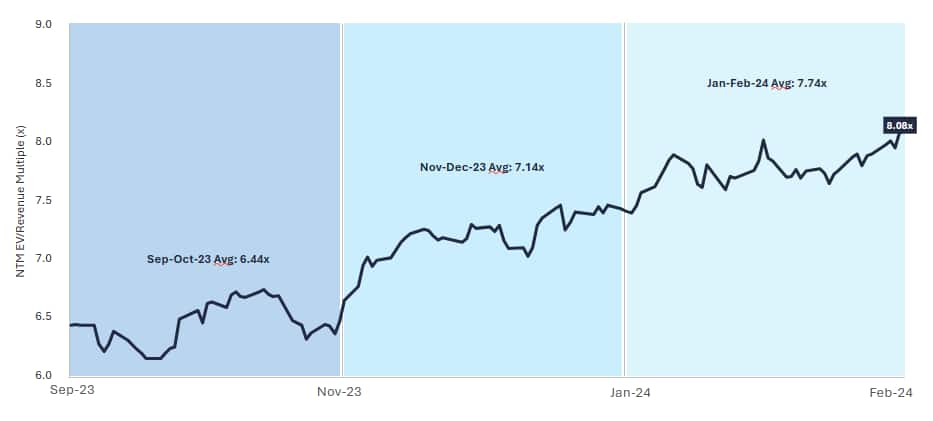

Material re-rating in the RainGauge Index (RGI) valuation multiples has happened between September 2023 and now.

The EV/Revenue NTM multiple has been calculated as total daily enterprise value of TRMG RGI companies in INR divided by Total NTM sales of all companies in INR; Source: Factset

The EV/Revenue NTM multiple has been calculated as total daily enterprise value of TRMG RGI companies in INR divided by Total NTM sales of all companies in INR; Source: Factset

India’s listed tech platforms have come of age – both in terms of delivering profits with scale coupled with supernormal growth and the markets are appreciating that. Growth is being richly rewarded - those index constituents that are growing at higher than 25% are trading at 40% premium to those who don’t.

On the contrary, those with EBITDA margins less than 5% today are trading at a 2x premium to those with higher current margins. The market is clearly valuing earnings power over current earnings.

Data Source: Factset; LTM EBITDA Margin as on Dec-23

Data Source: Factset; LTM EBITDA Margin as on Dec-23

The RGI companies trade at 1.7x the mid-cap companies because they grow at 1.5x times higher than them.

Data source: FactSet; Enterprise Value as on Feb 29,2024; Revenue & EBITDA as on 31/12/2023

Data source: FactSet; Enterprise Value as on Feb 29,2024; Revenue & EBITDA as on 31/12/2023

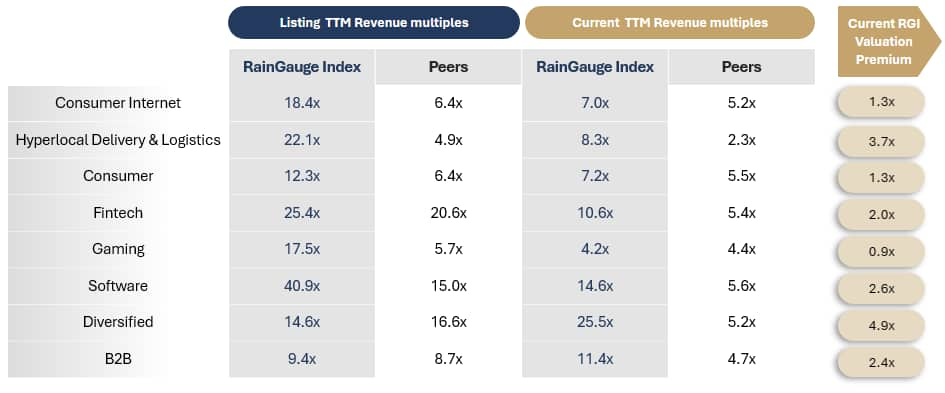

RGI Companies trade at 1.3-4.9x its direct peers which is a mix of traditional companies and global tech peers.

Note: Current TTM Revenue Multiples as on Feb 29, 2024. Revenue multiples at listing is the average of trailing TTM revenue multiples at the end of the first quarter post listing of companies within each category. Revenue multiples at listing for peers represents average trailing TTM revenue multiple at the end of the first quarter post listing of their counterpart in the TRMG RainGauge Index. Any mention of stock/sector names does not constitute investment advice. For educational purposes only. Data Source: FactSet

Note: Current TTM Revenue Multiples as on Feb 29, 2024. Revenue multiples at listing is the average of trailing TTM revenue multiples at the end of the first quarter post listing of companies within each category. Revenue multiples at listing for peers represents average trailing TTM revenue multiple at the end of the first quarter post listing of their counterpart in the TRMG RainGauge Index. Any mention of stock/sector names does not constitute investment advice. For educational purposes only. Data Source: FactSet

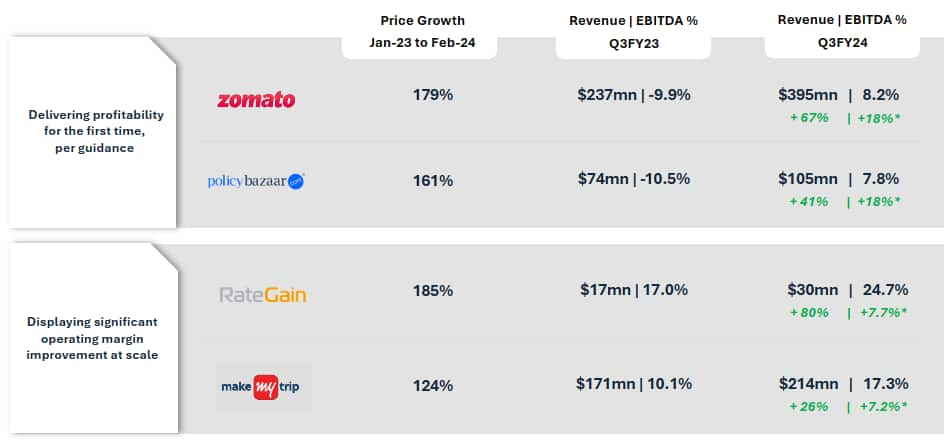

Zomato and PolicyBazaar have been top gainers in the RGI riding on first time profitability while RateGain and MakeMyTrip have been gainers riding on significant margin expansion.

Note: Price growth is absolute growth in price from 01-01-23 to 29-02-24; *EBITDA improvement is calculated as % point improvement in the EBITDA margin from Q3FY23 to Q3FY24

Note: Price growth is absolute growth in price from 01-01-23 to 29-02-24; *EBITDA improvement is calculated as % point improvement in the EBITDA margin from Q3FY23 to Q3FY24

The majority of the RGI companies that listed at a premium have sustained the momentum and continue to trade above their listing prices.

$ Current Price as on 29/2/2024. # Current Gain/Loss calculated as the absolute (%) since listing. ^ Price adjusted for splits and bonuses * Price in US Dollar

$ Current Price as on 29/2/2024. # Current Gain/Loss calculated as the absolute (%) since listing. ^ Price adjusted for splits and bonuses * Price in US Dollar

The buoyant market and performance of listed peers have prompted several VC-backed companies to file for IPOs.

Note: Majority of Unicommerce is owned by Snapdeal | Source: Company DRHP filings with SEBI; Tracxn

Note: Majority of Unicommerce is owned by Snapdeal | Source: Company DRHP filings with SEBI; Tracxn

The complete report can be downloaded from: RainGauge — The Rainmaker Group

Kashyap Chanchani is the Managing Partner at The Rainmaker Group, Dhwani Mehta and Jayati Jain are his colleagues. The firm advises mid-late stage private, venture-backed companies on fundraising.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.