If you are weighing the options between the new tax and the old tax regime, then understand that the math significantly affects salaried individuals earning Rs 15 lakh. This is because the 25 percent tax slab that would have been applicable to them has been removed as per the 2023 union budget.

Even though the new tax regime offers a lower taxation rate of 20 percent to those earning Rs 15 lakh, the old tax regime offers the benefit of reducing the overall taxes with the help of deductions and exemptions. So, the steep 30 percent tax bracket applicable under the old tax regime for those earning Rs 15 lakh fails to negate the benefits that the deductions offer.

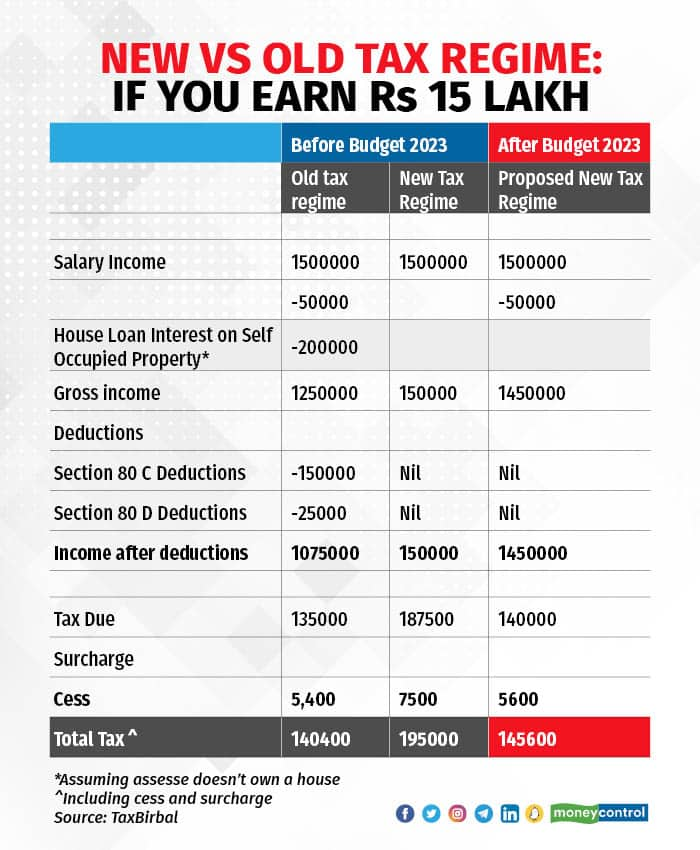

Let’s compare the old and the new tax regimes based on actual numbers. Moneycontrol.com, in collaboration with Tax Birbal, has drawn up the comparison for you.

For the purpose of these tax calculations we have considered a standard deduction of Rs 50,000 for both the tax regimes. However, a total deduction of Rs 3.75 lakh — including section 80 C benefits worth Rs 1.5 lakh, section 80 D benefits for medical insurance worth Rs 25,000, and Rs 2 lakh worth of home loan interest benefit — have been considered for the old tax regime.

How does the new tax regime fare? As per the new tax regime announced by Finance Minister Nirmala Sitharaman on February 1, 2023, for an income of Rs 15 lakh, a 20 percent tax liability would translate to a tax of Rs 1,45,600 (including cess) as the standard deduction, which wasn't available under the new tax regime has been offered in the proposed new tax regime, even though the tax bracket of 25 percent has been removed.

This tax regime has been made the default option for tax assesses and would offer a lower tax rate and simplified tax compliance. Exemptions or deductions for house rent allowance, leave travel allowance, home loan interest repayment, and even tax-saving investments can’t be used to reduce taxes.

The revised new tax regime will be applicable from April 1, 2023. Per the existing new tax regime (pre budget 2023), which doesn’t offer the standard deduction benefit, an income of Rs 15 lakh one would fall under the 25 percent tax bracket, and one’s tax liability would be Rs 1.95 lakh.

A comparison of the old tax regime with the new (proposed) tax regime for income of Rs 15 lakh.

A comparison of the old tax regime with the new (proposed) tax regime for income of Rs 15 lakh.

Is the old tax regime better? If you were earning Rs 15 lakh and opted for the old tax regime, then the total taxes after deductions worth Rs 3.75 lakh would work out to Rs 1,40,400 per annum — a saving of Rs 5,200 compared to the revised new tax regime applicable from April 1.

Compared to the existing new tax regime, one would save taxes amounting to Rs. 54,600.

So, even with the changes announced in the new tax regime, it does not make sense for those earning an income of Rs 15 lakh.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.