Funding for India’s startups, collectively the world’s third-largest, plunged to about a third in the first quarter of 2023 with no respite for companies battling slowing growth amid worsening macroeconomic headwinds.

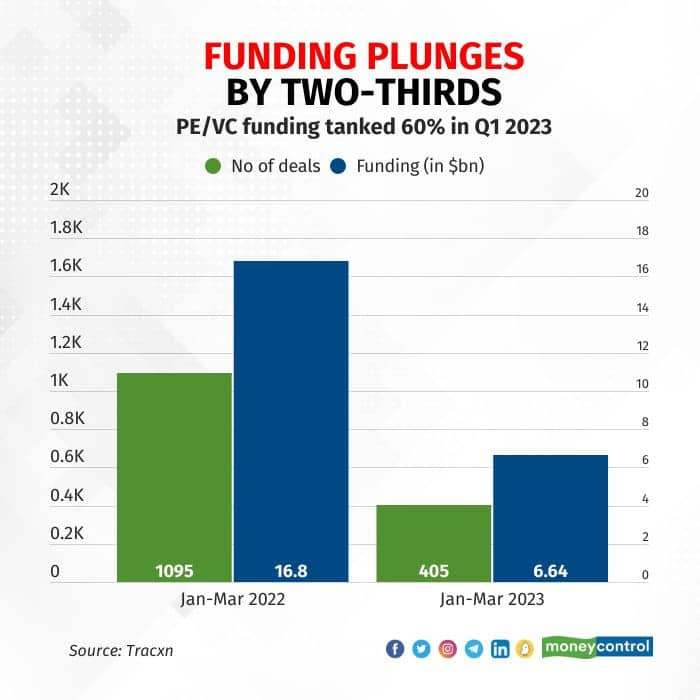

Private equity and venture capital (PE/VC) funding fell 60.5 percent to $6.64 billion in January-March from $16.8 billion a year earlier, according to data collated by Moneycontrol through Tracxn Technologies. Startups secured 405 funding rounds against 1,095 in the first three months of 2022, the data showed.

Funding plunges in Q1 2023

Funding plunges in Q1 2023Investors participated in 122 rounds and invested about $3.6 billion in March, against $5.69 billion invested across 406 funding rounds in the year-ago period.

Funding in March

Funding in MarchAlso Read: Funding to Indian startups falls 77% in no respite for the world’s third-largest startup ecosystem

Fintech was the most-sought after sector, raising $1.31 billion. Consumer tech and retail followed. Last year, SaaS (software-as-a-service) had emerged as the top sector in the first three months with companies raising $5.29 billion.

Top sectors in Q1 2023

Top sectors in Q1 2023“SaaS has been a strong sector during Covid on account of higher engagement resulting in many companies in this space achieving high valuations. It’s not uncommon for valuations to fluctuate based on the perceived growth potential and financial performance,” said Ankur Pahwa, managing partner of PeerCapital. “Overall, the SaaS sector is complex and diverse, and the performance of individual companies can vary widely. As investors, we carefully evaluate the fundamentals of each company before making investment decisions.”

Recovery periodYCombinator, one of the world’s largest startup incubators and a VC that has invested in almost 2,000 SaaS companies globally, emerged as the top investor in the first quarter of 2023. YCombinator participated in 10 funding rounds alongside 100x.VC, a domestic early-stage investor, touted as India’s YCombinator. To be sure, YCombinator topped the investors’ list in the first quarter of 2022 also with 34 deals.

Top PE/VC investors in 2023

Top PE/VC investors in 2023Tiger Global Management, one of India’s most active startup investors that sounded extremely bullish on the country, participated in only one round in the first three months of 2023 compared with 14 in the year-ago period. Sequoia Capital participated in three rounds against 12 a year earlier. SoftBank, another aggressive startup investor in India, did not invest in any deal during the period.

“I view this as a rationalisation. The big daddies of tech investing have all tightened their spigots after shouldering investing big in 2021 and having seen valuations decline in 2022. While they may have hit the pause button, I do feel that this is a recovery period, and some investors are waiting for market conditions to stabilise,” said Pahwa.

While early-stage investors emerged as the top backers, early-stage investments lagged steam. Until last year, early-stage investments were robust even as late-stage funding had taken a hit. In January-September 2022, investors made 573 bets worth $2.3 billion compared with 726 deals worth $2.5 billion in the whole of 2021, Moneycontrol reported.

Late-stage Funding

Late-stage FundingEarly-stage deals tanked 58 percent in January-March 2023 versus the year-ago period. Early-stage investors closed 312 deals and invested 916 million against $2.18 billion invested across 834 deals in the same period last year.

Early-stage Funding

Early-stage Funding“The earliest stages had seen tourist investors and founders come in over the last couple years. These are the ones who have stopped investing. Investors like us have consistently been investing in the earliest stages regardless of outcome,” said Vatsal Kanakiya cofounder of 100x.VC. “Value creation in startups is a function of creating customer value. As long as founders keep building new businesses, there will be investors to help them along. These businesses will be built with the implicit assumption that late-stage capital will be limited.”

Late-stage investments, on the other hand, remained under pressure. In the first three months of 2023, late-stage startups secured $2.72 billion in funding across 41 deals against $10.9 billion across 168 deals in the first quarter of 2022.

Double whammy“Late-stage deals have been impacted by high previous round valuations from 2021, unprofitable bonus models, burn-and-earn mindset, and slowdown on the overall hyper growth they saw in 2021,” said Pahwa. “This reset period for large companies to build companies sustainably will certainly help them as the macro conditions improve in the next 3-4 quarters.”

The funding data of the first quarter brings little cheer to India’s startup ecosystem, which is now hit by a double whammy of a prolonged funding winter and slowing demand for technology-led services amid recessionary fears.

The recent crisis triggered by the fallout of Silicon Valley Bank has further dampened overall investment sentiment. Investors are of the opinion that the funding winter may now last longer than what most had anticipated and a reversal may start only by the first quarter of 2024.

With no end to the funding winter in sight, startups have taken cost-cutting measures and have laid off over 25,000 employees in the past 12 months.

“We expect times to be tough for the foreseeable future. Having said that, there is enough and more capital at the earliest stages,” said Kanakiya of 100x.VC. “The broader conversation has been towards conserving cash and extending the runway by at least 12 months. Investors are expounding posterity in hiring, in growth, and in economics. Those that will survive this market will be ready to capitalise on the next bull market.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.