Thinking of investing in the U.S. markets but not sure how to go about it and how much to invest? If you also have the same questions in your mind then you are not alone.

The toughest decision to make is to come out of the comfort zone – in this case, it is the domestic market where investors usually invest in. They have complete knowledge about the variables that impact the market as compared to say the U.S. market.

But, a platform like Stockal has made this task relatively simple for first-time investors who are looking to diversify.

Opening an account is relatively easy and once you are all set signed up then one can keep learning from the online library. It takes less than 15 minutes and 2-3 business days on platforms like Stockal to open an account and start trading.

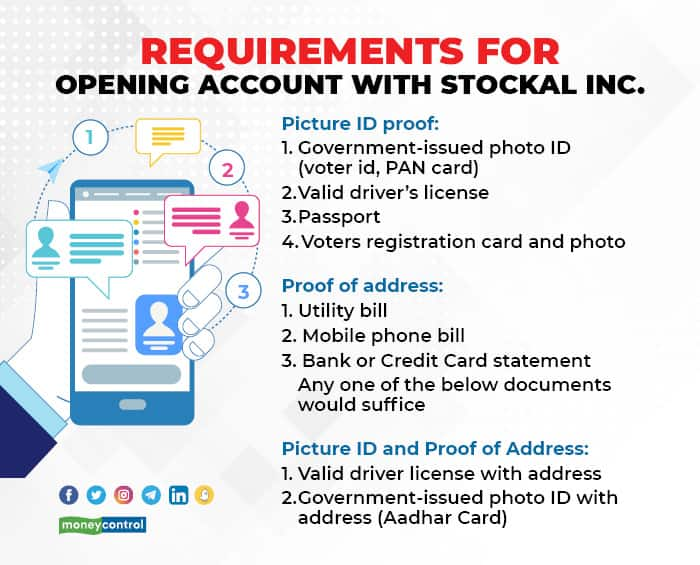

Investors need to fill the Account Opening Form on the platform. They will be required to upload their address and ID proofs during this process. It takes 2-3 business days for the account to get approved by the U.S. brokerage partner, DriveWealth. They do the KYC documentation and filing within this time frame.

(KYC means Know Your Customer and sometimes Know Your Client. It is a mandatory step to establish the identity of the user via picture ID and proof of address.)

Any one of the following documents for a combination of identity and Proof of Address are required:

Once you are all set up, the next step is to finalise how much to invest. You can start investing as low as $10 (Rs 750*) and go upto $250,000 (Rs 1.8cr*) every year in foreign stocks from India. *(Rs 75/USD)

This amount can change subject to RBI guidelines. Your investments in the U.S. securities are also governed by the same limit.

It is to be noted that all foreign investments fall under clearly defined RBI guidelines. The remittance of money for foreign investments comes under the Liberalized Remittance Scheme (LRS).

Under LRS, an Individual can remit up to $250,000 per financial year to invest in foreign equities done through an authorized dealer such as Stockal. As per the RBI policy, having a PAN card is required to purchase shares in foreign countries.

It looks like you are all set to start trading in the U.S. markets.

Happy investing!

To invest in the U.S.Stocks, visit: https://moneycontrol.stockal.com/landing-page and Visit https://www.moneycontrol.com/msite/global-investing for FAQs and Daily News Updates.(This is a partnered post)

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.