ONGC Ltd, the state-owned Oil & Gas major, is forecasted to witness a 28.3 percent year-on-year jump in its standalone profit after tax (PAT) for the quarter ended December, 2022. The growth in revenue and earnings is likely to be driven by a surge in APM gas prices which zoomed ~3x YoY and 40 percent QoQ.

The crude prices after the impact of the windfall tax are likely to remain stable on a yearly basis. This positive impact of higher prices, however, is partially negated by muted volumes in both its oil and gas business streams.

The ‘Navratna’ company is slated to declare its results for the quarter ended December 2022 on Tuesday, February 14.

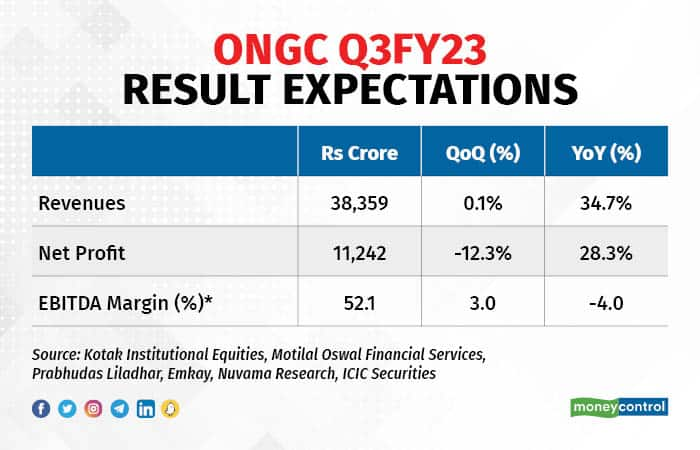

According to a poll of brokerages conducted by Moneycontrol, ONGC is forecasted to report a standalone PAT of Rs 11,242 crore for the quarter with the standalone revenues likely to clock Rs 38,359 crore.

The company had recorded a standalone PAT of Rs 8,764 crore during the corresponding period of last year on revenues of Rs 28,473 crore.

During the preceding quarter of the current fiscal, the standalone PAT stood at Rs 12,826 crore on revenues of Rs 38,321 crore.

What do brokerages expect?

Emkay India Equity Research

The brokerage and research firm expects the revenue to jump 36 percent on year and one percent sequentially to Rs 38,737 crore, and expects earnings before interest, tax, depreciation and amortization (EBITDA) of 18,609 crore, a growth of 25.3 percent on year and 15.6 percent QoQ.

It expects a PAT of Rs 10,651 crore, which is a YoY growth of 21.5 percent. Sequentially, however, the PAT is likely to be down 17 percent due to higher other income in the previous quarter.

Emkay expects “net crude oil realisation at $ 84.7 per barrel, gas up 43-44 percent QoQ, while crude oil/gas production volumes expected to decline by 1 percent and 5 percent YoY each.”

Kotak Institutional Equities

Kotak pegs the standalone revenues for the company to grow at 38 percent on year and 2.4 percent QoQ to Rs 39,242 crore, while EBITDA is forecasted to grow at ~30 percent YoY and 10 percent sequentially to Rs 20,687 crore.

“We model overall crude oil sales volumes of 4.8 million metric tonnes (MMT) (up 2 percent QoQ but down 5 percent YoY) and natural gas sales volumes to decline 4 percent YoY and one percent QoQ to 4.1 billion cubic meters (BCM) as long-term decline continues for legacy fields, and ramp-up continues to see a delay in KG-98/2 block”, the brokerage said in its report. “We model gross crude price realization of $85 per barrel (-11 percent QoQ) and net oil price realization (post royalty, windfall tax and cess) of $ 46 per barrel (-1 percent QoQ)”.

It forecasts a PAT of Rs 12,002 crore, a 37 percent mYoY growth and a 6.4 percent sequential decline.

EBITDA margin at 52.7 percent is seen declining by 337 bps on year but on a sequential basis, there is an improvement of 362 bps.

Motilal Oswal Financial Services

The brokerage sees a 37.6 percent YoY increase in revenue to Rs 39,168 crore and estimates an EBITDA of Rs 19,551 crore at a YoY growth of 22.4 percent and a sequential growth of 4 percent.

PAT at Rs 11,345 crore is a growth of 29.5 percent compared to the same period last year but it has declined 11.5 percent over the preceding quarter.

The analysts at the brokerage expect, “net realization (before windfall tax) to grow 17 percent YoY but decrease 7 percent QoQ, in line with Brent movement. Expect oil sales at -5 percent YoY and +1 percent QoQ, with gas sales at -5 percent YoY and -2 percent QoQ. Value added product sales to decline 13 percent YoY.”

Production from the KG Basin remains crucial. Its completion stood at 76 percent in Oct’22 and first oil is expected in May’23.

ONGC closed Rs 1.45 higher at Rs 148.15 on February 13 at The National Stock Exchange. The stock is down 11.9 percent over the past year and is trading flat over the past one month.

Disclaimer: The views and investment tips of investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.