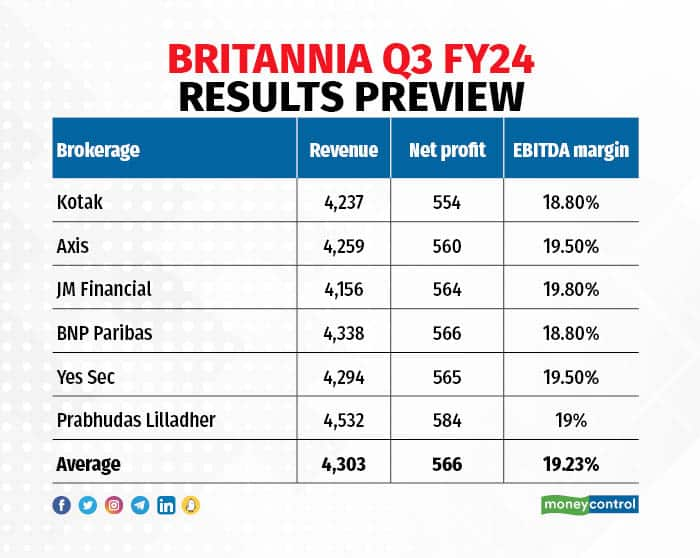

Britannia Industries Ltd on February 6 is likely to report a 2 percent year-on-year jump in consolidated net profit for the quarter ended December 2023. The net profit is seen at Rs 566 crore, as per a poll of six brokerages, as against Rs 556.8 crore in the year-ago period.

Analysts see muted growth in Q3 FY24 on the back of a high base (anniversarisation of price hikes), some price cuts, high competition and low single-digit volume growth. This will restrict revenue growth at 3 percent YoY at Rs 4,303 crore for the quarter.

On the lower end of the range, Kotak Institutional Equities and Axis Securities expect 1-2 percent growth in topline while BNP Paribas' estimate is on the higher side.

It is also important to note that Britannia had an exceptional gain of Rs 359 crore in the base quarter. If that is included, then net profit in Q3 FY23 works out to about Rs 932 crore. In that case, this quarter's net profit estimate looks like a fall of 39 percent YoY.

The net profit in base quarter included an exceptional gain due to the joint venture agreement with (France's) Bel SA for the cheese business.

Volume growth and margin

Competition from unorganised, local players is expected to keep volumes under check. Axis and Kotak peg volume growth at 1 percent, while Motilal and Yes Securities see it at 3 percent. Meanwhile, JM Financial expects volume growth at 4 percent YoY.

Since there is no major risk on the commodity front, brokerages expect gross margin to improve by an estimated 60 basis points sequentially. One basis point is one-hundredth of a percentage point. However, EBITDA margin at 19.23 percent is expected to decline on a YoY and QoQ basis.

"We estimate EBITDA margin to decline 110/70 bps qoq/yoy off a high base (1) lower employee costs boosted EBITDA margin in Q2 FY24, and (2) Q2 FY23 EBITDA margin was aided by wheat forward covers and about 40-50 bps benefit pertaining to prior period PLI incentives," Kotak Institutional Equities noted.

According to analysts, investors will be on watch out for management commentary on rural demand environment, raw material cost outlook, market share trends, update on core biscuits portfolio, cheese portfolio and other adjacencies.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.