8 Rakesh Jhunjhunwala portfolio stocks in which FIIs, MFs moved in tandem

In the March quarter, both foreign institutional investors and mutual funds increased their stake in the same four companies and trimmed their holdings in another four.

1/9

Investors keenly follow big bull Rakesh Jhunjhunwala’s portfolio picks for investment leads. It will also be interesting to see what foreign institutional investors (FIIs) and mutual funds (MFs) do with these stocks, as they invest at a much bigger scale. In the March quarter, Jhunjhunwala's portfolio shows holdings in around 35 companies. Moneycontrol analysed those stocks that saw interest from FIIs as well as MFs—either both increased their holdings in the March quarter or trimmed their stakes. Only eight of the 35 stocks met the criteria. Both FIIs and MFs increased their stake in four stocks and reduced their holding in an equal number of companies. We have considered companies in which institutional investors held a stake in the December quarter. Please note that this may or may not be an exhaustive list of Jhunjhunwala’s portfolio but only a list of companies in which he holds over 1 percent stake. (Data Source: ACE Equity)

2/9

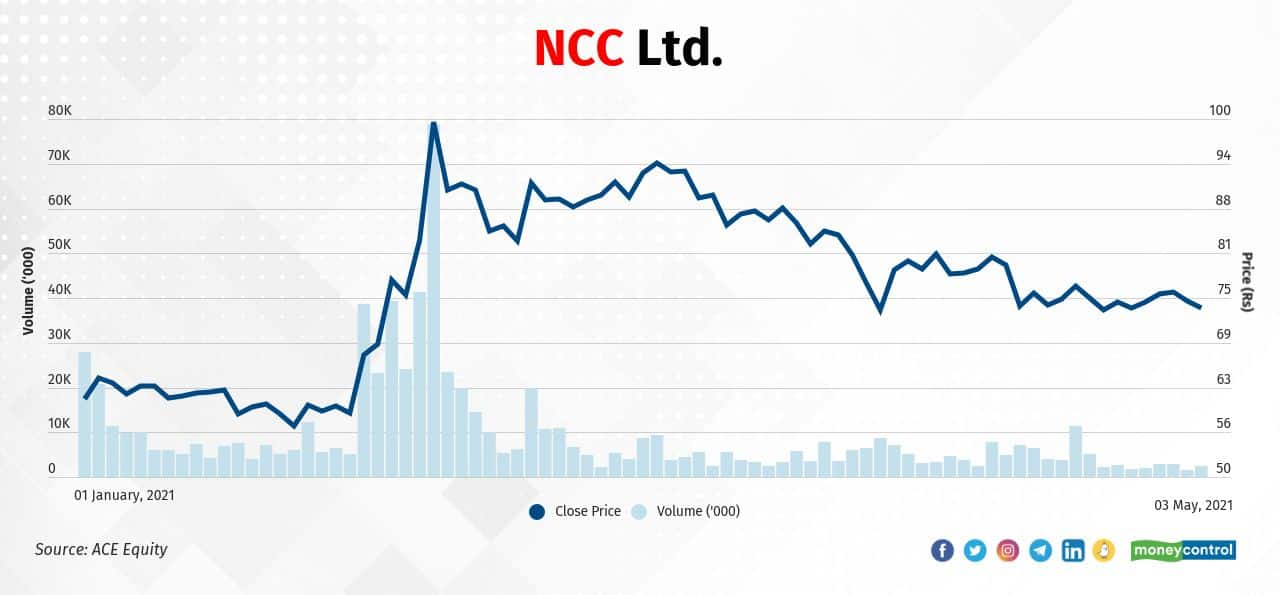

NCC | In the March quarter, Rakesh Jhunjhunwala held a 10.94 percent stake in the company. Foreign institutional investors increased their holding from 10.32 percent in the December quarter to 13.12 percent in the March quarter. Similarly, mutual funds increased their holding from 11.31 percent to 12.05 percent during the period. In 2021, the stock price jumped 28 percent to Rs 73.65 on May 3, 2021 from Rs 57.65 on December 31, 2020.

3/9

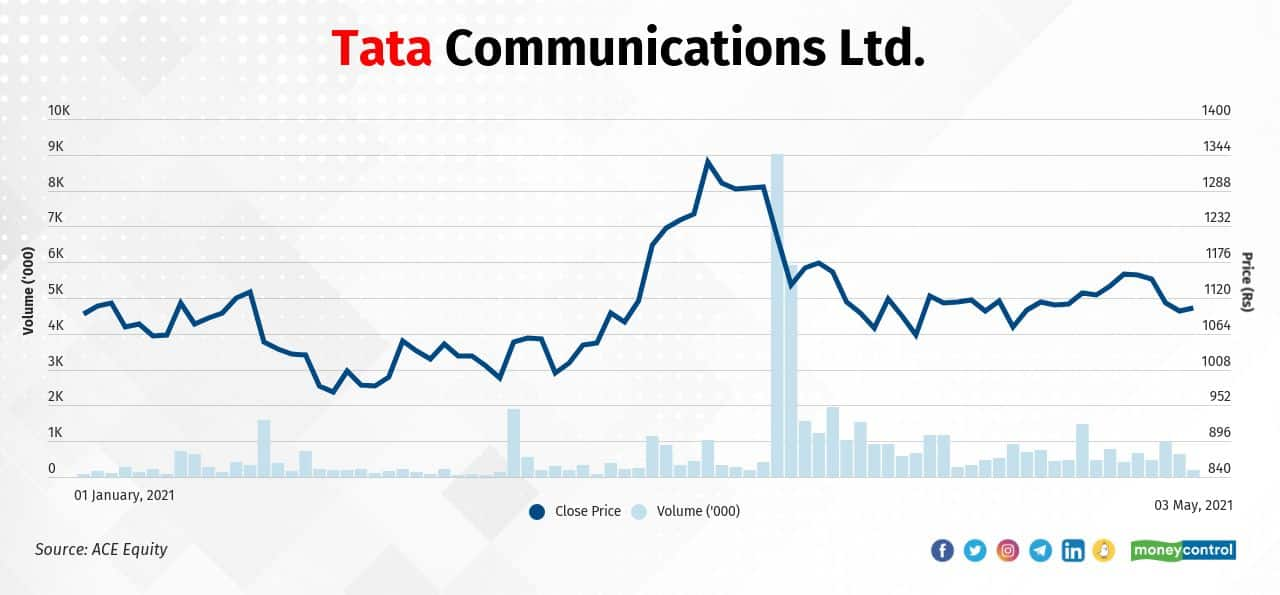

Tata Communications Ltd. | In the March quarter, Rakesh Jhunjhunwala held a 1.04 percent stake in the company. FIIs increased their holding from 17.65 percent in the December quarter to 24.40 percent in the March quarter. Similarly, mutual funds increased their holding from 0.41 percent to 4.01 percent during the period. In 2021, the stock price gained 0.41 percent to Rs 1,104.75 on May 3, 2021 from Rs 1,100.20 on December 31, 2020.

4/9

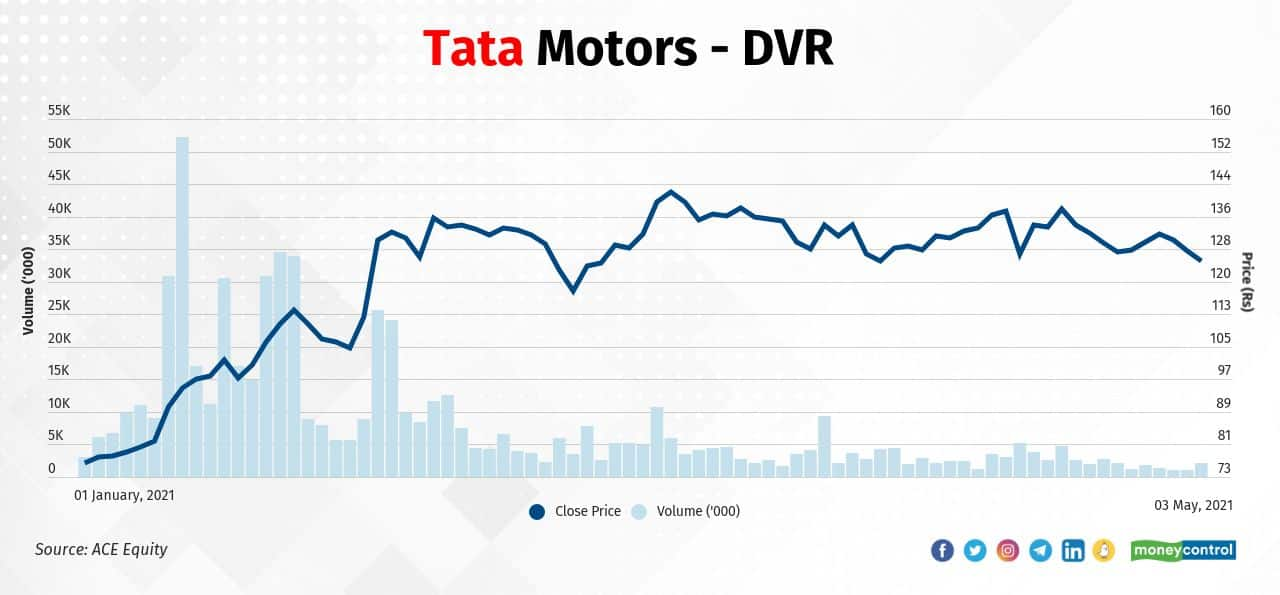

Tata Motors-DVR Ordinary | In the March quarter, Jhunjhunwala held a 1.97 percent stake in the company. FIIs increased their holding from 22.26 percent in the December quarter to 23.55 percent in the March quarter. Similarly, mutual funds increased their holding from 22.12 percent to 22.29 percent during the period. In 2021, the stock price jumped 67 percent to Rs 125.50 on May 3, 2021 from Rs 75.20 on December 31, 2020.

5/9

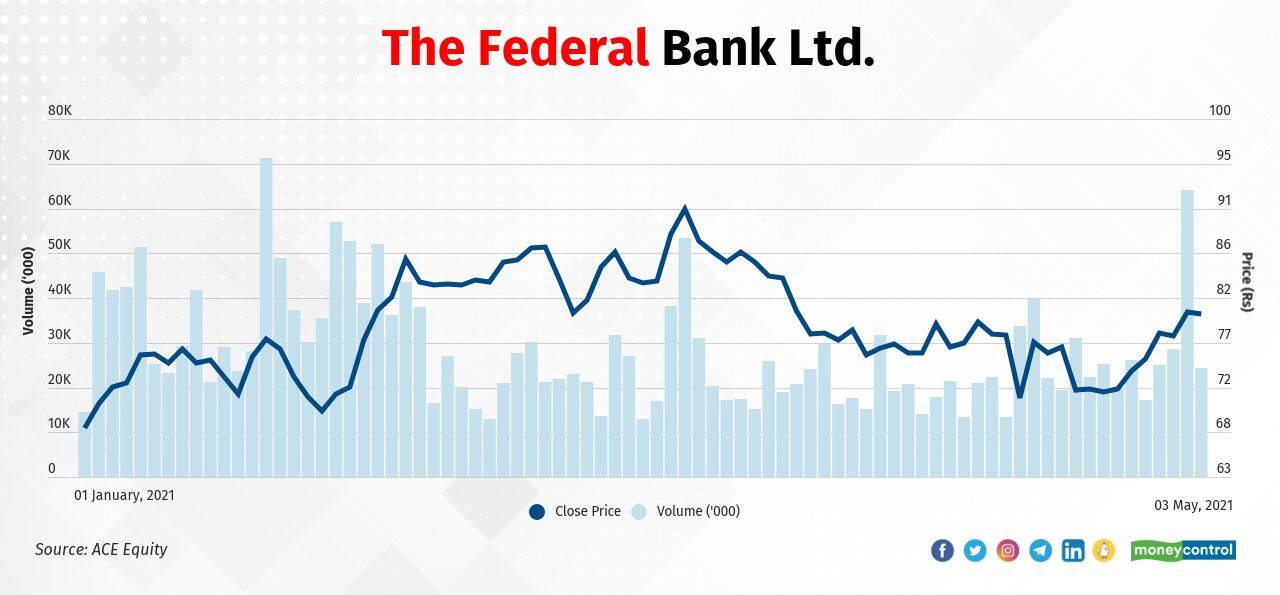

The Federal Bank Ltd. | In the March quarter, the ace investor held a 2.4 percent stake in the company. FIIs increased their holding from 21.69 percent in the December quarter to 24.51 percent in the March quarter. Mutual funds increased their stake from 29.90 percent to 30.23 percent during the period. In 2021, the stock jumped 20 percent to Rs 79.80 on May 3, 2021 from Rs 66.70 on December 31, 2020.

6/9

Lupin Ltd. | In the March quarter, Jhunjhunwala held a 1.6 percent stake in the company. Foreign institutional investors pared their stake from 18.97 percent in the December quarter to 17.87 percent in the March quarter. Similarly, mutual funds decreased their holding from 13.21 percent to 13.05 percent during the period. In 2021, the stock price jumped 10 percent to Rs 1,072.75 on May 3, 2021 from Rs 976.70 on December 31, 2020.

7/9

Prakash Pipes Ltd. | In the March quarter, Jhunjhunwala held a 1.31 percent stake in the company. FIIs reduced their holding from 0.28 percent in the December quarter to 0.14 percent in the March quarter. Similarly, mutual funds trimmed their stake from 0.03 percent to 0.02 percent during the period. In 2021, the stock price jumped 19 percent to Rs 138.45 on May 3, 2021 from Rs 116.30 on December 31, 2020.

8/9

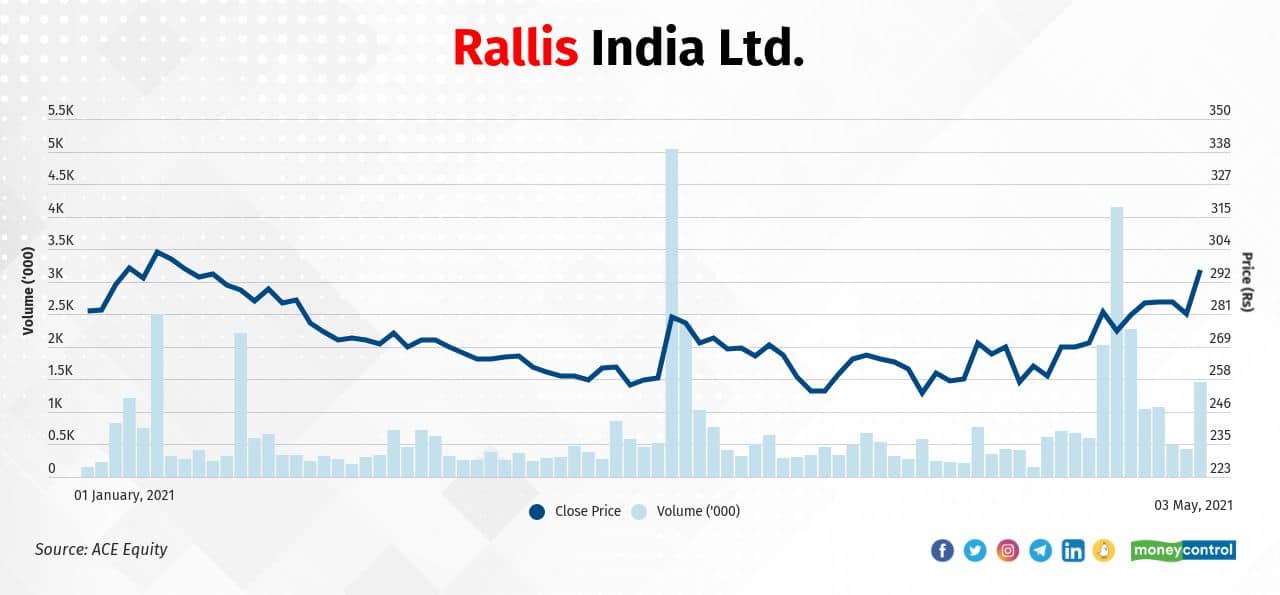

Rallis India Ltd. | In the March quarter, Jhunjhunwala held a 9.93 percent stake in the company. FIIs cut their holding from 8.16 percent in the December quarter to 7.58 percent in the March quarter. Similarly, mutual funds reduced stake from 12.84 percent to 12.83 percent during the period. In 2021, the stock has jumped 5 percent to Rs 295.90 on May 3, 2021 from Rs 280.95 on December 31, 2020.

9/9

The Indian Hotels Company Ltd. | In the March quarter, Jhunjhunwala held a 2.1 percent stake in the company. FIIs reduced their holding from 12.51 percent in the December quarter to 12.27 percent in the March quarter. Mutual funds, too, trimmed their stake from 20.19 percent to 19.70 percent during the period. In 2021, the stock has fallen 7 percent to Rs 111.50 on May 3, 2021 from Rs 120.10 on December 31, 2020.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!