Macro proof your SIPs with this MC30 midcap fund by Edelweiss MF

Investors with medium to high risk profile can consider investing in the Edelweiss Mid Cap Fund for long term given its less macro dependent portfolio that could be less responsive to the short-term gyrations

1/8

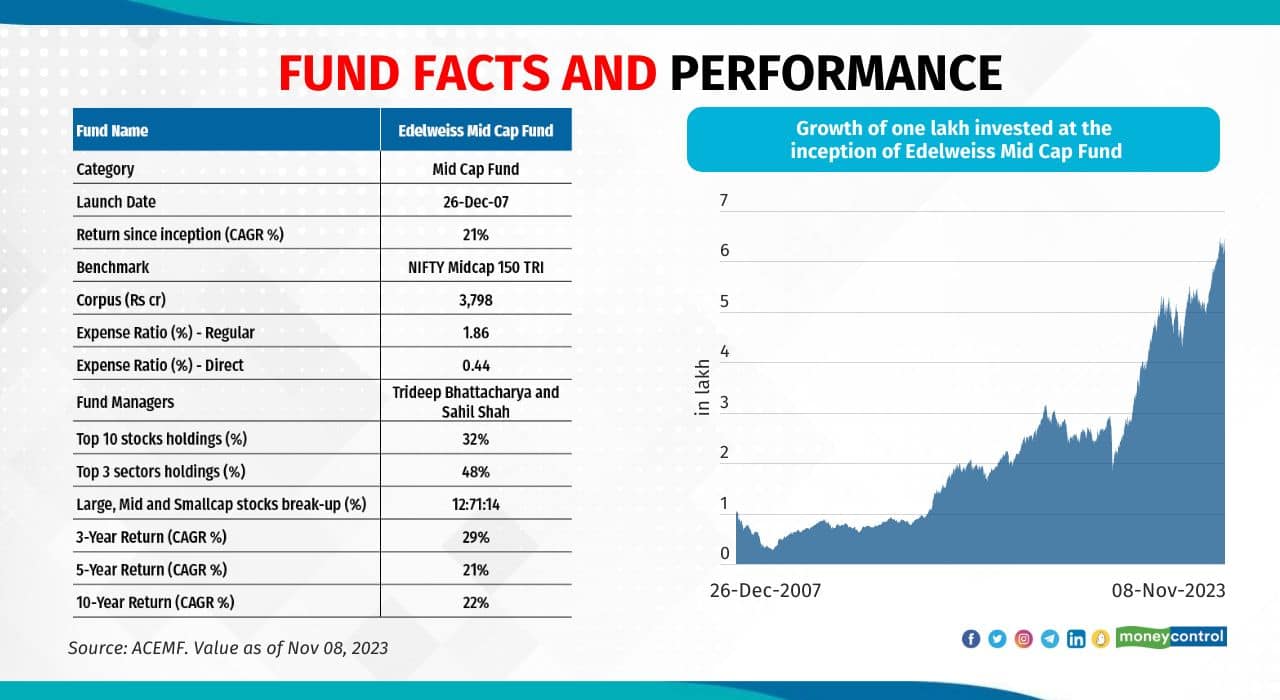

Edelweiss Mid Cap Fund (EMF) is a part of MC30; Moneycontrol’s curated basket of 30 investment- worthy top mutual fund (MF) schemes.

Fund managers: Trideep Bhattacharya and Sahil Shah.

Who is this meant for?: Investors with medium to high risk profile.

Why?: Good, long-term risk-adjusted returns. Portfolio is less dependent on macro-economics, and hence less responsive to the short-term gyrations.

Fund managers: Trideep Bhattacharya and Sahil Shah.

Who is this meant for?: Investors with medium to high risk profile.

Why?: Good, long-term risk-adjusted returns. Portfolio is less dependent on macro-economics, and hence less responsive to the short-term gyrations.

2/8

• EMF invests at least 65 percent in midcap stocks and the rest in large and smallcap stocks.

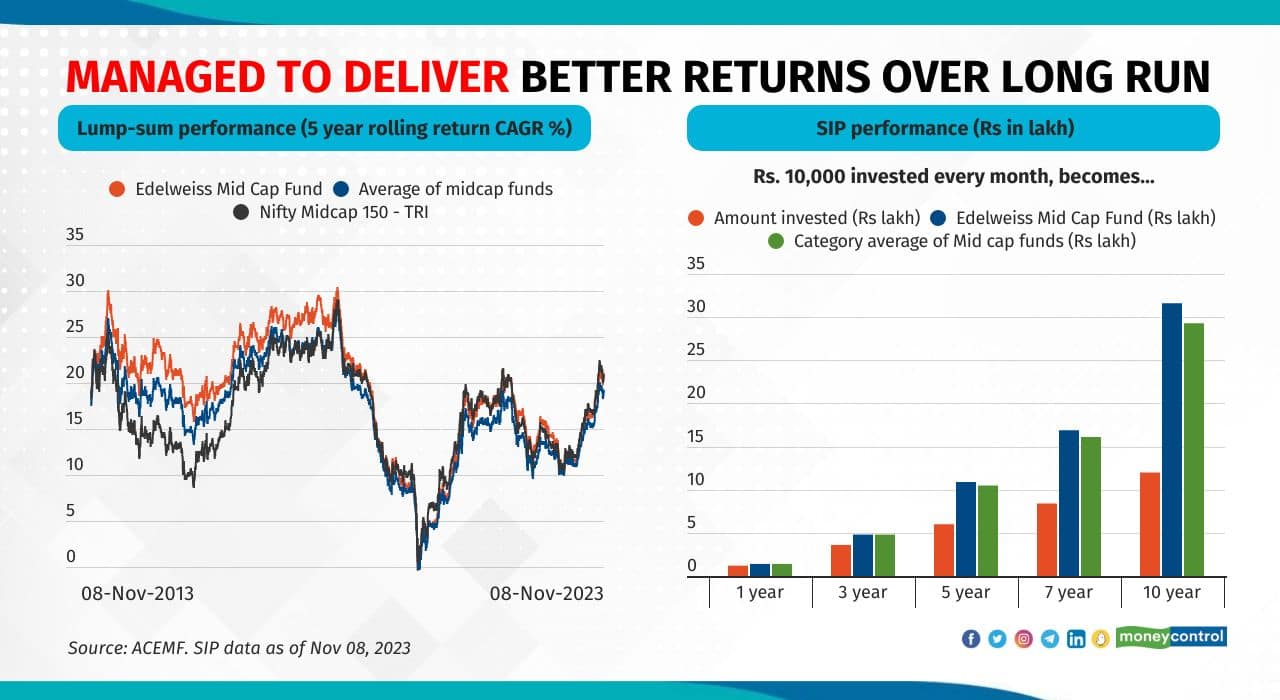

• Despite its recent average performance, EMF has managed to deliver decent returns over the long run.

• For instance, its performance as measured by 5-year rolling returns calculated over the last 15 years shows that EMF delivered a CAGR of 19 percent while the category average was 17 percent. Meanwhile, the benchmark Nifty Midcap 150 – TRI (Total Returns Index) gave 16.5 percent.

• Despite its recent average performance, EMF has managed to deliver decent returns over the long run.

• For instance, its performance as measured by 5-year rolling returns calculated over the last 15 years shows that EMF delivered a CAGR of 19 percent while the category average was 17 percent. Meanwhile, the benchmark Nifty Midcap 150 – TRI (Total Returns Index) gave 16.5 percent.

3/8

Portfolio strategy

• Bhattacharya says that EMF invests in quality businesses having profitable products and services and run by good managements. The portfolio is less macro dependent and more bottom-up driven, he adds.

• Bhattacharya is overweight on the less macro dependent sectors such as industrials, capital goods, infrastructure, construction and lending financials. Some of the niche areas in the midcap space wherein the fund manager holds meaningful exposure include building and building materials, defence and electronics manufacturing services.

• Utilities, commodities and the companies that are lot of dependent on the government are some of the areas that the fund has underweight positions.

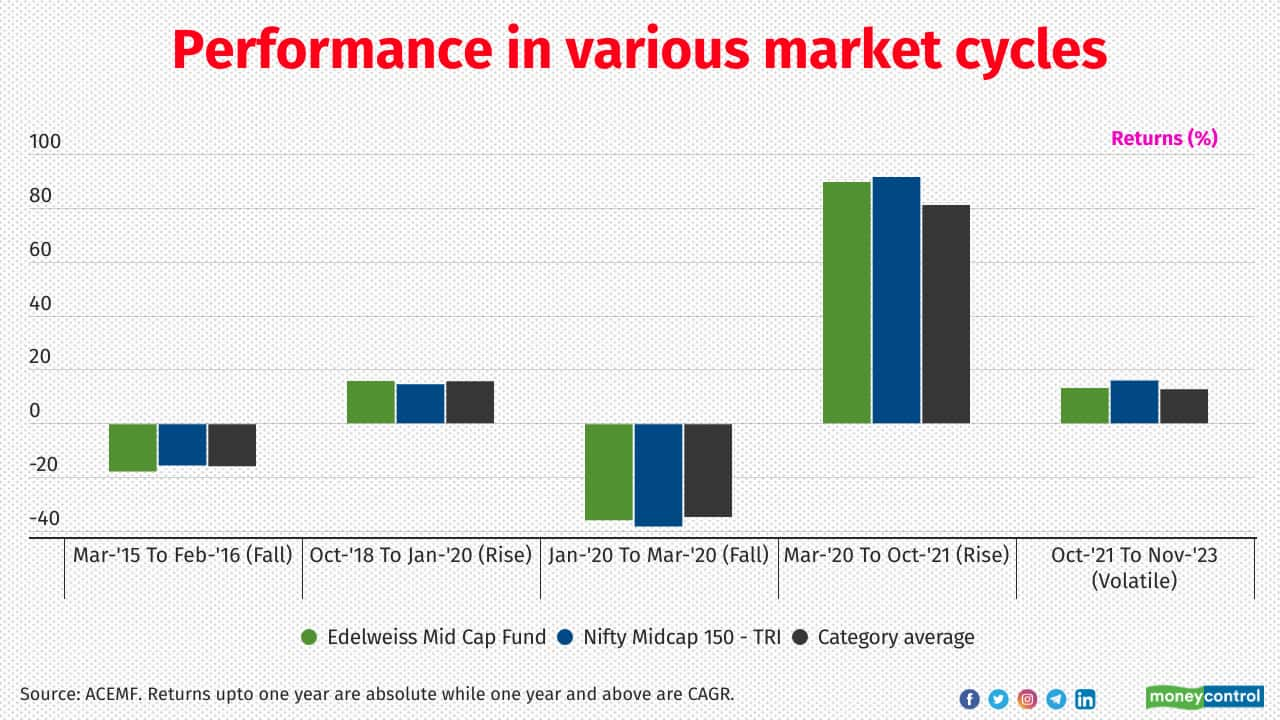

• EMF has been consistent in delivering above-average returns across market cycles. Typically, it has appeared in the first two quartiles within the category in most timeframes. Explaining the reason behind the recent underperformance, Bhattacharya says that some of the PSUs and some companies with low corporate governance in mid and small cap space where he was underweight rallied significantly.

• Bhattacharya says that EMF invests in quality businesses having profitable products and services and run by good managements. The portfolio is less macro dependent and more bottom-up driven, he adds.

• Bhattacharya is overweight on the less macro dependent sectors such as industrials, capital goods, infrastructure, construction and lending financials. Some of the niche areas in the midcap space wherein the fund manager holds meaningful exposure include building and building materials, defence and electronics manufacturing services.

• Utilities, commodities and the companies that are lot of dependent on the government are some of the areas that the fund has underweight positions.

• EMF has been consistent in delivering above-average returns across market cycles. Typically, it has appeared in the first two quartiles within the category in most timeframes. Explaining the reason behind the recent underperformance, Bhattacharya says that some of the PSUs and some companies with low corporate governance in mid and small cap space where he was underweight rallied significantly.

4/8

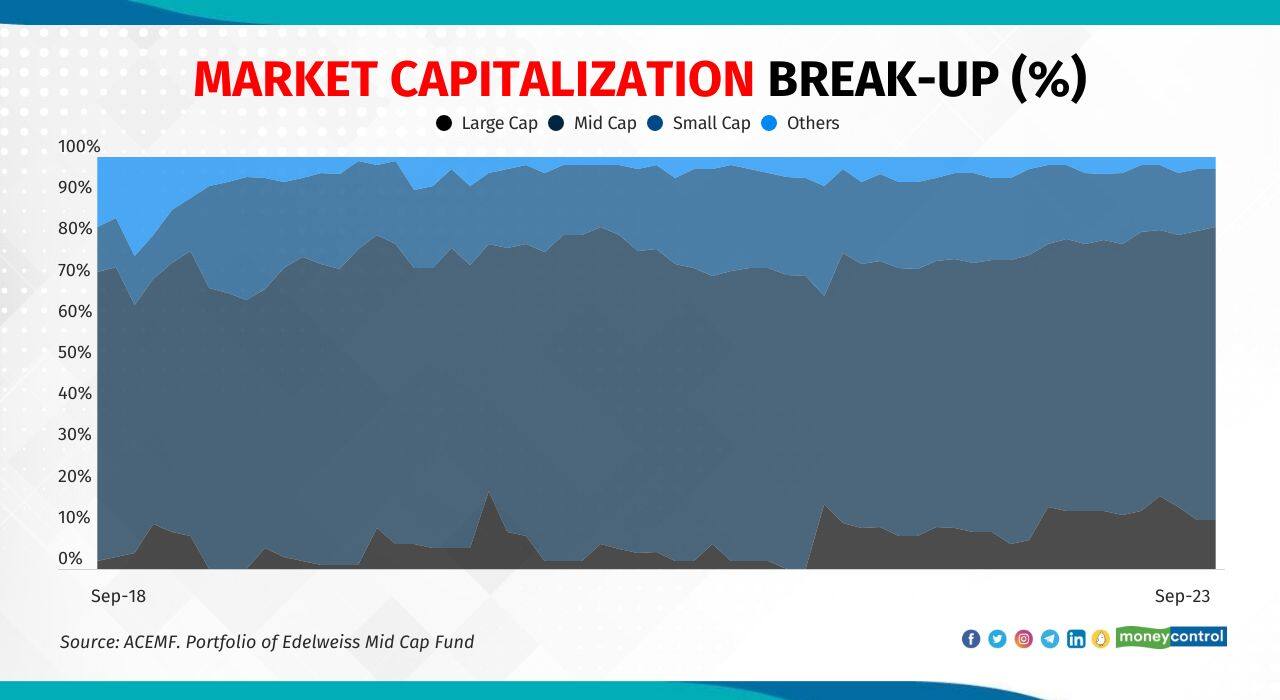

About 90 percent of the portfolio has comprised mid and smallcap stocks. “We manage the scheme as a true midcap fund and we do not want to hide behind the largecaps,” Bhattacharya adds. Over the last three years, EMF allocated just an average of seven percent to largecap stocks. “We invest in largecaps only in those areas where we do not find good alternatives in the mid and smallcap space,” adds Bhattacharya. The scheme decreased exposure in the smallcap space while increased allocation to midcaps in the last few months. “We have migrated towards those areas where we find still margin of safety and valuations in the midcap space”, Bhattacharya explained.

Also see: Thematic ETFs: Low on liquidity but worth a look

Also see: Thematic ETFs: Low on liquidity but worth a look

5/8

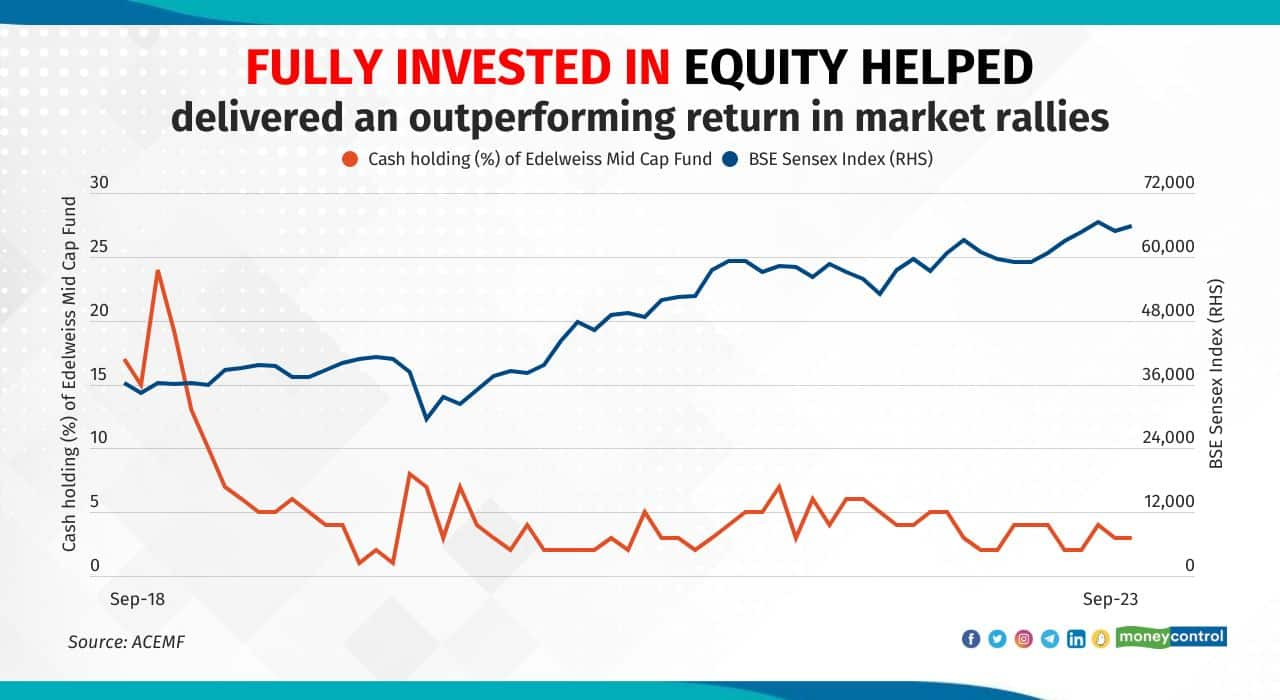

EMF’s portfolio has been fully invested and the cash component is less than 5 percent in most of the timeframes. “We don’t want to time the market using cash as a tool. It is more to manage the liquidity” says Bhattacharya.

6/8

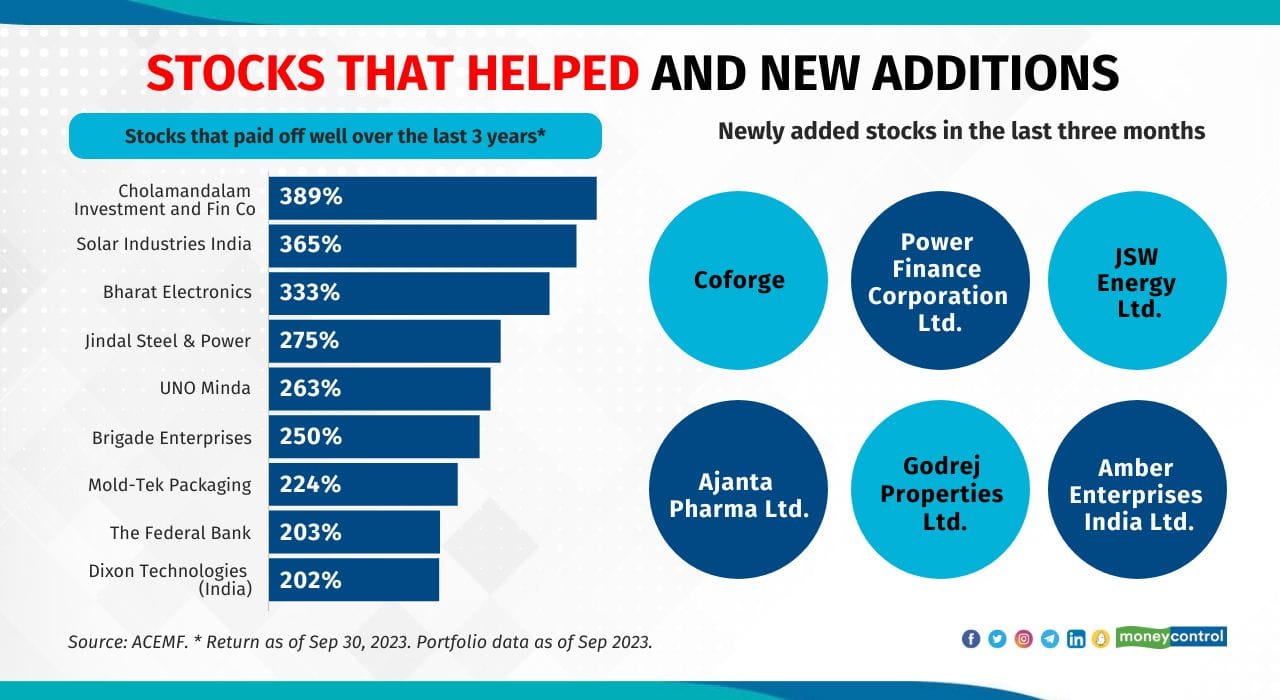

Some stocks that rewarded the schemes well in the last 3 years include Cholamandalam Investment and Fin Co, Solar Industries India, Bharat Electronics and Jindal Steel & Power.

Also see: Contrarian bets in market peaks: Midcap stocks that have turned contra fund favourites

Also see: Contrarian bets in market peaks: Midcap stocks that have turned contra fund favourites

7/8

The scheme is less aggressive on churning the portfolio as it follows buy and hold strategy with an average holding period of three years and more.

8/8

EMF can be part of the core portfolio of investors with a big risk appetite, with a time horizon of seven years or more. Investors can opt the systematic investment route to invest in the schemes considering the uncertain current market scenario.

Also see: 15 smallcap gems that category III AIFs love to hold

Also see: 15 smallcap gems that category III AIFs love to hold

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!