After a low interest rate regime during COVID, the rates have been on an upswing as Reserve Bank of India (RBI) takes steps to tame inflation. In line with the interest rate hikes by RBI, banks/Non-Banking Financial Companies (NBFCs) as well as insurance companies/corporates have raised their rates on fixed deposits (FDs) and investment schemes.

The debt instruments are back in favour as even stock markets generated negative real returns in the last year. With markets under pressure because of a looming global recession, debt offers good options to lock-in a high rate of interest for medium to long term.

A Range of Offerings: So choose wisely

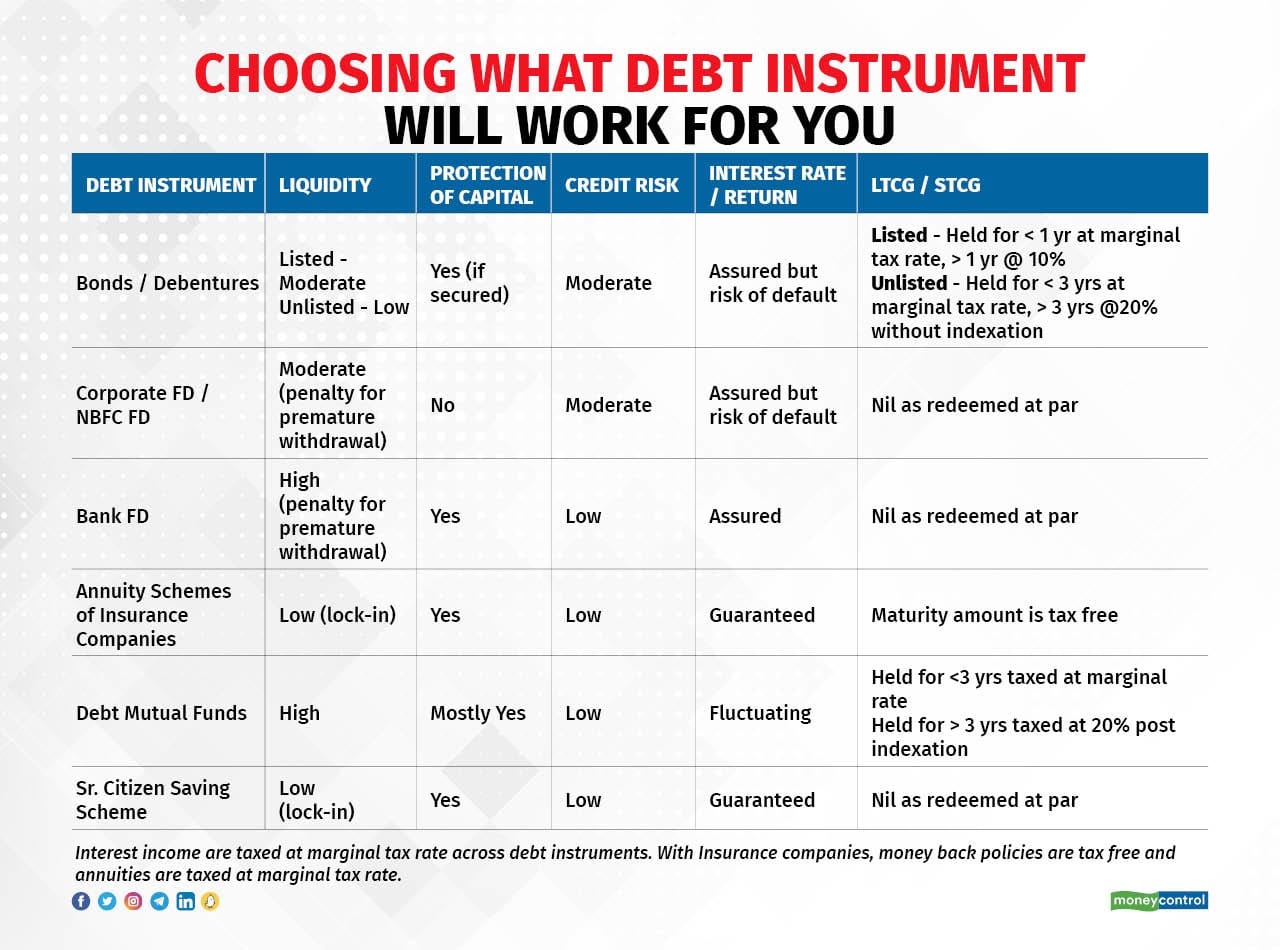

Many options are available to investors ranging from bonds/debentures to FDs of Banks/NBFCs/Corporates to annuity schemes of insurance companies to saving schemes for senior citizens to debt mutual funds. An individual shouldn’t just consider the interest rate/rate of return while investing in debt instruments. Other factors such as liquidity, credit risk, taxation, etc. should also be considered.

All instruments except for debt mutual funds and annuity schemes of insurance companies offer annual interest payments, which are taxed at your marginal rate of taxation. One can also opt for re-investment of the interest amount in FD. However, it doesn’t affect taxability.

Investing in corporate bonds/debentures/FDs of co-operative banks will provide higher interest rates but could translate into credit and/or liquidity risk. This implies chances of not getting back your money invested or getting it over a long period of time: Example: YES Bank, DHFL, Amtek Auto, PMC Bank, etc.

Annuity schemes of insurance companies and Senior Citizen Saving Schemes while providing guaranteed returns (taxable), have high lock-in period thereby scoring low on liquidity.

A large scheduled commercial bank FD is the safest instrument, with protection of capital and high liquidity, it scores low on taxability as interest payments are taxed at marginal rate, thus impacting the overall post tax returns.

Debt Mutual Funds vs FDs

A Debt Mutual Fund scheme invests in interest bearing instruments. Its Net Asset Value (NAV) will keep rising as the interest rates start declining. On the contrary, if interest rates rise further from here, its NAV grows at a slower pace. Debt mutual funds earn periodic interest from instruments they have invested in, which is not paid out to investors, but adjusted in the NAV.

In addition, if held for more than 3 years, investor gets indexation benefit (after adjusting for inflation) resulting in lower/nil tax liability compared to other debt instruments. Even if a debt mutual fund delivers returns equal to 75 percent of the interest rate on FD, its post-tax returns are similar to a FD. In normal course, post tax returns are higher in debt mutual funds compared to a FD.

Debt funds have generally shown to deliver better-annualised returns than FDs, although bank FDs have a lower risk profile thanks to DICGC coverage.

Risks associated with debt mutual funds include credit risk, interest rate risk and reinvestment risk, whereas risks associated with fixed deposits include liquidity risk, default risk, and inflation risk.

However, if your investment horizon is less than three years, then it is better to invest in FD as against Debt Mutual fund.

Now there are umpteen schemes in Debt Mutual Funds. So which one should an individual opt for in the current circumstances?

The Gilt Fund Option: FDs vs G-Secs

To simplify, we are comparing 3-5 year FD rates and Gilt Funds. Gilt Fund schemes invest only in Government backed securities and hence have low credit risk.

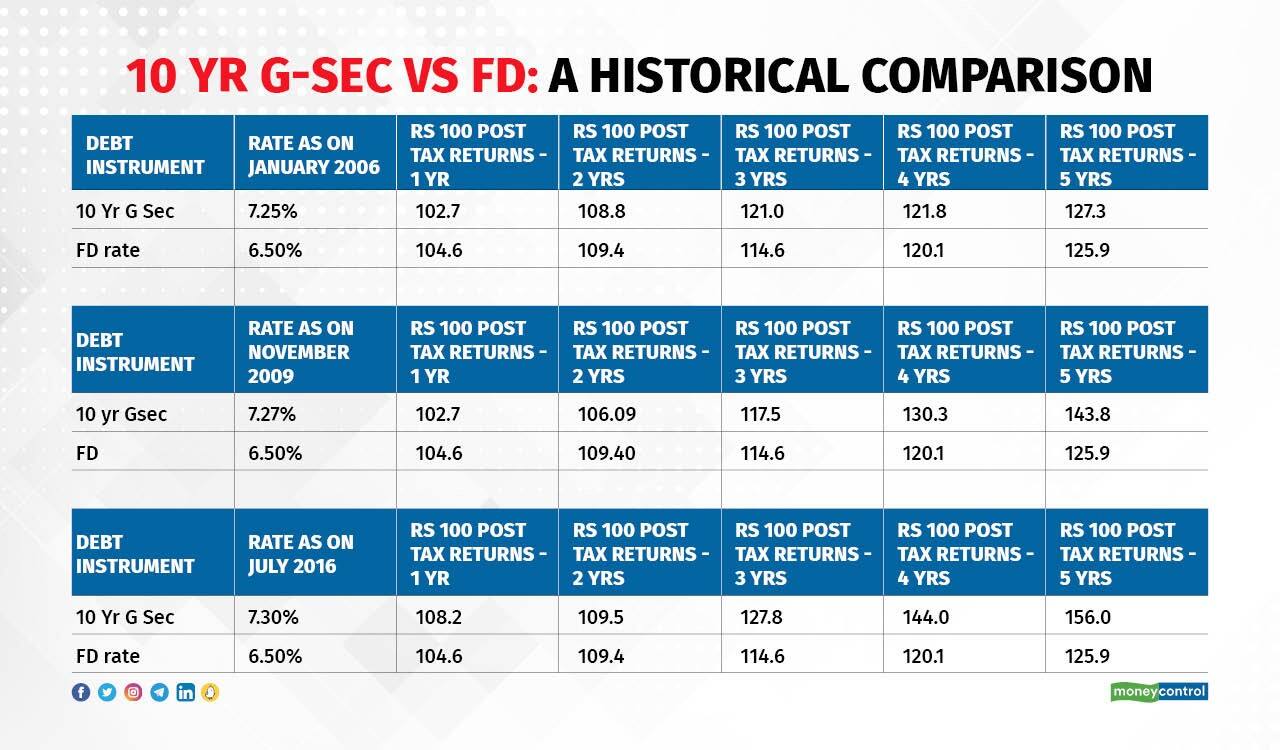

The following table provides a historical comparison of post-tax returns of a Gilt Fund against FD over three different time periods. The chosen time periods mirrors the prevailing FD rates and 10-year G Sec rates namely 6.5 percent for 3-5 year bank FDs and 7.3 percent yield on the 10-year G Sec.

In the first two scenarios (2006 and 2009) interest rates kept on rising and hence the post-tax gain in Gilt Fund was lower than FD especially in the first two years, while in 2016 interest rates were steadily declining and hence post-tax returns was higher than FD rates.

However, across scenarios Gilt Funds was a better alternative to FDs if held for a longer duration (three years at least).

K Shankar and Amitabh Tiwari are co-founders of Finanza Personale. Views are personal and do not represent the stand of this publication.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.