In late 2022, the US turned a blind eye on Iranian oil sanctions, allowing Tehran to quickly boost production and helping the White House contain energy prices. With Venezuela, the Biden administration has gone much further, formally lifting oil sanctions rather than just overlooking them. But the result in terms of output — and price — won’t be the same.

The US Treasury on Wednesday issued a six-month general license authorising oil transactions with the Latin American country, including with state-owned Petroleos de Venezuela SA, which it banned in 2019 under President Donald Trump.

The relief is broader than the energy market had expected. It also arrived quicker than anticipated, only days after talks, which the US encouraged, between the autocratic government of President Nicolas Maduro and the Venezuelan democratic opposition. In lifting sanctions,Washington is betting that after a decade of repression, Maduro will allow free national elections in the second half of 2024.

Oil prices immediately fell on Thursday. Yet Venezuela is unlikely to boost production nearly as much as Iran has managed to do so over the last year.

Since late 2022, Iranian oil production has surged nearly 600,000 barrels a day. On top of that, Tehran has also sold most, if not all, of the barrels it kept stored on floating oil tankers, adding an extra 100,000 b/d over the same period. All counted, Iran has supplied the market with about 700,000 extra b/d to a total of just above 3 million b/d. And China has bought the bulk of those extra barrels.

Venezuela’s situation is different — and its oil output is not as influential. The base case scenario is that the nation would add an extra 150,000-200,000 barrels a day over the next six months, bringing its total output to about one million b/d.

Yet petroleum workers are a rather resourceful bunch, as I’ve learned from years of reporting on the ground of war-ravaged nations like Iraq and Libya. So let’s add an “engineering ingenuity premium” to any recovery forecast, and expect Venezuela to boost output by, perhaps, 300,000 b/d by mid-2024. By end of next year, that could go even higher if Maduro keeps his promise of holding elections and the White House extends sanctions relief another six months.

Still, at best, that’s half of what Iran has done in recent months. Though it’s not nothing: If oil demand grows next year by about one million b/d, as many in the industry expect, Venezuela could meet 20 percent-30 percent of the increase, helping the Biden administration to contain prices.

Why would Venezuela produce less than Iran? There are five big differences between the two that explain it.

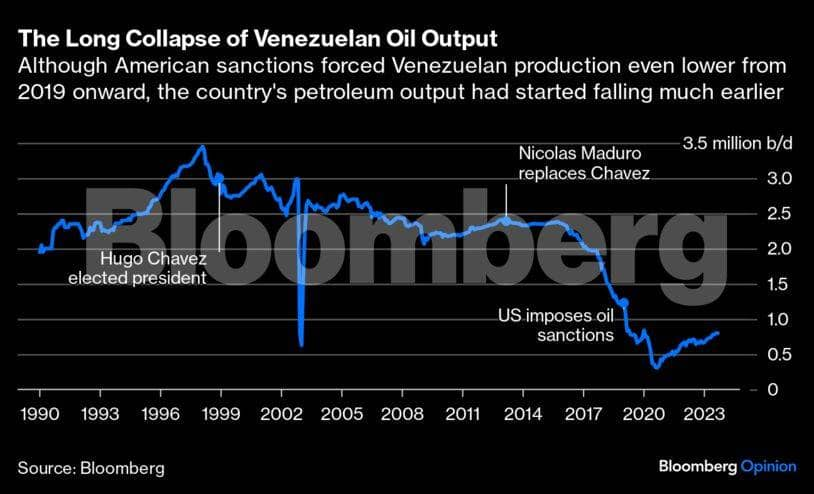

First and foremost, the collapse in the country’s oil production predates American sanctions. Venezuelan production reached its most recent peak just before Hugo Chavez was elected in December 1998; since then, it has trended down under successive populist and increasingly autocratic governments that reduced investment in the industry. The arrival of Maduro in 2013 after the death of Chavez accelerated the trend.

Second, unlike Iran, the Latin American nation doesn’t have a cache of crude idly sitting on board dozens of oil tankers ready to be shipped. Third, its energy industry is in disarray after years of neglect, underinvestment, vandalism and corruption. Iran, on the other hand, kept its oil fields in pristine condition and kept pouring money into them, ready to take advantage of any sanctions easing.

Fourth, geology matters. In the case of Iran, oil fields benefited from the production shutdowns as their reservoir pressure naturally improved over time; in Venezuela, the reservoirs are different, and they are unlikely to emerge from the shutdowns in better shape than they were previously.

Finally, the fabric of the industry is different, too. Iran tightly controls its petroleum sector, with the Iranian National Oil Company doing much, if not all, of the work. It also has a capable workforce that remained at home, while, in Venezuela, much of it left the nation. In the latter country, PDVSA is the biggest actor, but the national oil company relies heavily on foreign companies, including Chevron Corp, Repsol SA of Spain and Eni SpA of Italy. PDVSA also partners with Russian companies, which are excluded from the sanctions relief offered by the White House. Western oil executives with operations in Venezuela told me that foreign companies are still likely to take a cautious approach for now.

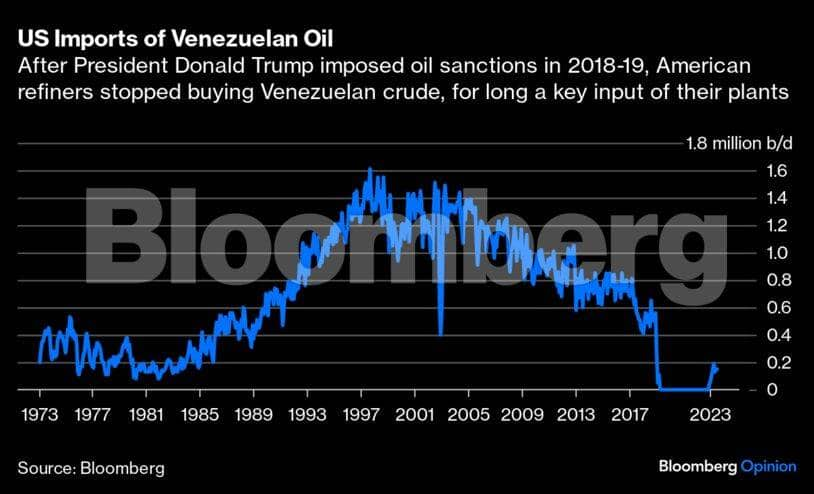

For Maduro, the oil sanctions relief offers a cash prize even if crude production doesn’t recover meaningfully. Currently, Caracas sell most of its oil to China, where it’s forced to offer significant discounts, often larger than $10 a barrel, to compensate for higher shipping costs and banking constraints. Now, Venezuela will be able to redirect its barrels to America, which was its biggest export market until 2019. The barrels would trade at market prices, effectively lifting their value by about 10 percent. With oil changing hands at around $90 a barrel, that’s a lot of cash for a government facing — supposedly — competitive elections in 2024.

Before Trump imposed oil sanctions on Venezuela, American refineries bought about 500,000 barrels a day from the Latin American country. Imports plunged to zero from June 2019 until January 2023, when some oil started to flow again after some sanctions were eased. In July, the US imported about 150,000 barrels a day of Venezuelan crude. US refiners like Valero Energy Corp., Phillips 66 and Marathon Petroleum Corp. run plants that could accommodate more of the oil.

So even if production doesn’t increase much, the extra barrels are likely to flow to America. It’s easy to see how the other real winner here is the US.

Javier Blas is a Bloomberg Opinion columnist. Views do not represent the stance of this publication.

Credit: Bloomberg

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.