It is February 2000. My dealing room is in a frenzy. Our traders are getting orders (all Buys) from large FIIs to get money into stuff like Infosys, Satyam, DSQ Software, Silverline, Global Tele etc. My personal accountant wanders in into this inner sanctum of capitalism, and dares to disturb me with a shocking piece of news.

"Boss, take a look at your P&L account." In between drags on a cigar (yeah, back then one could do such stuff and even worse, in offices), I glance at the numbers. The multiple zeros attached like remora to a shark, seem unreal. Surreal.

They make no sense. It simply cannot be true that my Rs. 20 crores put in, in late '98, have multiplied a dozen times and more in just a few months' time. It's nuts.

Lake of Returns

The Lake of Returns is overflowing. The dam is about to burst, killing idiocy in the village. I am about to be killed too.

Fast forward to December 2007. I sit in my secret analysis room (it's true, it existed) with just two of my closest analysts next to me. I ask them for the CAGR from the market since the bull run began. "Around 50% annually over 4 years, Boss".

The numbers on my P&L again make no sense. The same zeros appear again, probably one or two more than the ones I saw in 2000. The shark appears even bigger and hungrier ready to devour the pesky remora or the zeros.

A frightening thought appears in my head: instead of a number which is bigger than 0 right at the beginning of this string, the entire string is going to become zeros. It's all gonna go.

The Lake of Returns is about to burst, killing idiocy in the village. I am about to be killed too.

These two turning points in market history were ‘Fountainheads’ to the embedded Howard Roark inside me.

Clearly, I didn't get killed. I prospered. I am alive to tell the tale.

Largely because of the LORT.

Essentials of LORT

The SS LORT, which helps gauge marker sentiment, posits that each and every asset class and sub- component of it, has a natural return reservoir attached to it based on its long-term history.

In order to judge if the market's lake is low or high in terms of water or returns, we need to look at the kinds of returns we have seen generated in the past few years. This can give us a reasonably good estimate of how far full or empty the lake of returns from that particular asset is.

While in my market assessment model that I built 24 years ago called " SS Agreement in Motion" ( SS AIM) , there are several sub-stacks, the LORT is a very integral one.

Take a look at some of the exhibits below, to get a broad sense of how LORT divines market cycles. Of course, there are subtleties and nuances which I'm not revealing just yet, but you can still get the broad drift:

1. The Sensex returns were abysmal for over 6 years from Jan’82 to March’88. Water levels were low.

2. The Sensex Lake Of Returns reached flooding levels in the next 4 years, rising 80% CAGR.

3. And then, the Lake Of Returns dries out over the next 11 years

4. From April 2003, over the next 5 years, the Sensex Lake Of Returns filled up massively, reaching overflow levels by end -2007

5. The Lake refilled gradually from March’09 to March’15, taking the Sensex Lake Of Returns to 21% CAGR

6. Again, between March’15 to March’20, the water level depleted to just a 1% CAGR

7. Then came COVID, and the Sensex Lake Of Returns levels have expanded to twice the Lake’s capacity!

8. Similarly, the Small Cap Lake Of Returns have exploded!

When you start to look at markets in a non-emotional way, much like an assassin who does not know who the target is but is simply focused on getting the crosshairs squarely onto the center of the forehead, a lot of the noise around investing gets eliminated.

LORT provides a top-down perspective to shut out the noise

The signal-to-noise ratio in investing is extremely adverse to the signal but looking at markets from a top-down perspective eliminates the clutter. That's what the SS LORT does. And it does it very pictorially, so it will appeal immensely to the WhatsApp generation.

Take a look at this exhibit for the American markets.

9. The Dow Jones Industrial Average reached overflow levels in Aug’29

10. Thereafter, the US lake dried up for the next 25 years with 0% return

11. The US Lake filled up rapidly from Aug’82 to Aug’87 and reached overflow levels

12. Again, between Sep’87 to May’90, the water level depleted to a CAGR of 3.4%

13. The Mega flood of the Tech Boom began

14. The Dam burst, causing the water level to recede dramatically

15. Pre- GFC lake filling

16. The GFC crash, and again, Lake return levels depleted rapidly

17. Then came COVID, and the US S&P 500 Lake Of Returns has expanded to twice the Lake’s capacity!

18. Similarly, the US NASDAQ Lake Of Returns has exploded!

When you put all the above exhibits into a blender and you drink it up like a smoothie, all it's goodness will spread from your gut up to your brain.

It just makes you think better. It makes you think alone. It makes you think like ‘The Jackal’. It lends you clarity about how long and how hard you need to run with the herd. And then it tells you when the deep gorge is coming up and when you should swerve away.

Proof of the pudding is in the tweeting

This is not some idle theorizing. I have used this amongst my several other components in the SS Agreement in Motion (SS AIM) Method, over decades to approach markets with complete and total sangfroid.

Take a look at this exhibit of a tweet I put out in June 2023. It was still a very youthful bull market.

19. 28-June 2023 Tweet

20. "The Lake is Half Full": June 2023

As you can see from exhibit 21 below, that forecast was spot on because the period from then up until September 2024 was the equivalent of Sachin Tendulkar's 1998-2001 period.

21. Performance of Indian Indexes since then

But then, exactly a year later, in July 2024, I tweeted this, asking for Fixed Income Managers in USD.

And that is because the Indian Lake of Returns was clearly close to bursting out into utter devastation

22. 17-July-2024 Tweet

Thanks to this, I got a couple of excellent fixed income managers who are delivering me 12% fixed dollar returns, paid monthly. My equity allocation in India was cut to the lowest it has been in 15 years, in August and September, 2024.

The key is to get the macro view right

You see, there is a method involved in getting markets right. And no matter what anybody says, most of your returns will flow from getting the macro top down view, right eg , " Developed Markets or Emerging Markets? Tech or non-Tech? Commodities or Consumers? Large Caps or Small Caps?".

Once you get those top-down bets right, you have pretty much locked in 70% of your potential gains. Then the rest of the gains will come from better sector selection and then, better stock selection. Pretty much in that order. And please do not point to outlier investors. Just because one out of 1 million got a particular stock right and made a few thousand crore, it means nothing. Chances are overwhelming that following a more systematic approach is what is going to work for you rather than following a mercurial one.

The inner game of investing is all about getting the macro cycle right and my Lake of Returns Theory is something that , stoically, tells me where in the cycle we are.

What will the future be?

Ok, so let's get the main question out of the way: where are we headed now?

See these exhibits:

23. Here is what the next 5 years will look like for the US Lake Of Returns

I have been extremely bearish on the US, since November 2024, in particular, the NASDAQ, and I have long dated puts on their major indexes. If you ask my honest opinion, it would not surprise me to see the NASDAQ fall between 30 and 50% in the next couple of years.

24. Here is what the next 5 years will look like for the Indian Lake Of Returns

The data from the Indian Lake of Returns is talking loud and clear: we are looking at a period of extremely low to negative returns from today for the next 5 years. Of course, in the middle we will see plenty of rallies but on a displacement basis, we will have next to zero rupee returns and substantially lower US dollar returns which could even be a negative 5% CAGR or more. In this period, I see the Indian rupee trading at Rs.100 to a dollar

Some of you might question as to why I am taking only 11% total CAGR from the Indian market.

Simple: the nominal GDP growth over the past few years and projected for the next years is approximately 10%. Your macro returns from the market will mirror this. Our long-term returns of around 15% are no longer applicable because they came in a period of nominal GDP growth of around 15%, but now our growth plane has shifted markedly downward.

The days of 15% returns annually from the market are over.

One more thing: one can actually put into a mathematical equation ( I have), about approximately how long a bull market will last based on the data of the previous bear Market and similarly, how long a future bear Market might last, given the data of the preceding bull market.

But I can't tell you this formula because if I told you, I would have to kill you and I don't want to be called a mass murderer at this age.

Bull markets have a short life

An Indian bull market close to celebrating its 5th birthday is already on the verge of others celebrating its Death Day.

Year 5 for the Indian Bull is like an ice cream after a 3-hour fridge breakdown.

Bull markets are not built to run very long periods at high speed. That is why we have a bull representing the animal of the stock market on an uptrend, not a horse.

A bull market is built for speed, not for comfort. You simply do not become too comfortable and too complacent riding the bronco bull. It is only slightly safer than riding the tiger.

Both will kill you because both will shake you off at some point in the cycle.

Investing is all about prosaic data. But the way it has been abused in India, it has become abstract poetry: "Always bet on India. India is the next superpower. This is India's century".

All this is logic- free, fact -free, sense-free. This is standard bull market drivel that's dusted out like an old T-shirt every 5 years. Harshad Mehta started this, saying in 1991: "India is the best stock in the world". We had 10 barren years after that.

If we start investing like this, we may as well start smoking weed to heighten this sense of floating high above reality.

The SS LORT is one such method to keep you grounded. Investing is all about cold neutrality. It's having a mind of steel, when others have knees of jelly. Data will give you that elusive metal instead of common gelatin.

That is another thing that statistical models like the SS LORT will do for you: it will make you a lone wolf. It will make you shun public gatherings discussing stock markets. It will closet you into a cocoon with only numbers and no human beings. It will make you into a Howard Roark. A " bheed mien bhi reh me sabse alag" kinda guy.

As I always say, I trust numbers more than humans because the failure rate for numbers is a lot less than the failure rate for humans.

If you buy stories, you should be prepared to get unhappy endings.

If you buy statistical probability, you will, almost always, have happy endings.

Immutable rule: Markets are cyclical

So what are we going to do for the next 5 bear market years?

It's pretty simple: from a trending market, we are going to become a trading market. We will get amazing rallies. We absolutely must play these rallies in order to keep profits alive or else, for large parts of the portfolio, the buy and hold strategy that worked for the last 5 years, will malfunction in the next five. We will get a few amazing bargains for sure which will become structural multi-compounders In this very period but for the bulk of our gains, remaining nimble, jabbing and moving fast out of harm's way, will be the way to navigate this passage of play.

Us, over -the-hill old timers, got Asian Paints, HDFC Bank, Infosys, Dr. Reddy 's, etc in the very dry Lake of Returns decade of the 90s. We will get something else again.

Actually, I love bear markets. I find bull markets boring. Bear markets hold far more intellectual challenge for me.

Bear markets also give you the chance to put massive distance between yourself and the rest of the world in terms of wealth. If you play them right.

To conclude, there are only two certainties in life.

One, that markets are cyclical.

Two, Virat Kohli will be forever snicking to slip in England and in Australia.

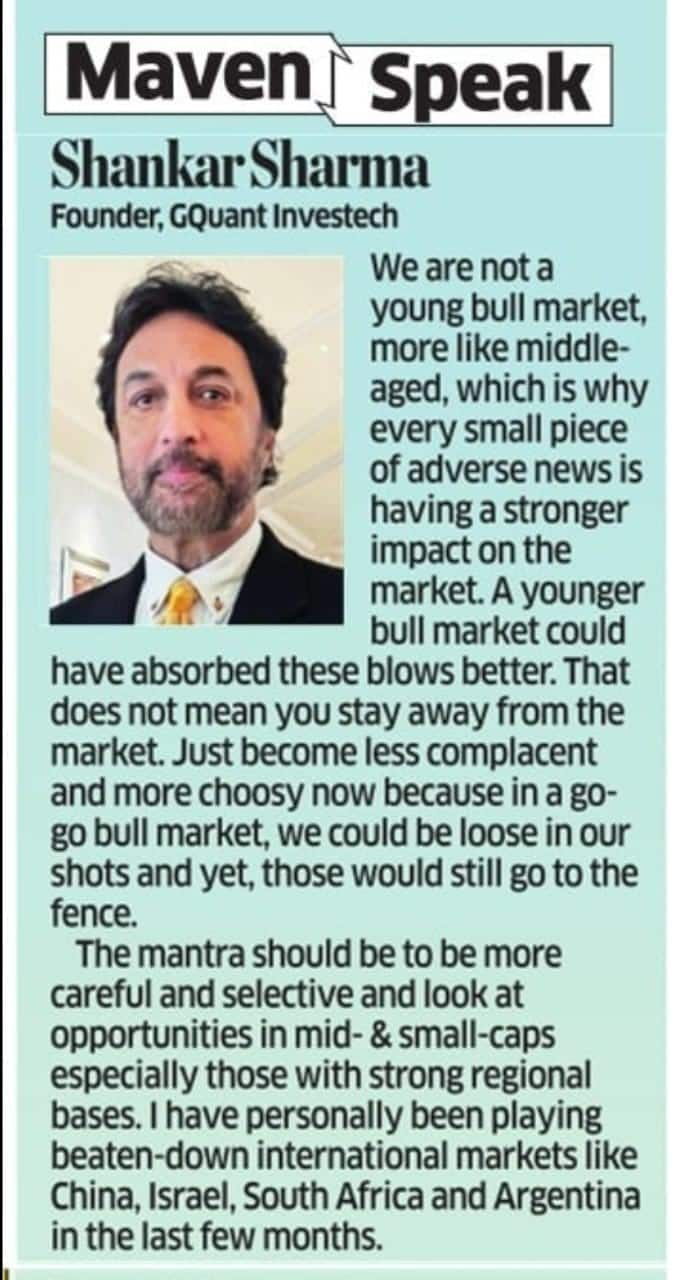

Shankar Sharma is an ace investor and founder of AI firm Gquant Investech. He writes as Le Grand Fromage.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.