Non-food bank credit, or credit to borrowers other than the Food Corporation of India (FCI) for its procurement operations, increased by 15.3 percent in the year to November 23, 2018. The government has been trying to get weak banks to relax the Prompt Corrective Action (PCA) framework so that they can start lending again. Clearly, the government seems to feel the banks are not lending enough.

But is that perception correct? In November 2013, before the Modi government came to power, non-food bank credit growth was 14.6 percent, lower than what it is now. But then, one month’s numbers may be a flash in the pan.

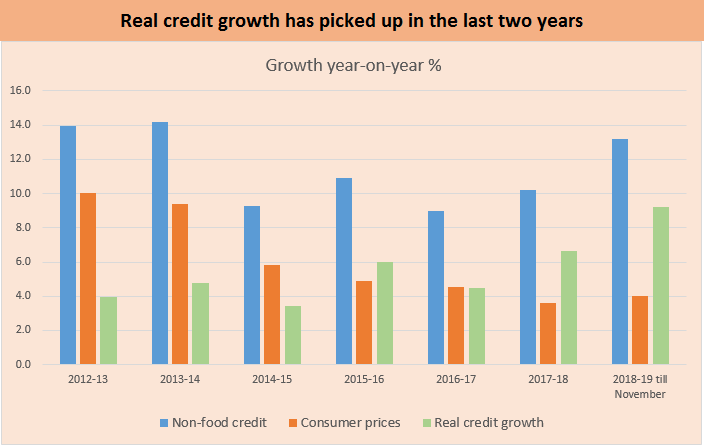

What if we take a longer period? Well, for the year 2013-14 as a whole, the growth in non-food bank credit was 14.2 percent, according to RBI data. For 2018-19 till November, the average of the monthly rates of growth in non-food credit is 13.2 percent, lower than the growth notched up in 2013-14.

But what if we look at real credit growth in the economy? If inflation is high, it stands to reason that bank credit growth will also be higher in nominal terms. We will then have to adjust for inflation to arrive at real credit growth.

Consumer price inflation in 2013-14 averaged 9.3 percent. That means the real growth in non-food credit was (14.2-9.3) or 4.9 percent. In the first eight months of the current fiscal year, on the other hand, the average rate of consumer price inflation is 4 percent. That gives a real rate of growth in non-food credit of 9.2 percent, much higher than in 2013-14. Indeed, as the chart shows, the real growth in non-food credit from the banking sector has been higher since 2017-18. The only reason it dipped in 2016-17 was because of demonetisation, which was, in terms of economic policy, akin to shooting oneself in the foot.

What’s more, former governor Urjit Patel mentioned in his last press conference that ‘the total flow of resources to the commercial sector from banks and non-bank sources together has increased year-on-year by over 50 percent as on November 23rd.’ That is an extraordinary rate of growth and it implies there’s no shortage of funds for the right kind of borrowers.

Why then is the government concerned about the lack of credit growth? Simply put, most of the rise in credit in the last few years has been on account of personal loans, as the industrial cycle turned down. Growth to the services sector, on the other hand, has picked up and growth in bank credit to non-bank financial companies in October 2018 was a huge 55.6 percent from a year ago. Surely, with growth rates that high, an Asset Quality Review is badly needed for NBFCs, at par with the review for banks, to flush out non-performing assets? Such a review would be prudent before banks lend any more funds to NBFCs.

That said, it is a fact that loans to micro enterprises, classified as priority sector lending, has seen growth rates well below that notched up in the UPA-II period. This is true even for real rates of growth, or bank credit growth to micro-enterprises after adjusting for inflation. Moreover, the problem lies is lending to micro-enterprises in the manufacturing sector----credit to those in the services segment has held up well.

That suggests the issue lies in the cyclical downturn in the industrial sector, which has hit credit to both large and small units in the segment. Forcing banks to lend to small enterprises will lead to burgeoning bad loans at a later date. But then, in an election year, politics will trump economics.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.