Angel Tax (Section 56(2)(viib)) has long been the bane of the Indian startup ecosystem. A Local Circles and IVCA report from 2019 has put the number of startups who have received such notices at around 2,100. The linkage of Section 68 (unexplained cash credits) to Angel Tax has added a new dimension to this saga as the onus of supporting the creditworthiness of the investors falls on the startup in question.

A recent post on X (previously Twitter) by the Indian Tax Dept provided some relief from this onerous measure, but founders are still struggling to navigate these notices.

Due to the prevalent nature of this issue, 3one4 Capital has developed a comprehensive “Playbook for Handling Angel Tax and Section 68 Tax Notices”. This should help founders and entrepreneurs with a working understanding of the issue, how to sensitise investors to this, questions to ask of one’s advisors, and more.

It is not a supplement to professional advice, but a means of understanding the issue.

Key extracts of the Playbook are given below, and the full playbook can be accessed here

1: What is “Angel Tax”?

“Angel Tax” or Section 56(2)(viib) of the Income Tax Act is an anti-abuse measure introduced in 2012 as a means of “preventing the generation and circulation of unaccounted funds”.

The Section states that if:

* A private limited company

* Issues shares at a premium (i.e., above its face value)

* Which exceeds the fair market value (FMV) of the shares

* The difference between the issue price and the FMV will be subject to tax as “Income from Other Sources”

2: Is High Share Premium Indication Of Wrongdoing?

No. A high share premium can be the consequence of perfectly valid, legal, commercial decisions taken by the Company.

A high share premium is the result of 3 factors, all of which are individually valid business decisions taken by a company:

* Valuation

* Low share base

* Low face or par value

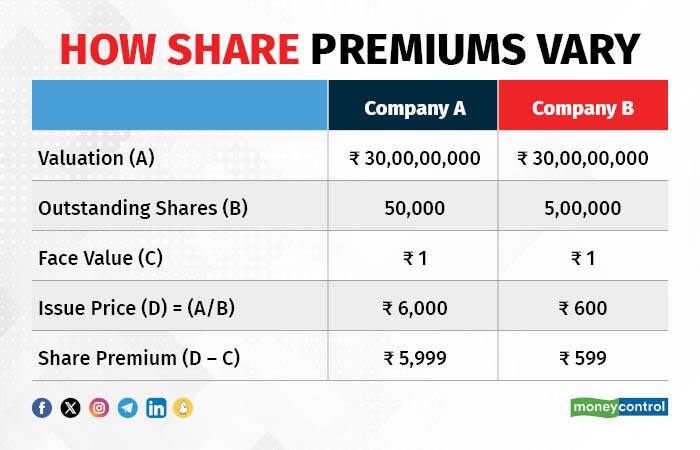

If one were to take the example of two companies with the same valuation but different outstanding shares:

An increase in any of the factors, viz, valuation, outstanding shares or face value, creates a massive difference in the share premium, showing how a high share premium is not an indicator of unaccounted funds.

Companies Act, 2013 does not prescribe a minimum paid-up capital for a private company. As such, entrepreneurs can start a business with any amount and raise funds from investors for scale.

3: What Is Section 68?

Section 68 is an anti-abuse measure which serves as a means of “preventing the generation and circulation of unaccounted funds”.

If any money received by a person for which said person doesn’t offer a valid explanation about the nature or source of the funds, to the satisfaction of the taxman, such amount can be liable to tax as per this section.

4: Who Pays “Angel Tax” And Tax Under Section 68?

The private limited company pays “Angel Tax” and tax under Section 68, not the investors.

5. What are the chances that my company may get picked up for scrutiny under Computer Aided Scrutiny Selection (CASS) for Angel Tax or Section 68?

As CASS is a computer-based system, the following may be criteria it employs for selecting cases:

* Has the Company issued shares at a premium?

* Is the amount raised by the Company substantial?

* Is the Company loss-making?

Basis discussions with experts as well as companies who have received such notices, these seem to be the common criteria for selection. Other criteria would also apply.

If your company meets the aforementioned criteria, you may end up getting such a notice. It's best to prepare for the same.

6. What should one do after receiving such a notice?

1. First, reach out to a CA/Tax Advisor who has worked on this before. Time is of the essence.

2. Inform your investors of such a notice and ask them for the information provided in the Tax Notice

3. Collate all the information required in the notice

Respond to all the queries on time – even if the response is that the Company was unable to secure the information, note it down in writing

7: What happens if my investors do not want to give confidential information such as their bank statements and tax returns?

This is understandable. The taxman has powers under Section 133(6) of the Income Tax Act, 1961, to directly seek such information from any taxpayer.

* Make attempts to ask your investors for such data

* If they refuse to provide it, ask them for a letter which should state the following:

- Name, contact details and PAN of the Investor

- That the Investor has invested in the Company

- Details of the investment (number of securities, face value and share premium)

- The Company has asked for sensitive information such as tax returns, bank statements, etc

- Owing to the sensitive nature of the information, the Investor is not inclined to share the same with the Company

- However, the Investor can share the same with the Tax Department in a secure, confidential matter if the Tax Department sends a request for the same.

- That the Investor shall fully cooperate with the Tax Department on this

- Collate responses and send it to the Tax Department on time. Even an email or letter from the investors should work. Speak with your tax advisor on this.

Founders must take note that the intent of Angel Tax and Section 68 is to prevent abuse, and they are not intended for genuine companies. The Tax Department has a challenging task of handling such matters, and a proper response has helped many genuine startups to navigate these notices. Knowledge is key and should be shared to ensure that Angel Tax does not derail the arduous journey of a founder.

Siddarth Pai is Founding Partner, 3one4 Capital. Views are personal, and do not represent the stand of this publication.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.