Anil Kumar

Twenty five years ago, in 1994, 2G mobile telephony services were introduced in India. It began with post-paid voice call services. Two years later SMS was launched with hoardings on street poles describing how to make use of this service, followed by the pre-paid model. All mobile operators minted money, charged hefty fees, both for incoming and outgoing mobile calls, expensive SMS services, and so on.

3G services were introduced much later, sometime in 2003. This latter network is something that Bharti Airtel intends to wind-up by March 2020. In its communication to the Telecom Regulatory Authority of India (TRAI), Airtel has said that all the 900 MHz of 3G spectrum has been re-farmed for 4G. The 2100 MHz spectrum of 3G is also being re-farmed. More than 70 per cent of all the spectrum available with Airtel is being used for 4G, which will go up to 80 per cent once the 2100 MHz is fully re-farmed.

However, Bharti wants to continue with its 2G network - a hugely spectrum-inefficient, old and outdated technology.

One wonders why Airtel is discarding 3G, a relatively newer technology, for 4G, while a 25-year old technology (2G) is being retained. What is the idea behind this move, especially when Airtel claims that its 4G towers are located at almost the same geographical locations where its 2G/3G towers are present?

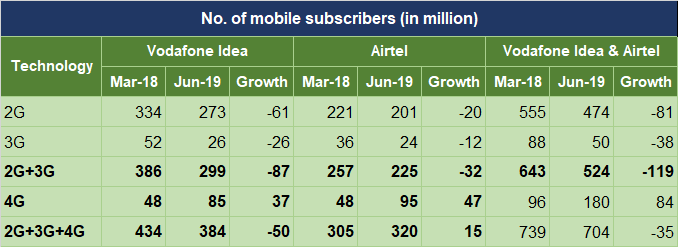

Also, Airtel’s number of 4G towers stood at 340,132 as on August 2019 covering 93 per cent of the population, much higher than its combined 2G & 3G tower strength of 293,763. In June 2019, its 2G & 3G subscribers stood at 225 million, whereas, it has only 95 million 4G subscribers. That is, 279 subscribers per 4G tower, and 766 subscribers per 2G/3G tower. That means, sufficient spare capacity is available in the 4G towers of Airtel for its customers to move to a new technology.

Yet, Airtel is not discarding its 2G technology.

The reason is simple. Airtel is eyeing Vodafone Idea’s 2G & 3G customer base, which as of June 2019 stood as high as 299 million, higher than Airtel’s own 2G & 3G customer base of 225 million.

Airtel is hoping that Vodafone Idea will not be able to withstand competition. Vodafone’s losses are as high as Rs 14,376 crore in FY 2018-19 on a revenue of Rs 32,980 crore. At the end of March 2019, its subscriber base declined by 9 per cent from a year ago to 395 million. The subscriber base further declined by 3 per cent to 383 million in the June 2019 quarter. Therefore, Airtel believes that Vodafone Idea will not upgrade its 2G network, resulting in the churning of the subscriber base into Airtel’s kitty. It is also not very keen on hiking tariffs at this stage, because its interest will be best served if Vodafone winds-up.

Airtel publicly has stated three reasons for sticking to 2G technology.

First, VoLTE handsets, which can handle voice calls also, are expensive.

Second, most of the dual SIM handsets use 4G SIM in slot-1, and 2G/3G SIM in slot-2. There are no dual SIM handsets having both the slots 4G-enabled.

Third, there is low financial and digital literacy in rural areas, especially in Odisha, West Bengal and Bihar, where most of the people (60 per cent) are using 2G handsets, much higher than country’s average of 49 per cent.

However, a deeper analysis would reveal that all the three reasons are bogus. VoLTE handsets are available at the same price point as 2G handsets. Entry-level VoLTE handsets are priced under Rs 1,000. So, Airtel’s logic that VoLTE handsets are expensive holds no ground.

Second, the argument about the non-availability of dual 4G SIM slots in handsets at affordable price points is also not correct. Most handsets are now made in India and manufacturers are in regular touch with the telcos. In all its official communications to TRAI, Airtel has also said that it has “deep engagements with all handset manufacturers in India to support Airtel VoLTE”. The manufacturers can easily produce 4G+4G dual SIM handsets replacing 4G+2G/3G, with no additional cost, if such a demand is made by the telcos. It seems that the incumbents have not made any such requests so far.

Third, justifying continuity of 2G due to lack of digital literacy in rural areas, too does not bode well. Women in rural area can handle even touch phones smartly; if they can’t, their children will teach them.

In the 15-month period between March 2018 and June 2019 a total of 119 million 2G/3G subscribers left the legacy network of the two incumbents (Table-1).

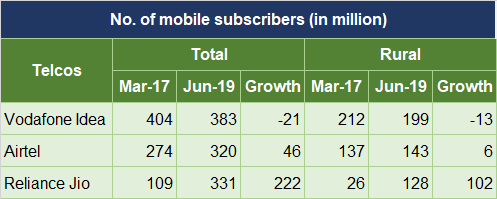

They have shifted to 4G. This latest churn is coming from the rural area. In the last 27 months, Jio has added 102 million 4G subscribers in the rural areas (Table-2). This table also shows that the incumbents’ focus is not the rural; Vodafone Idea base in rural area is down by 13 million, and Airtel has added just 6 million subscribers.

So, the policy makers should see through Airtel’s real design of hiding behind public interest for keeping 2G alive, a technology which long ago should have been consigned to museums.

Anil Kumar is the editor-in-chief of Telecom Live and founder of Telecom Watchdog, an NGO. Views are personal.

Disclaimer: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd which publishes Moneycontrol.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.