Madhuchanda DeyMoneycontrol Research

Donald Trump, who apparently is concerned about the 100th day of his presidency going by without his having signed any major legislation, made two of his colleagues, Gary Cohn and Steven Mnuchin, unveil a tax plan yesterday that didn’t differ much from what was promised in the run-up to the general election last year. The plan lacked the details and rigour to convince the markets that it will be implemented any time soon.

The skeletal outline of a tax package unveiled at the White House in a single-page statement filled with bullet points, was less a plan than a wish list. Officials still called it the ‘biggest tax cut’ in US history that stands to benefit businesses, the middle class and certain high-earning individuals.

The highlight of the proposal is a reduction in federal income-tax rate to 15 percent from the current 35 percent, for corporations, small businesses and partnerships of all sizes, although the effective top rate is far less after tax breaks.

The proposal also talks about a Territorial tax system and imposing a one-time tax on about USD 2.6 trillion in earnings that US companies have parked overseas. There is widespread agreement that the current system of worldwide taxation destroys jobs and suppresses wages for US workers. The proposal also mentions about eliminating tax breaks for special interests.

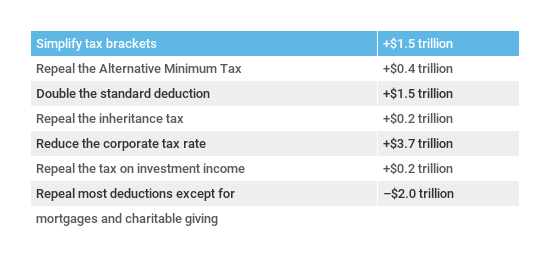

For individuals, without delving into great detail, the plan proposes replacing the existing seven income-tax rates to three: 10 percent, 25 percent and 35 percent. The top rate will drop to 35 percent from 39.6 percent. But the Trump administration has not said which income ranges would apply to those brackets.

The intention is to end a 3.8 percent net investment income tax that helps pay for Obamacare and applies only to individuals who earn more than USD 200,000 a year. Other highlights include repealing the alternative minimum tax and eliminating the estate tax, which currently applies only to estates worth more than USD 5.49 million for individuals and USD 10.98 million for couples.

The plan endeavours to eliminate the federal income-tax deduction allowed for state and local taxes, a provision that would hit high earners in high-tax states. The only itemized deductions that would be preserved under the plan would be for home mortgage interest and charitable contributions.

President Trump’s proposed changes to the tax code could increase the deficit by an estimated USD 3 trillion to USD 7 trillion over the next decade, according to the Committee for a Responsible Federal Budget, an advocacy group focused on reducing deficits.

On the campaign trail, Trump had pledged to cut the US’ USD 19 trillion debt. The 20-percentage-point cut to corporate tax rates alone would add significantly to the national debt. The plan, therefore, faces significant obstacles because of the “reconciliation” rules that place strict limits on any tax cuts that result in increases to the deficit.

However, for Indian companies one big takeaway was that there was no mention of the controversial “border adjustability tax”.

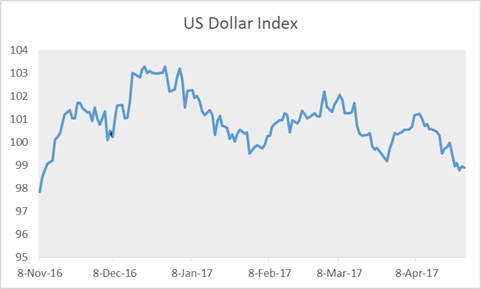

In the absence of the standard details of such rollouts, such as detailed charts showing the cost of each provision, phase-in periods, the impacts of the proposals on people and testimonials on the programme’s potential benefits, markets weren’t convinced. The Dow Jones and S&P 500 ended marginally lower and the Dollar Index also declined in a clear sign of disbelief about the ongoing promises. Investors are waiting for Trump to start walking a lot of talk.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.