Historically, it is observed that most of the times market likes to remain in a relatively narrow range (neither an uptrend nor a downtrend); such scenarios are generally termed as a ‘sideways market’. During such phases, most of the traders tend to make huge losses due to aggressive positions and importantly, due to lack of knowledge on how to tackle such market conditions. We find so many articles suggesting avoid trading during sideways market; but, we believe that, with the help of some options trading strategies, traders can not only safeguard their gains; but also can increase their profit potential.

Here are some basic options strategies that can be used in sideways market conditions —

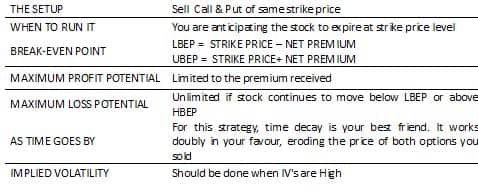

1. Short Straddle — This strategy is carried out by holding short positions — in both call and put — that have the same strike price and expiration date. The maximum profit is the amount of premium collected by writing the options.

2. Short Strangle — This is another effective options strategy, which is quite similar to the straddle. The only difference in a Strangle is the strike price, as it is carried out by using out-of-the-money strikes of both call and put options. This strangle has the ability to save both money and time for traders operating on a tight budget.

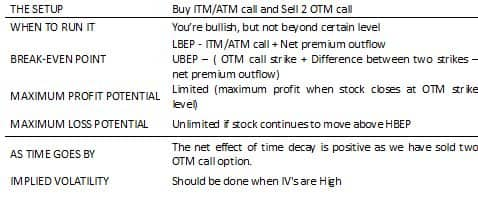

3. Ratio Bull Call Spread — This strategy involves buying ATM (At-The-Money) call option and simultaneously selling two OTM (Out-of-the-money) call options. It is generally used when a stock is trading at the lower side of the range and is expected to rise to a certain level in short term. As we sell two call options, it results in reducing the upfront payment for the position making the risk reward ratio quite favourable. While it also results in a profit even if the underlying stock stays stagnant or goes down.

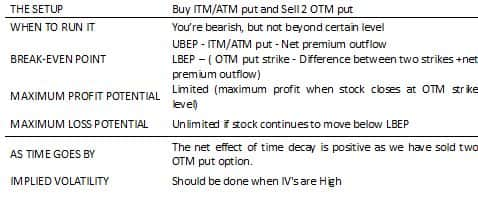

4. Ratio Bear Put Spread — This strategy is similar to the above strategy Ratio Bull Call Spread. It involves buying ATM (At-the-money) put option and simultaneously selling two OTM (Out-of-the-money) put options. It is generally used when a stock is trading near the higher side of the range and correction is expected to a certain level.

Note: Traders need to be very careful while entering into ‘Short Straddle’ and ‘Short Strangle’ strategies as the risk becomes unlimited. Hence, it’s advisable to avoid such strategies just ahead of any big event which may bring higher volatility in terms of price movement in the underlying stock/index.

(The above opinion is that of Ms. Sneha Seth, Equity Derivative Research Analyst -Angel Broking, & is for reference only.)Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.