Shishir Asthana

Gold seems to be taking a break from its traditional "safe haven" status. In the midst of a trade war between the US and China, investors should ideally have been taking shelter in gold, but this time around they are avoiding it like a plague, or shorting it.

So what is happening in the gold market that is scaring investors away? A strengthening dollar is the main reason. The greenback is the currency in which the precious metal is traded, and a stronger dollar means a lesser amount of gold can be bought in the consuming country.

Gold prices recently touched their lowest in the last 19 months, down by nearly 14 percent since their April 2018 high. The reason this fall is so important is that it has weight behind it. Bets on the gold price going lower have increased to record levels. The difference between bets on the shining metal going down and those on it moving higher is now at the highest level ever.

According to reports, traders have shorted 53.5 tons of gold via the futures market in the last one week. Selling volume since the end of June now stands at almost 260 tons – equivalent to nearly a month’s worth of global gold mining production.

Adding to the bearish data is the fact that holdings of gold by exchange-traded funds (ETFs) tracked by Reuters are down 4 million ounces, or 7 percent, from late May. Gold ETFs have been shedding the metal for 13 consecutive weeks, the longest run in five years.

Apart from the financial investors and speculative interest, genuine demand for gold has also taken a beating. In the first half of 2018 demand for gold was at its lowest level in the past decade, thanks mainly to lower demand from India.

The devastating floods in Kerala are only going to make things worse for gold. Kerala is the largest consumer of gold in India, accounting for over 10 percent of gold demand, most of it coming during Onam.

A strengthening dollar has impacted the demand for gold, the currency in which the precious metal is traded. A stronger dollar means a lesser amount of gold can be bought in the consuming country.

Both Indian Rupee and Chinese Yuan have taken a beating against the dollar. These two countries account for the lion’s share of gold demand.

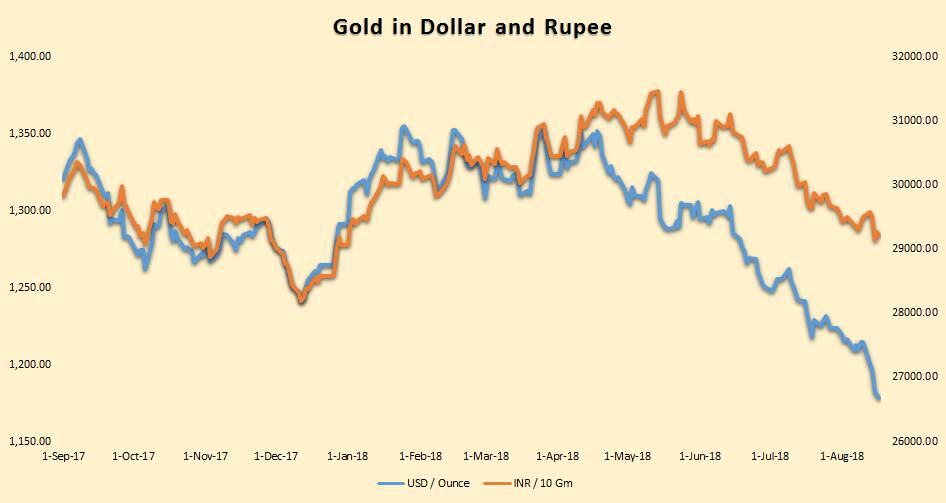

Though gold prices have fallen in Indian markets too, the fall has not been as severe as it is in dollar terms (see chart). Gold, in Indian rupees, is near its eight-month low level.

Dollar, in turn, has gained in strength ever since the US Fed started increasing interest rates. Investors prefer to park their money in interest yielding US bonds than in gold. Which is why the Fed meet over the weekend is considered important by gold bugs.

Gold is hovering around a critical level of $1,200 an ounce. Though it trades slightly lower, the recent news of US-China trade talk, and its cooling impact on the dollar, is expected to bring it close to that level. The level of $1,200 is considered important both from a technical as well as the operational point.

For gold producers, the $1,200 level is considered a sweet spot in terms of production costs. It is viewed as a threshold for profitability in the gold-mining industry and suggests that prices below that level could slow production growth.

That brings us to the all important question, is it time to buy gold? Well. everyone who wanted to be short on the metal is short. Gold is now at a price level where supply will be hit if the price falls further. The key, as mentioned earlier, is interest rates and the dollar.

The Fed meeting will be critical for gold’s price movement. Chinese investors have already played their hand by investing $68 million last week in gold ETFs, the highest in three months.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.