In his maiden Independence Day speech as Prime Minister on August 15, 2014, Narendra Modi broke convention by speaking extempore for 65 minutes. Sporting a polka-dotted Gujarati red-and-green turban, Modi played the outsider card, explaining to a national audience how Delhi’s elites looked upon him as an “untouchable” and how he found not one united government but many, with government departments often fighting with each other rather than working as one.

All the usual touchpoints of the Modi model that were soon to become signature programmes of his government – “Digital India”, mobiles, Swachh Bharat and toilets – first featured in this inaugural Red Fort speech.

Social Welfare Through Financial Inclusion

It was also the first time Modi spoke about the idea of the Pradhan Mantri Jan-Dhan Yojana. In a country where a majority of the citizens had never had a bank account, the scheme’s ambition was sky high. It promised a zero-balance bank account, a debit card and an insurance safety net of Rs 100,000 to every poor Indian.

With the Aadhaar pipeline in place, Modi in that 2014 speech outlined the contours of the first grand expansion of social welfare and financial inclusion that it was about to engender. Tellingly, he compared the mobile in the digital age to the railways in a previous era—a grand connector of the nation.

“I wish to connect the poorest citizens of the country with the facility of bank accounts through this yojana,“ he said. “There are millions of families who have mobile phones but no bank accounts…. We have to change this scenario….There was a time when we used to say that the railways provided connectivity to the country. That was it. I say that today it is IT that has the potential to connect each and every citizen of the country and that is why we want to realise the mantra of unity with the help of “Digital India”.

The PM Jan-Dhan Yojana scheme was formally launched two weeks later, on August 28, 2014. The results have been stunning.

The PM Jan-Dhan Yojana In Numbers

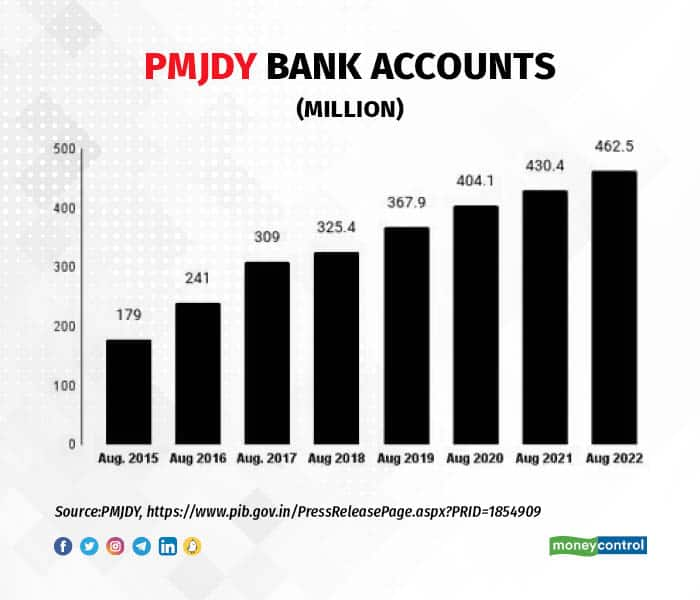

Consider this. In eight years, India opened over 462 million new bank accounts for the poor. That’s more than the entire population of the United States, France and the UK put together (see charts in Figure 1). By any yardstick, this is an astonishing number for anyone interested in global financial inclusion.

A Guinness World Record started the Jan Dhan campaign—18 million accounts in one week between 23 and 29 August 2014—and it has grown consistently since. Crucially, over two-third of these accounts (308.9 million) are in rural and semi-urban areas. Over half (257.1 million) are in the names of women.

Banking for the Poor: India’s Financial Inclusion Revolution (2015-2022)

These are mind-boggling numbers. If you count operative accounts, i.e., those that have had a transaction within the last two years, they amount to 375.5 million. Again, that is more than the population of the United States and Australia put together.

Overall, between 2015 and 2022, account numbers increased three-fold, and the money in these increased by over seven times.

Global Institutions Take Note

Numbers like these on banking for the unbanked explain why drum-beaters for financial inclusion have been excited about India.

It is also why the World Bank in a G20 policy document has emphasised that without the digital public infrastructure, India may have otherwise taken 43 years to reach a financial inclusion rate of 80 percent that it reached in just 6 years.

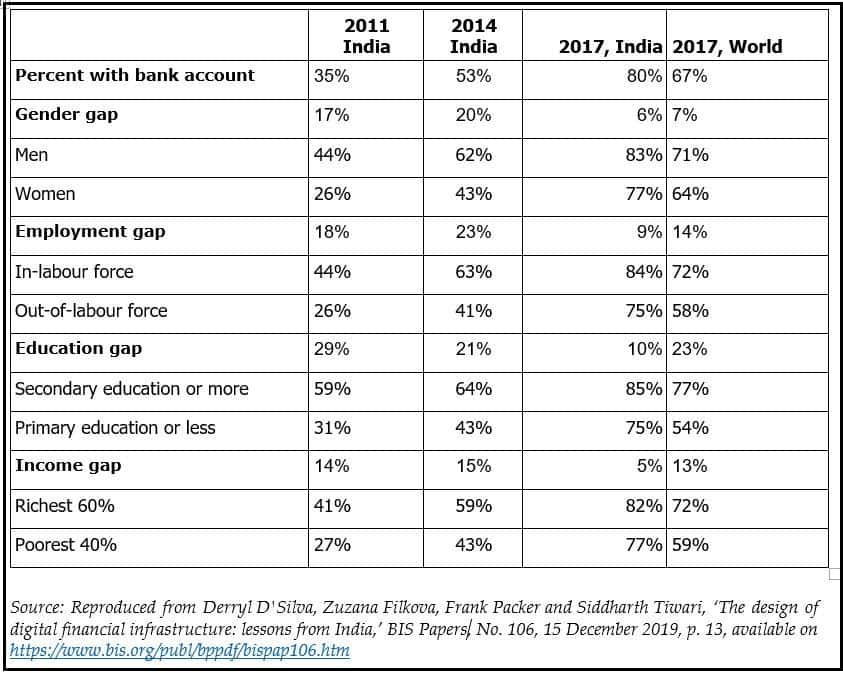

As the International Monetary Fund (IMF) noted in a 2021 working paper (by Yan Carriere-Swallow, V. Haksar and Manasa Patnam), the excitement accrued from the fact that the introduction and expansion of the Jan-Dhan Yojana “coincided with a period of rapid increase in financial access, in which the percentage of [Indian] adults with a bank account increased from 35 percent in 2011 to 80 percent in 2017.”

The IMF emphasised that this was possible essentially because of “the development of the digital infrastructure” including an interoperable payments system, a universal digital ID, and other features.” “India’s journey in developing world-class DPI (digital public infrastructure)”, the IMF research argued, “highlights powerful lessons for other countries embarking on their own digital transformation.”

The Bank of International Settlements (BIS) reached a similar conclusion in 2019. It noted in a detailed paper on the “lessons from India” on the design for financial infrastructure that “India offers an example of how various policy reforms related to digital finance — including transformation of the traditional banking system with the central bank playing a pivotal role—can solve many of the challenges of inclusive financial development that once seemed out of reach."

India Outpaces The World

It also offers insights into how the regulator (e.g. the central bank) and the regulated (e.g. commercial banks) can together run a payment system that operates around the clock, throughout the year, is open to participation of firms ranging from boutique fintechs to big techs, and provides all the network benefits that big tech systems usually provide, but settles instantly in fiat money inside the central bank.

How India bridged the gap on financial inclusion with Aadhaar and UPI

Research by Derryl D’Silva, Zuzana Filková, Frank Packer and Siddharth Tiwari for BIS showed how India had leapfrogged on financial inclusion matrices (see table above). This shift occurred fundamentally because of what one of the report’s authors called “visionary action” by the state.

It is this unprecedented success in financial inclusion and digital payments that India will be showcasing at the G20 summit over the weekend.

Nalin Mehta, an author and academic, is the Dean of School of Modern Media at UPES University in Dehradun, a Non-Resident Senior Fellow, Institute of South Asian Studies at the National University Singapore, and Group Consulting Editor, Network 18. He is the author of India’s Techade: Digital Revolution and Change in the World’s Largest Democracy). Views are personal, and do not represent the stand of this publication.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!