Flows from Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) have been considered key factors in determining potential returns on Indian equities. With valuations reaching a zone of discomfort, the argument we often hear is that it is liquidity that will continue to drive this market.

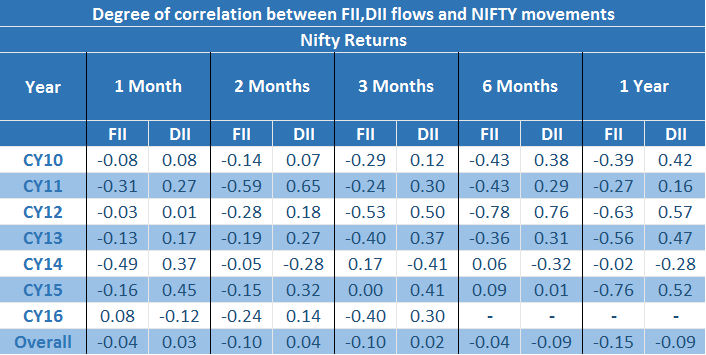

In this context, the correlation between short and medium term equity returns and flows, both from FIIs and DIIs, is worth exploring. We analysed the relationship between the net equity position of both categories and Nifty returns across different time periods - one month, two months, three months, six months, and a year. The data, analysed for a period six years, provides some interesting insights.

Surprisingly, neither FII nor DII flows have a strong correlation with market returns over a long period, as the correlation coefficient hovering close to zero suggests. Investors should clearly select stocks on merit rather than blindly following flow patterns. Tracking smart money in the long term doesn’t necessarily generate smart returns.

The correlation between FII flows and Nifty is weak even for short-term returns of Nifty (like one month to three months) and completely loses its relevance beyond six months.

Though the degree of correlation between DII flows and the index return over different time horizons has been varied, it is interesting to note that DII flows do have a relevance in pointing at slightly longer term return.

Our data suggests that in two out of the past six calendar years, there was a moderate correlation between the DII flows and the one-year benchmark return, and in two other years, a weak correlation.

For patient investors who are willing to wait it out in the market, watching domestic fund managers at work may be marginally more profitable than tracking foreign players.

However, in more recent times, the correlation has weakened considerably, especially for returns in the shorter term categories. From a one month and two month perspective, the correlation doesn’t say much – if one is trading in the market, following DII flows will not yield any result. Even though much of the recent rally in stock prices has been attributed to domestic flows, the weak correlation between DII flows and short-term returns doesn’t corroborate the argument.

There is no shortcut in investing. Investors need to do their homework, research stock ideas, and follow fundamentals, rather than relying on institutional flows as a sole lead indicator of future equity returns. However, for long term investors, keeping an eye on the strategies adopted by domestic fund managers may be a useful quality check.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.