Credit Suisse’s $4 billion fundraising was always going to be painful for shareholders, but with a deep discount on the new stock, their choice is only about how much of their ownership they want to lose.

The capital-raising plan was unveiled last week alongside a high-risk strategic overhaul, which still only promised a weak target for a 6 percent return on tangible equity in three years’ time, if things go according to plan. That is far below the 10 percent cost of capital assumed for big banks. It means Credit Suisse expects to be destroying value when its restructuring is done.

But the details of the share sale, which the bank released on October 31, leave investors with no real choice at all. The fund raising kicks off with new shares for a group of strategic investors led by state-controlled Saudi National Bank, who together will put in about $1.8 billion for a 14.8 percent stake.

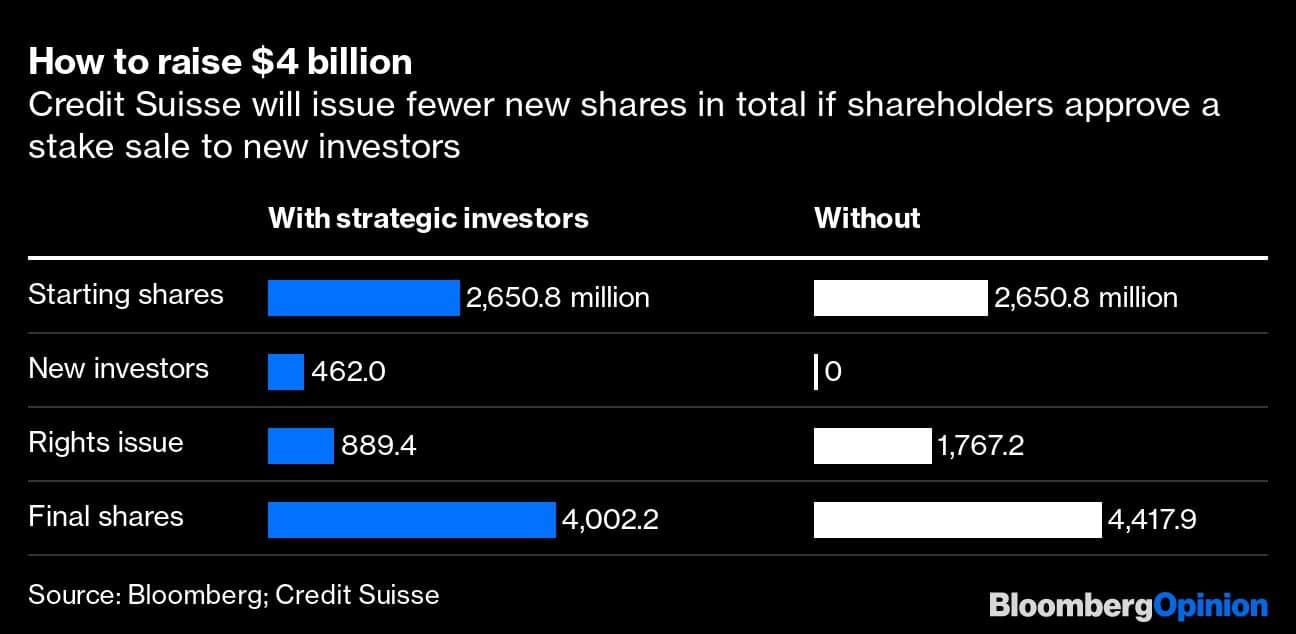

That’s to be followed by a $2.2 billion rights issue. That stock will be priced at just 2.52 Swiss francs ($2.51) per share, which is a 32 percent discount to the theoretical share price after all the new equity has been sold and based on the average share price over the final two days of last week. Having already seen new investors take a large stake, the rights issue will further dilute the claims of each share over Credit Suisse’s profit or book value by 22 percent.

Together, all the new shares lead to bottom-line dilution of earnings per share of almost 34 percent. That sounds horrible until you look at the dilution if shareholders don’t approve the strategic stake sale, which they are due to vote on at a November 23 meeting. Without the Saudi-led group, Credit Suisse would have to issue even more shares to raise the $4 billion it needs through a rights issue alone. The full dilution then would be 40 percent.

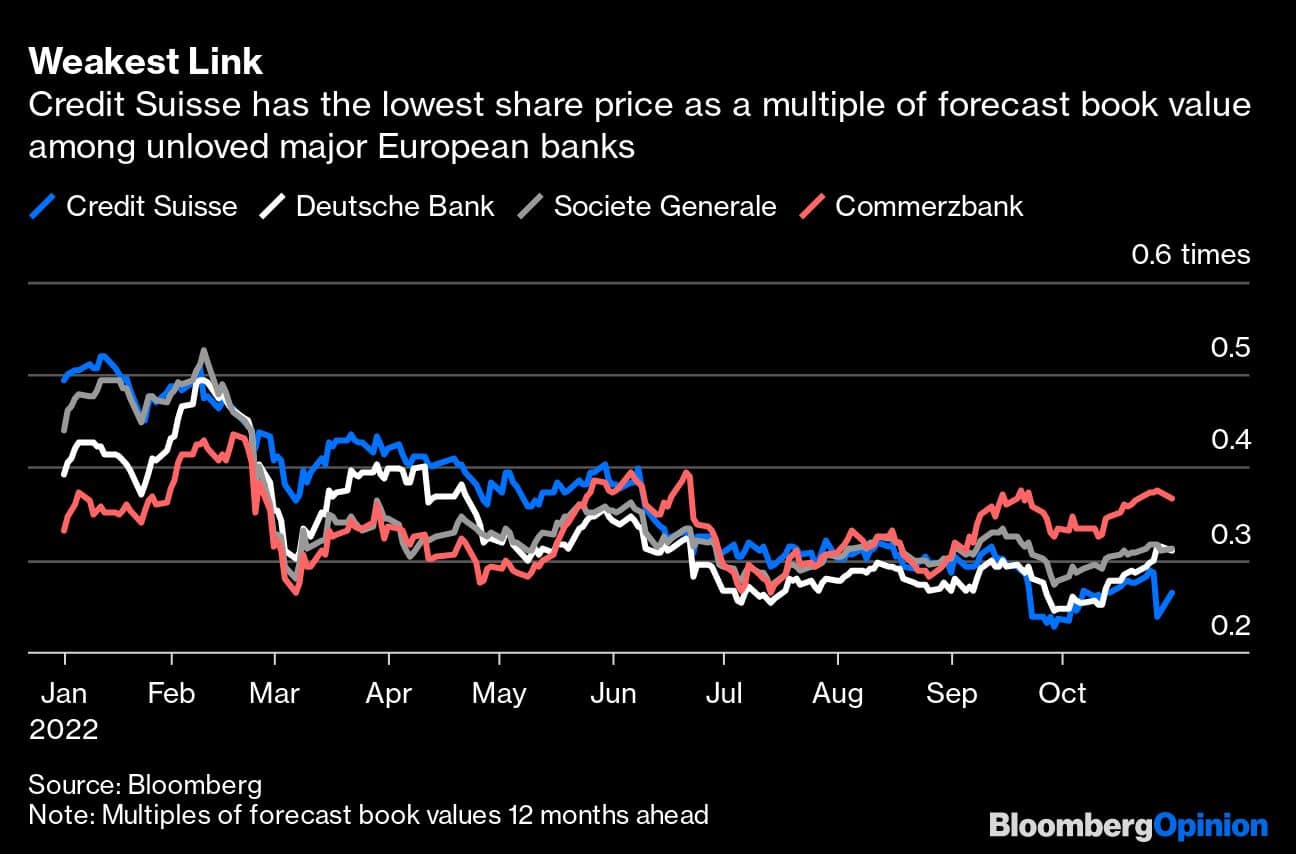

Credit Suisse stock has crumbled as executives struggled to deal with long-running scandals and losses, while investors lost faith in its ability to turn things around. After the October 27 strategy reveal, the shares closed at their lowest price in more than 30 years, down more than 57 percent in 2022. They trade with a valuation of just 25 percent of forecast book value, the worst of any major bank in Europe by some way.

What investors own right now – and what they are being offered more of — is really an option on the idea that Credit Suisse has hit rock bottom. That option looks cheap relative to book value, but not so cheap relative to forecast earnings per share after the dilution.

Credit Suisse will get its $4 billion. The rights issue is fully underwritten by the very large group of banks hired to share the burden. If shareholders balk and banks have to put up the cash, they’ll sell the stock to all comers and the price will likely get hit hard. The choice for existing shareholders is go along with the full plans and suffer a lot, or refuse one or more parts of it and suffer even more.

Paul J Davies is a Bloomberg Opinion columnist covering banking and finance. Previously, he was a reporter for the Wall Street Journal and the Financial Times. Views are personal, and do not represent the stand of this publication.

Credit: Bloomberg

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.