One of the vagaries of zero-carbon power as the world approaches its emissions peak is the way small year-to-year changes can mask the scale of the transformation underway.

Consider Europe. Russia’s invasion of Ukraine last year shut down gas imports just as drought conditions sapped hydroelectric generation and maintenance problems put much of France’s nuclear fleet out of action. The result was a rash of dire warnings about the continent’s “return to coal” as solid-fuel generators set for retirement were put on notice to fix the shortfall.

How’s the return to coal looking right now? Not so hot. The boom in 2022 turned out to be a blip. First-half coal generation in the European Union fell 23 percent this year, according to Ember, a research group pushing for the energy transition, sending fossil electricity to its lowest level for the period since at least 2000.

The same pattern is playing out on an even grander scale in China — and evidence is building that it’s going to be another blip.

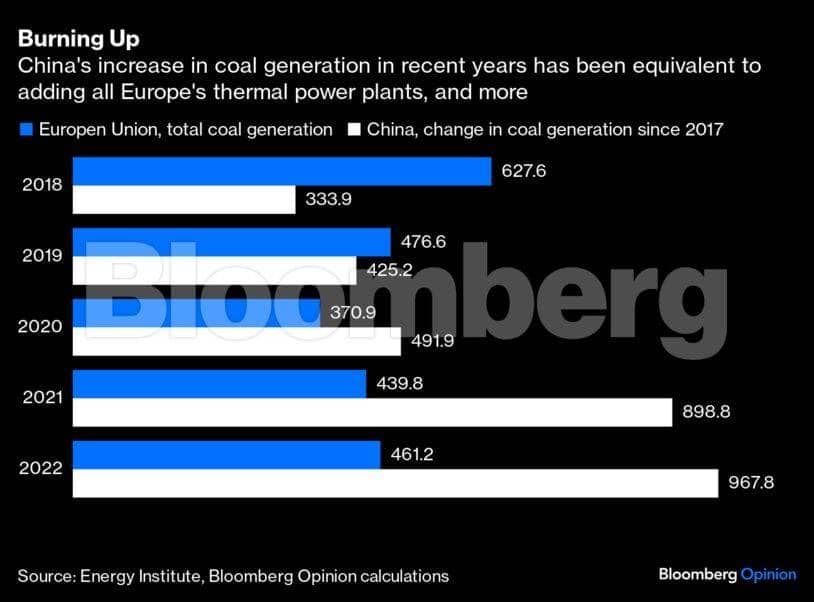

The past two years have seen a return to coal in China that’s quietly been vastly more dramatic than Europe’s. Just the increase in thermal generation alone between 2020 and 2022, at about 476 terawatt-hours, was equivalent to adding the output of every coal-burning power plant in the EU.

Unlike Europe’s governments, Beijing wasn’t treating this as a wartime one-off. In the first half of this year, it started construction on more than one new coal generator every week, according to Global Energy Monitor. The 243 gigawatts of new plants permitted and under construction is larger than the entire existing fleets in India or the US, the second- and third-biggest consumers of the fuel.

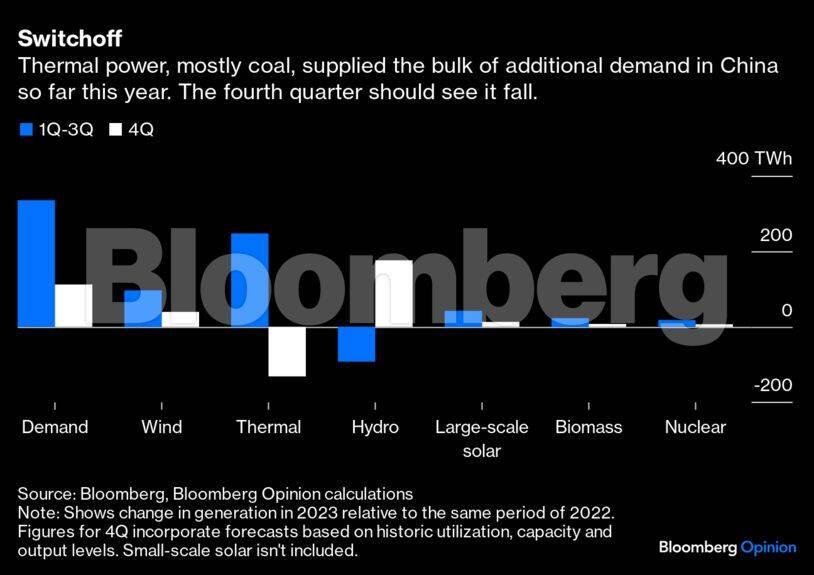

An odd thing has happened, however. Heavy rain over the summer months has finally brought an end to drought conditions that pushed utilisation of China’s vast hydroelectric sector to its lowest levels since 2014, as floodwaters flowed from the Himalayas into the network of dams and reservoirs along the upper Yangtze river. At the same time, hectares of solar panels have spread across rooftops while forests of wind turbines have sprouted in the desert and coastal waters. A few months ago, it looked like coal would smash through records in China’s power grid this year. It’s now touch and go whether it will increase at all.

The biggest factor is hydro. The generation capacity of reservoirs has doubled in China since the world’s largest power plant, the Three Gorges Dam, was completed in 2012. It now has about 30 percent of the world’s hydroelectricity. The tail end of the unusual three-year La Niña climate cycle over the past 18 months put much of that out of action. The shortfall in the first half of this year, relative to 10-year average levels, amounted to about 115 terawatt-hours — about the same as all the dams in the US generated during the period. Most of the gap was closed by soot.

That’s now reversed. Hydro power in September had the second-best year-on-year performance among all the major industrial goods tracked by China’s statistics bureau, according to data released Wednesday — second only to photovoltaic panels with a 39 percent annual growth rate. Combined with the blistering growth in wind and solar power, that may be sufficient to obviate the need for burning additional solid fuel. With falling output of cement and glass, and scant growth for steel and gasoline-powered cars, the country may yet experience its second-consecutive year of falling emissions — a sign that President Xi Jinping’s pledge of a peak by 2030 may have emerged nearly a decade early.

What could upset this outlook? The slowing economy meant that China’s first-half electricity consumption underperformed industry forecasts — but demand in September surged, growing at 9.2 percent from a year earlier. That compares to 5.3 percent during the first nine months and the China Electricity Council’s expectation of a 6 percent annual pace. If that faster rate is sustained, then we’re about to see a year-end growth spurt that could yet draw in more carbon.

Renewables could underperform their historic levels, too. Perhaps hydro operators will be required to hold more water behind their dams in case of future droughts. China’s solar panels often seem to be generating less power than you might expect, either because they’re being put in low-quality sites or because grid operators are cutting them off to stop them overloading the network. Should those factors worsen, coal still has a chance.

The path for growth has grown shockingly narrow, however. The billions that China once dedicated to real estate have shifted to the power sector, with investments in utilities increasing by 25 percent from a year earlier so far in 2023. Of all that new generation getting built, renewables are sucking up the majority of the funding and will be the most competitive in cost terms. China has been the last hope of coal demand globally. Even there, its days are now numbered.

David Fickling is a Bloomberg Opinion columnist covering energy and commodities. Views are personal and do not represent the stand of this publication.

Credit: Bloomberg

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.