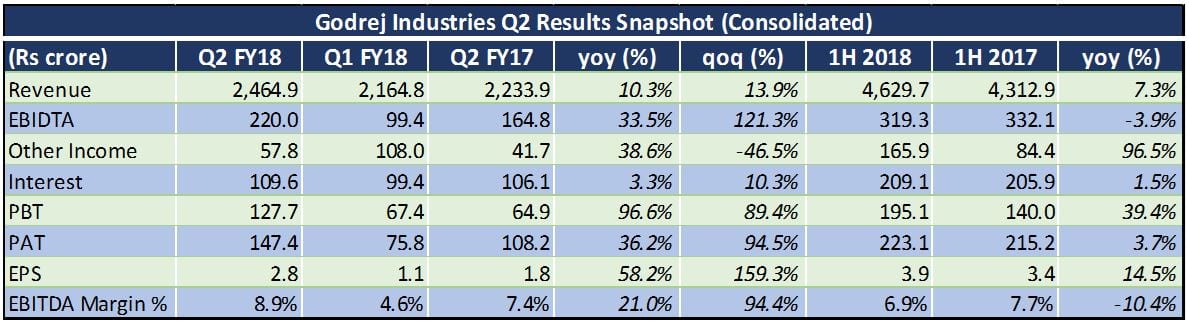

Godrej Industries (GIL) reported a 10 percent YoY increase in the consolidated revenue driven majorly by real estate (GPL) and consumer product businesses (GCPL). The chemical business reported a 12 percent YoY growth in revenue. However, Agrovets’ (GAVL) performance remained near flattish. Overall, the businesses gained some momentum post the subdued activity around GST implementation.

GPL was the major driver for GIL’s exuberating performance and reported a strong quarter with sales soaring 45 percent YoY and net profits up 91 percent. Over 50 percent of revenues came from the sale of inventory at the Bandra-Kurla Complex project. On the business development front, 8 new projects were brought in the pipeline.

Godrej Consumer registered decent growthGCPL reported a 10 percent volume growth along with a strong EBITDA performance attributable to an improved performance of the differentiated products portfolio. Growth was led by the soaps segment, with both hair colors and household insecticides registering a subdued growth. The international business delivered constant currency sales growth of 9 percent, driven by Africa, LatAm, and Europe.

Godrej Chemicals impacted by GST, exports provide supportThe chemical business saw revenues growing by 12 percent in Q2 and 20 percent in 1HFY18. However, high raw material prices and a subdued demand post GST impacted profitability with profit before interest and tax down 17 percent in Q2. The export portion provided support with a 26 percent YoY growth.

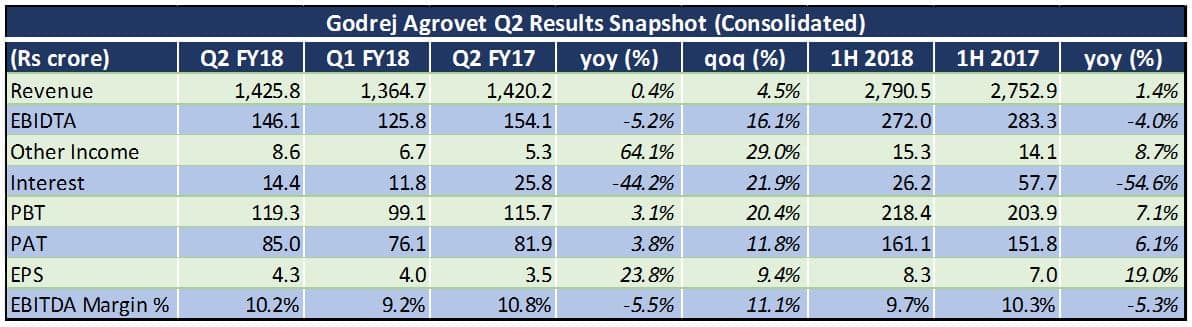

Godrej Agrovet flattish, future performance to improveDespite an uptick in volumes, GAVL reported a near flattish performance during the quarter, majorly owing to low commodity prices, especially corn, maize and soybean which impacted overall sales realizations. EBITDA saw around 5 percent fall due to surging employee costs. Lower interest costs and a healthy rise in other incomes, however, helped in improving net profit margins by around 4 percent.

Animal Feed business - The animal feed segment saw a 10 percent decline in sales led by low commodity prices. Headwinds in poultry feed and low live bird prices also impacted profitability.

Oil Palms Business – The oil palm business reported a 17 percent YoY rise in revenues during the quarter. The company reported improved cost efficiencies along with better oil extraction ratios which benefitted profitability.

Crop Protection – The crop protection business reported a healthy 12 percent topline growth despite difficult industry conditions. Export volumes were impacted during the quarter due to Malabar attacks.

Dairy – The dairy business reported strong revenue growth majorly driven by inorganic expansion and a single digit organic growth. Value added products added significantly to the growth. However, high procurement prices of milk (accounts for 75 percent volumes) due to farmer distress led to a collapse of margins during the quarter.

The Road AheadThe properties business is expected to sustain the improved margins in the coming quarters and remain the frontrunner for growth. Its focus on the joint development or management model to execute projects allows it to grow significantly faster than peers without stretching its balance sheet. With a robust pipeline of project in its kitty, we believe the exuberant performance to continue.

With low feed prices and high animal protein prices, the farmers stand in a profitable position and this profitability would help in expanding the animal farm market, which would benefit volumes in animal feed business in coming quarters.

Going forward, the company believes firming up commodity prices would bring in better realizations. With increase government focus on agriculture, promotion of animal husbandry and increased R&D focus, the industry prospects should be better.

Healthy monsoon and rise in oil prices are expected to further improve oil palm acreage and help expand the high margin oil palm production. Moreover, with a good monsoon and good sowing numbers Rabi sales are expected to be good (accounts for 33 percent of annual sales).

With stabilization of milk prices and pile-up of powder milk stocks, milk procurement prices are expected to go down in coming quarters which would benefit GAVL’s margins.

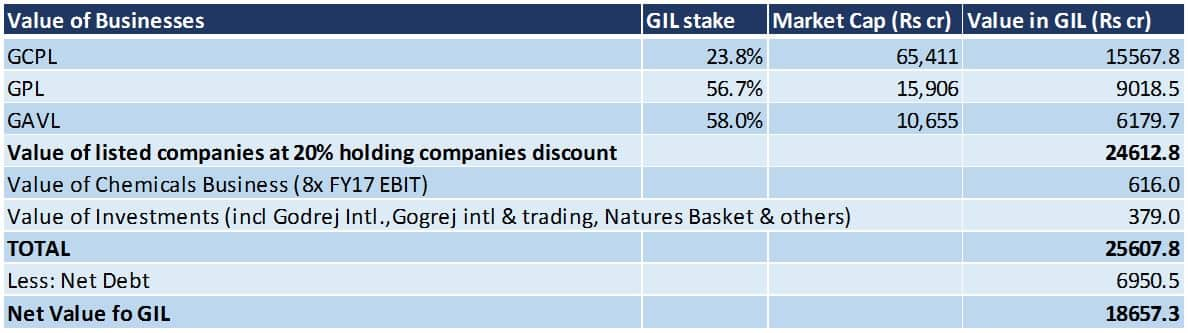

ValuationsGIL stock has run up 32 percent since the start of the year and had seen 9 percent rerating in October during the IPO of Godrej Agrovet. Looking at the current multiples, the company is trading at a 28X FY19 earnings. On a SOTP valuation, the company seems to be fairly prices currently (see table).

GIL’s business model and investments seem directionally sound. Group companies are operating in either under-penetrated or high growth industries and enjoy great brand presence and market shares. Overall, we recommend considering investment in GIL on correction.

Follow @RuchiagrawalFor more research articles, visit our Moneycontrol Research Page.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.