The market clocked a seven-tenth of a percent gains on September 5 despite weakness in global peers. All sectors participated in the run-up and the broader markets also gained momentum with the Nifty Midcap 100 index rising 0.4 percent and Smallcap 100 index climbing 1.2 percent.

The BSE Sensex rallied more than 440 points to 59,246, while the Nifty50 jumped 126 points to 17,666 and formed a bullish candlestick pattern on the daily charts, but still traded within the range of 17,300-17,800 levels.

"A reasonable positive candle was formed on the daily chart, which is placed beside the negative candle of Friday. Technically, this pattern indicates a rangebound action for the market with positive bias. Presently, Nifty is stuck within a high low range of 17,800 on the upside and 17,300 levels on the downside," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

Shetti feels a sustainable buying could only emerge on the move above 17,800 levels and the slide below the immediate support of 17,300 could pull the Nifty down to the next support of 17,000 levels for the near term.

However, the long-term charts like weekly and monthly are still positive and one may expect any downward correction to be a buy-on-dips opportunity, the market expert said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,576, followed by 17,487. If the index moves up, the key resistance levels to watch out for are 17,719 and 17,773.

The Nifty Bank jumped 385 points to 39,806, and formed a bullish candlestick pattern on the daily charts on Monday. The important pivot level, which will act as crucial support for the index, is placed at 39,520, followed by 39,235. On the upside, key resistance levels are placed at 39,978 and 40,151 levels.

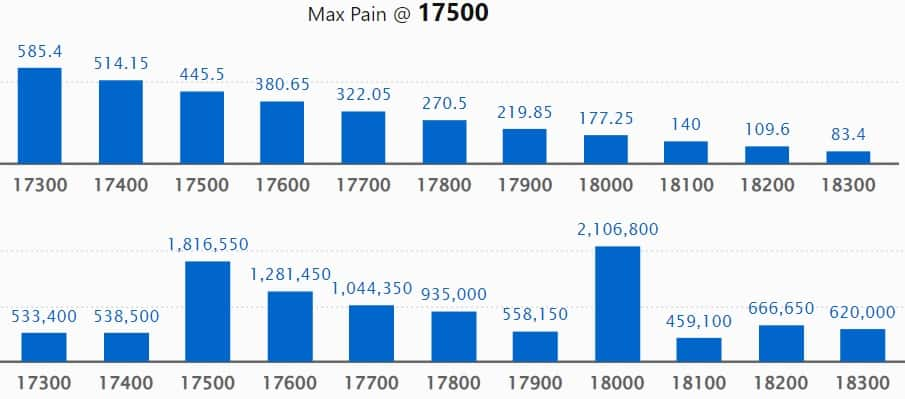

Maximum Call open interest of 21.06 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the September series.

This is followed by 18,500 strike, which holds 17.65 lakh contracts, and 19,000 strike, which has accumulated 17.49 lakh contracts.

Call writing was seen at 17,700 strike, which added 1.11 lakh contracts, followed by 18,700 strike which added 74,750 contracts and 18,900 strike which added 56,400 contracts.

Call unwinding was seen at 17,500 strike, which shed 3.98 lakh contracts, followed by 17,600 strike which shed 2 lakh contracts and 17,400 strike which shed 42,600 contracts.

Maximum Put open interest of 33.28 lakh contracts was seen at 16,500 strike, which will act as a crucial support level in the September series.

This is followed by 17,500 strike, which holds 30.26 lakh contracts, and 17,000 strike, which has accumulated 27.6 lakh contracts.

Put writing was seen at 17,000 strike, which added 1.37 lakh contracts, followed by 16,400 strike, which added 1.21 lakh contracts and 18,000 strike which added 1 lakh contracts.

Put unwinding was seen at 18,500 strike, which shed 63,350 contracts, followed by 17,300 strike which shed 55,000 contracts, and 17,500 strike, which shed 17,950 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Power Grid Corporation of India, HDFC Bank, Ipca Laboratories, Bajaj Auto, and Container Corporation of India, among others.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Exide Industries, Bank Nifty, Nifty Financial, Dixon Technologies, and Power Grid Corporation of India, in which a long build-up was seen.

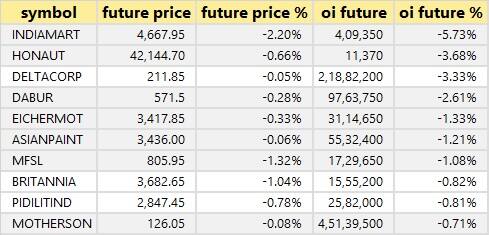

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including IndiaMART InterMESH, Honeywell Automation, Delta Corp, Dabur India, and Eicher Motors, in which long unwinding was seen.

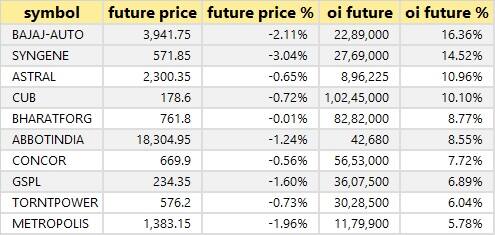

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including Bajaj Auto, Syngene International, Astral, City Union Bank, and Bharat Forge, in which a short build-up was seen.

52 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including Hindalco Industries, M&M Financial Services, Intellect Design Arena, and Alkem Laboratories, and GAIL India, in which short-covering was seen.

Apollo Micro Systems: Jupiter India Fund sold 2,45,463 equity shares or 1.18 percent stake in the company via open market transactions. These shares were sold at an average price of Rs 158.99 per share. Jupiter held 1.37 percent stake in the company as of June 2022.

V-Mart Retail: HSBC Bank Mauritius Limited AC Jwalamukhi Investment Holdings has exited the retail company by offloading entire 13,91,826 equity shares or 7.04 percent stake at an average price of Rs 2,816.29 per share. However, Plutus Wealth Management LLP was the buyer in this deal, acquiring 11.45 lakh shares or 5.79 percent stake in the company at an average price of Rs 2,815.03 per share.

(For more bulk deals, click here)

Investors Meetings on September 6

Tata Consultancy Services: Officials of the company will attend Morningstar Conference.

Metro Brands: Officials of the company will interact with Motilal Oswal.

Syngene International: Officials of the company will meet CLSA.

Voltas: Officials of the companies will attend Spark Capital Investor Conference, and Ashwamedh - Elara India Dialogue 2022.

Mastek, L&T Infotech, ONGC, VRL Logistics, Tech Mahindra, Nazara Technologies, Mahanagar Gas, Info Edge, Healthcare Global Enterprises, Inox Leisure: Officials of the companies will attend Ashwamedh - Elara India Dialogue 2022.

Torrent Power, Zee Entertainment Enterprises, Sterling and Wilson Renewable Energy, Inox Leisure, Aether Industries, Bajaj Consumer Care, KEI Industries: Officials of the companies will attend Spark Capital Investor Conference.

Bajaj Finance: Officials of the company will interact with a group of institutional investors/funds in London.

NLC India: Officials of the company will participate in investors meet organised by ICICI Securities.

Dr Lal PathLabs: Officials of the company will attend Kotak Institutional Equities' Healthcare Forum.

VIP Industries: Officials of the company will meet Capital Research Global Investors.

Greaves Cotton, Apollo Tyres: Officials of the companies will attend Citi India Autos trip.

Home First Finance Company India: Officials of the company will be attending “Housing Finance Day” organized by Mirae Asset Capital Markets.

Sapphire Foods India: Officials of the company will meet C Worldwide, Millennium Partners, Abu Dhabi Investment Authority, Government of Singapore (GIC), Invesco MF, and Franklin Templeton MF.

Stocks in News

DreamFolks Services: DreamFolks Services will make its grant debut on the bourses on September 6. The issue price has been fixed at Rs 326 per share.

Commercial Syn Bags: The stock will be in focus as the board of directors of the company has declared dividend at Rs 2.10 per share. The dividend will be paid to 1.27 crore equity shareholders of the company and total 6,07,500 warrants holder subject to conversion into equity shares. The record date for the payment of said dividend has been fixed as September23.

DCW: The company has made the payment towards the early partial redemption of 900 NCDs (out of 35,000 NCDs) having face value of Rs 1 lakh each.

Narayana Hrudayalaya: The stock will be in focus as it has signed an agreement with Shiva and Shiva Orthopaedic Hospital Private Limited and its promoters to subscribe to the optionally convertible debentures (OCDs). These OCDs are worth Rs 80 crore. With this, the company is going to acquire Shiva's orthopedic and trauma hospital (Sparsh Hosur Road' unit), situated at Narayana Health City campus, Bengaluru. Narayana Hrudayalaya will subscribe to the OCDs on completion of the conditions in the agreement with closure date expected to be on or before December 31, 2022.

Delhivery: SBI Mutual Fund acquired more than 1.07 lakh equity shares in the company via open market transactions on September 1. With this, its stake in the company increased to 5%, up from 4.98% earlier.

Fund Flow

Foreign institutional investors (FIIs) have net sold shares worth Rs 811.75 crore, whereas domestic institutional investors (DIIs) net bought shares worth Rs 533.77 crore on September 5, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Delta Corp remained in the NSE F&O ban list for September 6. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.