After a sharp downward move, the bears turned active given the negative crossover on the RSI (relative strength index) and may take the Nifty50 further down up to the 20-day EMA (exponential moving average) placed at 19,780. But if the index takes support at the horizontal resistance trendline which coincides with Wednesday's low in coming sessions, then a rebound towards 20,000-20,100 levels can't be ruled out, experts said.

The market extended selling pressure for yet another session on September 20, and saw the biggest single-day loss since July 21 this year, due to fall across sectors.

The BSE Sensex plummeted 796 points or 1.18 percent to 66,801, while the Nifty50 dropped 232 points or 1.15 percent to 19,901 and formed a bearish candlestick pattern on the daily charts.

The Nifty has dipped below its previous swing high on the daily chart, indicating a decline in bullish sentiment. Following a period of consolidation, the index experienced a correction, which could be considered as an early indication of a bearish reversal, Rupak De, senior technical analyst at LKP Securities said.

In the short term, he feels it is probable that the Nifty will decrease towards the 19,700-19,630 range. Selling on rallies might remain a favourable strategy as long as the index remains below the 20,000 mark, he said.

The broader markets were also down, but the loss was less compared to benchmarks. The Nifty Midcap 100 and Smallcap 100 indices declined 0.3 percent and 0.9 percent respectively. The market breadth was weak, too, with an advance-decline ratio of 1:2.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks are the aggregates of three-month data and not just the current month.

Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty may be taking support at 19,878, followed by 19,837 and 19,772. On the higher side, 20,009 can be an immediate resistance, followed by 20,050 and 20,116.

On September 20, the Bank Nifty also corrected sharply, led by HDFC Bank. The index plunged 595 points or 1.29 percent to 45,385 and formed a bearish candlestick pattern with a long upper shadow and minor lower shadow on the daily timeframe, indicating pressure at higher levels.

"The Bank Nifty was unable to break the previous swing high (record high of 46,370) which was a sign of weakness. On the downside, it can drift towards 45,070 – 44,930 where support in the form of the 50 percent Fibonacci retracement level and the 20-day moving average is placed respectively," Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas said.

Considering the sharp fall, he feels a pullback is possible. However, he expects it to be sold into and that should be the ideal trading strategy from a short-term perspective.

As per the pivot point calculator, the banking index is expected to take support at 45,290, followed by 45,179 and 45,000. On the upside, the initial resistance is at 45,648, then 45,758 and 45,937.

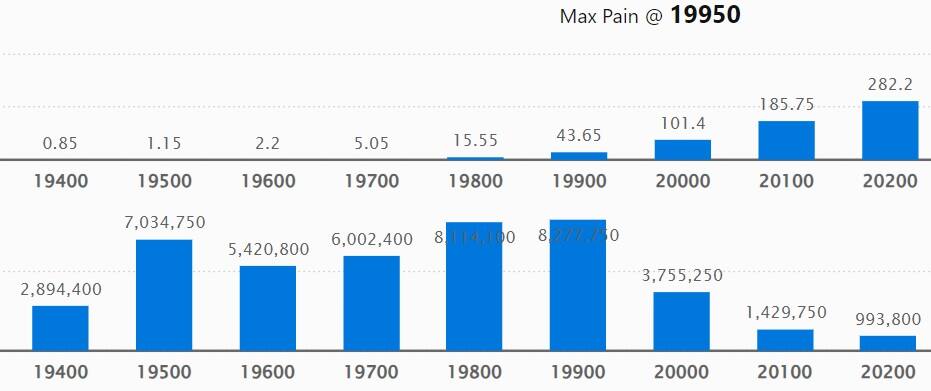

As per the options data, after Wednesday's fall, the maximum weekly Call open interest (OI) was seen at 20,000 strike, with 1.73 crore contracts, which can act as a key resistance for the Nifty. It was followed by 20,200 strike, which had 1.37 crore contracts, while 20,100 strike had 1.31 crore contracts.

The meaningful Call writing was seen at 20,000 strike, which added 1.6 crore contracts, followed by 20,100 and 19,900 strikes, which added 95.1 lakh and 50.84 lakh contracts.

The maximum Call unwinding was at 20,700 strike, which shed 12.72 lakh contracts, followed by 20,600 strike and 19,000 strike, which shed 3.67 lakh contracts, and 8,050 contracts.

On the Put side, the maximum open interest was at 19,900 strike, with 82.77 lakh contracts. This can be an important support for the Nifty in the coming sessions.

It was followed by 19,800 strike comprising 81.14 lakh contracts, and 19,500 strike with 70.34 lakh contracts.

The meaningful Put writing was at 19,900 strike, which added 36.93 lakh contracts, followed by 19,700 strike and 19,600 strike, which added 33.69 lakh and 30.08 lakh contracts.

Put unwinding was at 20,100 strike, which shed 66.36 lakh contracts followed by 20,200 strike and 20,000 strike, which shed 26.01 lakh and 23.1 lakh contracts.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Hindustan Unilever, Reliance Industries, Bharti Airtel, Maruti Suzuki and HCL Technologies have seen the highest delivery among the F&O stocks.

The long build-up was seen in 30 stocks on Wednesday, including Hindustan Copper, Glenmark Pharma, Dr Lal PathLabs, Vodafone Idea, and GAIL India. An increase in open interest (OI) and price indicates a build-up of long positions.

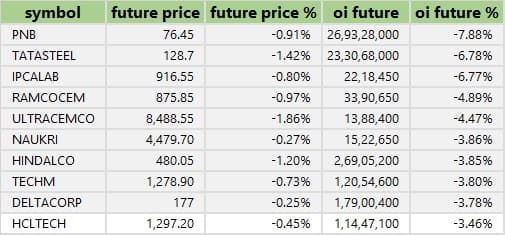

Based on the OI percentage, a total of 64 stocks including Punjab National Bank, Tata Steel, Ipca Laboratories, Ramco Cements, and UltraTech Cement, saw long unwinding. A decline in OI and price indicates long unwinding.

61 stocks see a short build-up

A short build-up was seen in 61 stocks, including HDFC Bank, Reliance Industries, Hero MotoCorp, Berger Paints, and Vedanta. An increase in OI along with a fall in price points to a build-up of short positions.

Based on the OI percentage, 32 stocks were on the short-covering list. These included Bharat Forge, Mphasis, Sun Pharmaceutical Industries, Bajaj Auto, and Eicher Motors. A decrease in OI along with a price increase is an indication of short-covering.

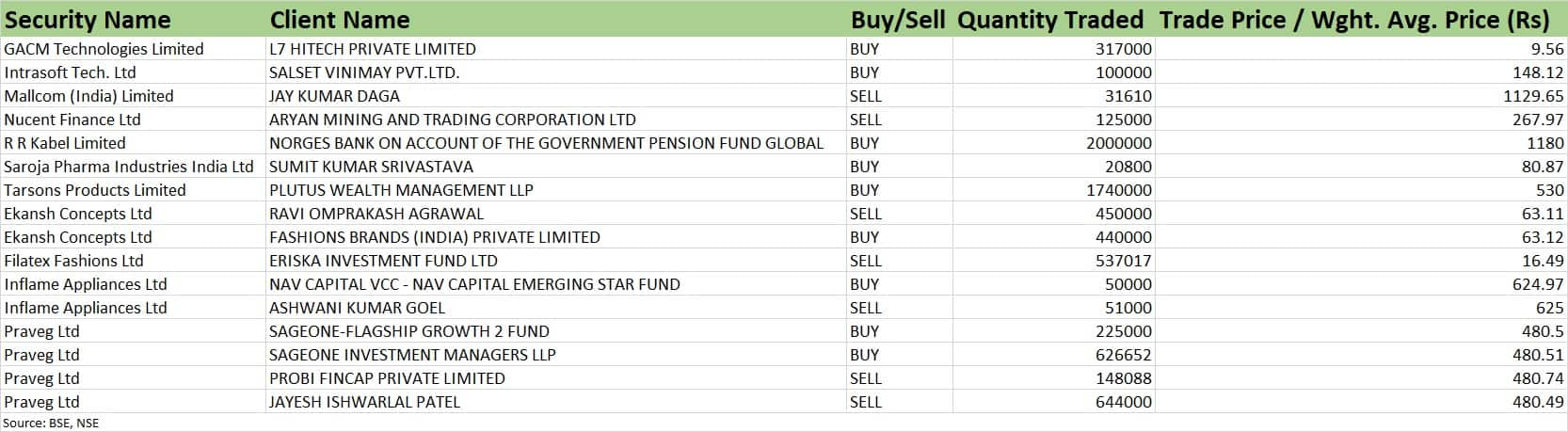

(For more bulk deals, click here)

Investors meeting on September 21

HDFC Bank: Senior officials of the company will attend JP Morgan – Emerging Markets Credit Conference.

Polycab India: The company's officials will interact with representatives of Goldman Sachs.

Rajratan Global Wire: Officials of the firm will meet Nalanda Capital.

Safari Industries: Management of the company will interact with Elephant Asset Management.

Adani Green Energy: Officials of the company will attend Credit Investor Conference organised by Nomura.

Sterling Tools: The company's officials will be interacting with investors and analysts.

Lloyds Metals and Energy: Senior officials of the company will meet Valorem Advisors.

Cigniti Technologies: The company's senior management team will interact with Miri Capital.

Brigade Enterprises: Senior management of the company will meet Schroders Asset Management, Oxbow Capital, Kotak Offshore, Janus Henderson Investors, and UG Funds, in Singapore.

MTAR Technologies: Officials will be interacting with institutional investors.

Phoenix Mills: The senior management team will be meeting Elephant Asset Management.

Stocks in the news

EMS: The sewerage solutions company will list shares on the BSE and NSE on September 21. The issue price has been fixed at Rs 221 per share.

SJVN: The government is going to sell up to 9,66,72,962 equity shares or 2.46 percent stake in the hydroelectric power generation company on September 21 and 22, with an option to additionally sell 9,66,72,961 equity shares or 2.46 percent stake. OFS opens for non-retail investors on September 21 and retail investors on September 22. The floor price of the offer will be Rs 69 per share.

Biocon: Subsidiary Biocon Biologics has received approval from the European Commission for marketing authorisation in the European Union (EU) for YESAFILI, a biosimilar of Aflibercept. YESAFILI, an ophthalmology product, is used for the treatment of neovascular (wet AMD) age-related macular degeneration, and visual impairment due to macular oedema secondary to retinal vein occlusion.

Cipla: After the inspection, InvaGen's manufacturing facility in Central Islip, New York has received 5 inspectional observations in Form 483, from US FDA. There are no repeat or data integrity observations. The US FDA inspected the said facility of subsidiary InvaGen Pharmaceuticals Inc during September 11-19. The inspection was a routine current good manufacturing practices inspection and a pre-approval inspection (PAI) for a site transfer product within InvaGen.

Apollo Tyres: Bias and OTR tyre production at the company's manufacturing facility in Limda, Gujarat has been stopped due to certain concerns amongst shop floor employees relating to the renewal of the long-term settlement agreement. The company is in discussions and negotiations with the labour union representatives to address their concerns and find an amicable resolution. There is no material impact on the operations at this stage.

Infosys: The country's second-largest IT services provider and Nasdaq-listed NVIDIA have expanded their strategic collaboration with the aim to help enterprises worldwide, drive productivity gains with generative AI applications and solutions. Infosys will train 50,000 employees on NVIDIA AI technology.

Zydus Lifesciences: The pharma company has received final approval from the United States Food and Drug Administration (USFDA) for Clindamycin Phosphate Gel USP, 1 percent which is used to treat acne. The drug will be manufactured at the group’s topical manufacturing facility at Changodar, Ahmedabad. The drug had annual sales of $37 million in the United States as per IQVIA MAT July 2023.

Fund Flow (Rs Crore)

Foreign institutional investors (FII) sold shares worth Rs 3,110.69 crore, while domestic institutional investors (DII) offloaded Rs 573.02 crore worth of stocks on September 20, provisional data from the National Stock Exchange (NSE) showed.

Stocks under F&O ban on NSE

The NSE has retained Balrampur Chini Mills, BHEL, Chambal Fertilizers & Chemicals, Delta Corp, Hindustan Copper, Indiabulls Housing Finance, Manappuram Finance, Punjab National Bank and Zee Entertainment Enterprises to its F&O ban list for September 21. Indian Energy Exchange was removed from the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!