The market almost moved closer to its immediate hurdle of 22,500 and also climbed back above the upward sloping resistance trendline on the Nifty 50, following rebound in last couple of hours of trade on March 6. This indicates the bulls retained upper hand over Dalal Street and are likely to lift Nifty towards 22,600-22,700, the immediate area of resistance, with support at 22,400-22,200 levels, experts said.

On March 6, the benchmark indices ended at a new closing high with the BSE Sensex rising 409 points to 74,086, while the Nifty 50 recovered 250 points from day's low and ended at 22,474, up 118 points, forming long bullish candlestick pattern on the daily charts with above average volumes. Also the index defended 10-day EMA (exponential moving average placed at 22,270).

The derivatives data indicates short positions outstanding in the index futures segment while the RSI (relative strength index) readings are positive. The index has continued the ‘higher top higher bottom’ structure. This could lead to a short covering of such positions which could lead the indices higher, Ruchit Jain, lead research at 5paisa.com said.

He feels the immediate support for Nifty is now placed around 22,200 while the retracements indicate possible targets around 22,700. Thus, he advised traders to continue to trade with a positive bias till the index trades above its support.

Rupak De, senior technical analyst at LKP Securities, too, feels the short-term trend appears positive, as the index concluded the day above the 21-day EMA (22,120) on the daily chart. "Looking ahead, there is potential for the Nifty to reach levels between 22,600 and 22,700 on the higher end," he said.

The volatility dropped further with the India VIX falling 0.59 percent to 14.30, giving support to bulls. The VIX fell for sixth consecutive session.

However, the broader markets remained under pressure, with the Nifty Midcap 100 index declining half a percent and Smallcap 100 down 2 percent.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty may face resistance at 22,503 followed by 22,567 and 22,671 levels. On the lower side, the index is likely to take immediate support at 22,294, followed by 22,230 and 22,126.

On March 6, the Bank Nifty was the star performer among leading sectors, climbing 384 points to 47,965 and formed bullish candlestick pattern on the daily charts with healthy volumes. The higher highs formation continued for fifth consecutive session. Now, the index is 671 points away from its record high of 48,636 seen on December 28, 2023.

"We expect the momentum to continue. Dips towards 47,800 – 47,680 should be used as a buying opportunity. The Bank Nifty is likely to retest the previous all-time high of 48,636," Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas said.

As per the pivot point calculator, Bank Nifty may see resistance at 48,131 followed by 48,301 and 48,575. On the lower side, the index is expected to take support at 47,582 followed by 47,412 and 47,137.

As per the weekly options data, the maximum Call open interest was seen at 23,000 strike with 1 crore contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 22,800 strike, which had 87.31 lakh contracts, while the 22,700 strike had 75.97 lakh contracts.

Meaningful Call writing was seen at the 22,800 strike, which added 27.84 lakh contracts, followed by the 22,700 strike adding 27.26 lakh contracts, and 22,600 strike with 21.85 lakh contracts.

The maximum Call unwinding was at the 22,400 strike, which shed 28.58 lakh contracts, followed by the 22,200 and 23,200 strikes, which shed 9.86 lakh and 5.66 lakh contracts.

On the Put side, the 22,000 strike owned the maximum open interest, which can act as a key support for the Nifty, with 1.1 crore contracts. It was followed by the 22,300 strike comprising 98.78 lakh contracts and then the 21,800 strike with 84.07 lakh contracts.

Meaningful Put writing was at the 22,300 strike, which added 49.74 lakh contracts, followed by the 22,400 strike and 21,800 strike, which added 48.46 lakh and 37.78 lakh contracts.

Put unwinding was seen at 21,700 strike, which shed 11.42 lakh contracts, followed by 21,300 and 21,400 strikes, which shed 5.95 lakh and 33,850 contracts, respectively.

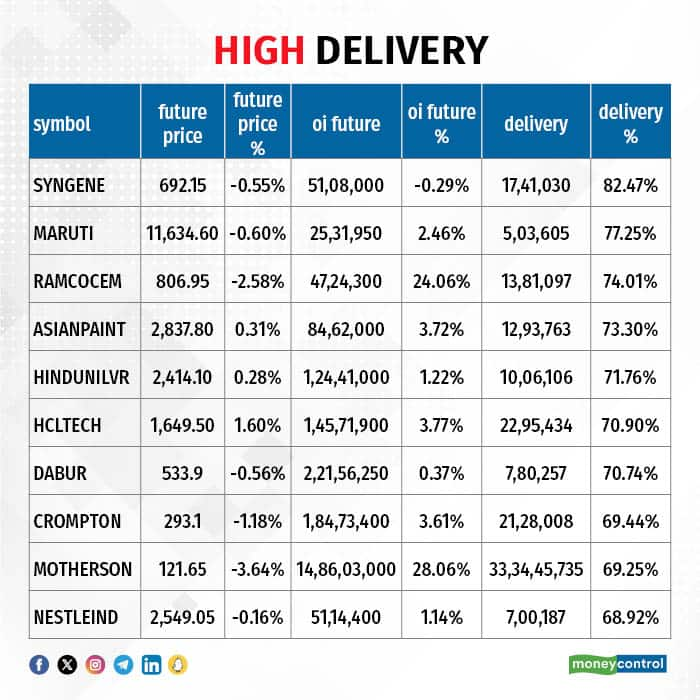

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Syngene International, Maruti Suzuki India, Ramco Cements, Asian Paints, and Hindustan Unilever saw the highest delivery among the F&O stocks.

A long build-up was seen in 39 stocks, which included Sun Pharmaceutical Industries, Bajaj Auto, Oracle Financial Services Software, SBI Life Insurance Company, and HCL Technologies. An increase in open interest (OI) and price indicates a build-up of long positions.

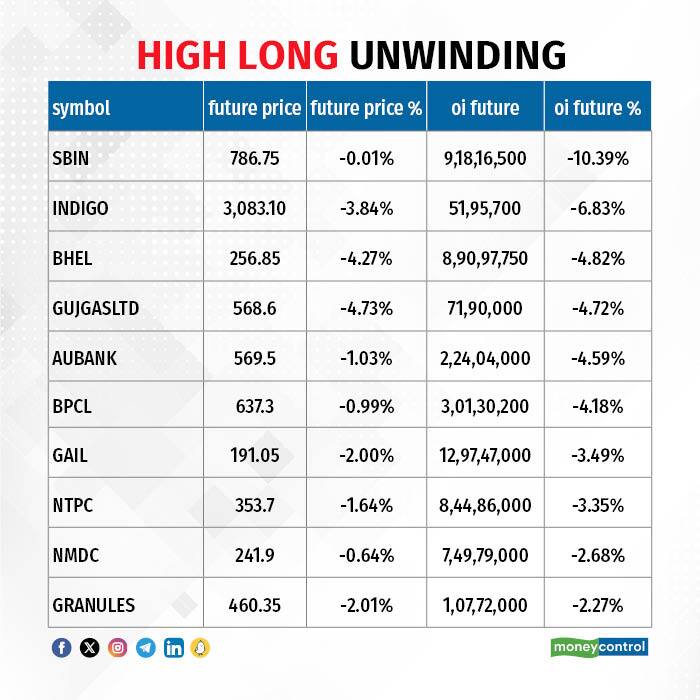

Based on the OI percentage, 44 stocks saw long unwinding. These include State Bank of India, InterGlobe Aviation, BHEL, Gujarat Gas, and AU Small Finance Bank. A decline in OI and price indicates long unwinding.

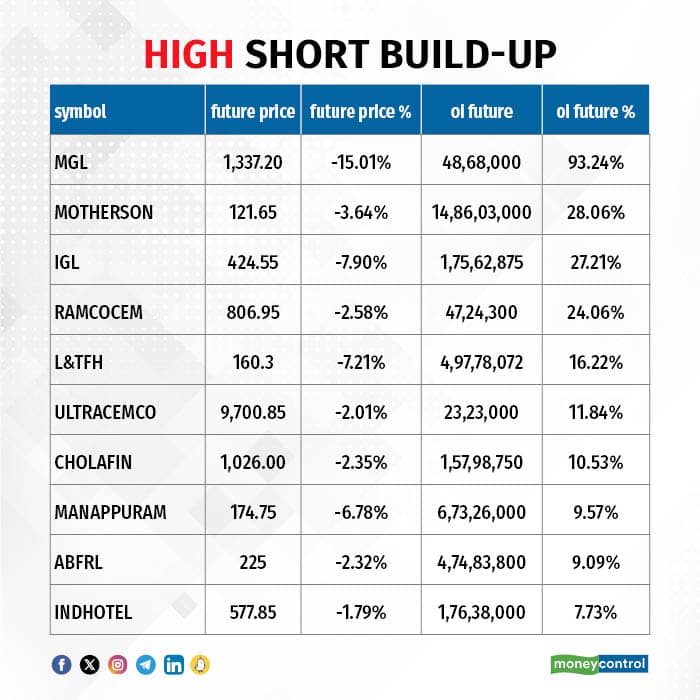

63 stocks see a short build-up

A short build-up was seen in 63 stocks, including Mahanagar Gas, Samvardhana Motherson International, Indraprastha Gas, Ramco Cements, and L&T Finance Holdings. An increase in OI along with a fall in price points to a build-up of short positions.

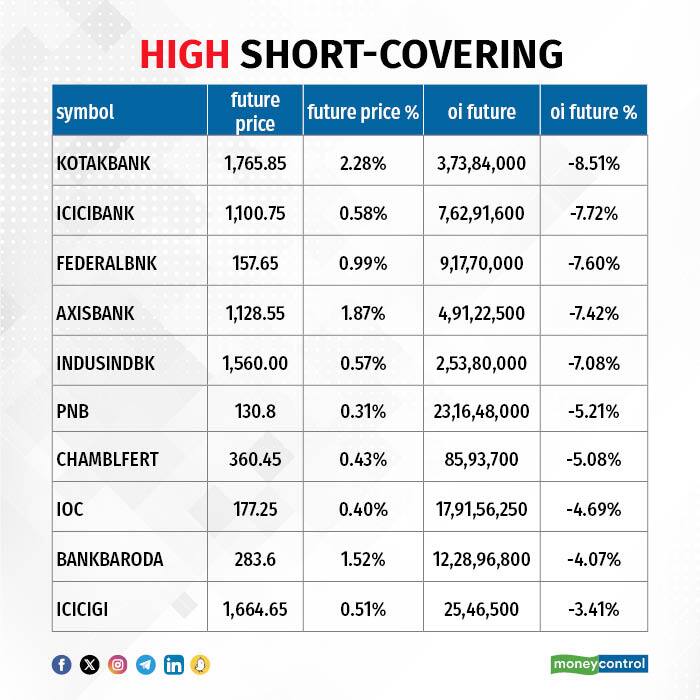

37 stocks see a short covering

Based on the OI percentage, 37 stocks were on the short-covering list. These include Kotak Mahindra Bank, ICICI Bank, Federal Bank, Axis Bank, and IndusInd Bank. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, jumped to 1.32 on March 6, from 1.23 in the previous session. Above 1 PCR indicates that the trading volume of Put options is more than Call options, which generally suggests a bearish market ahead.

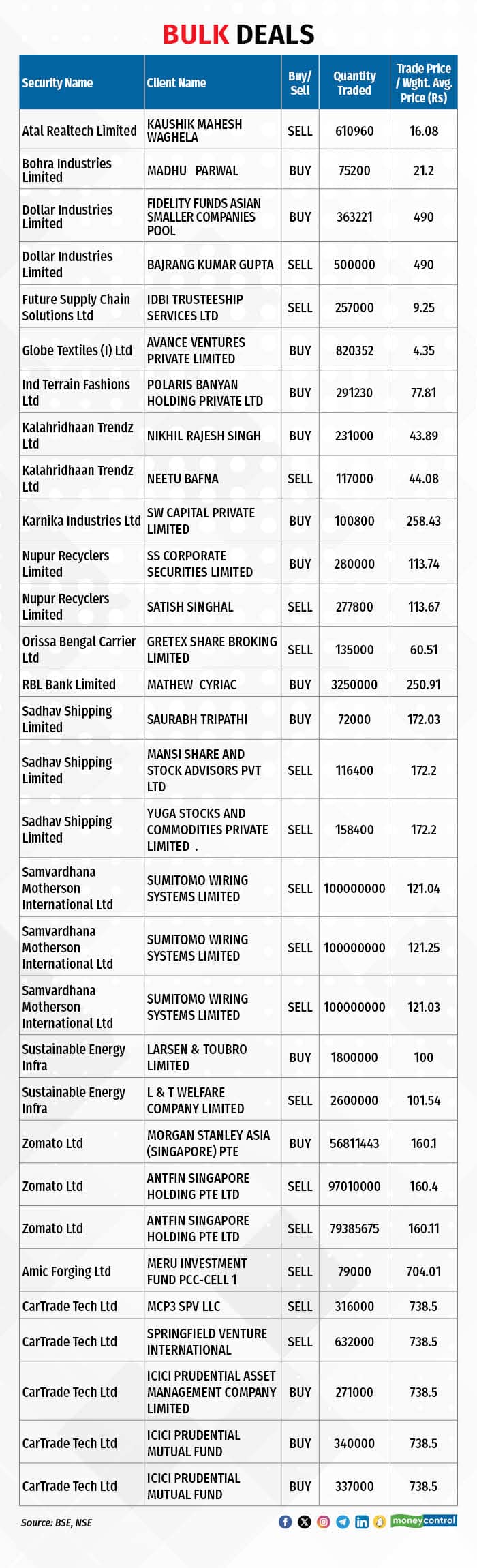

For more bulk deals, click here

Stocks in the news

Mahindra and Mahindra: A promoter group entity is likely to sell around 0.75 percent stake in M&M to raise around $215 million via a block deal, multiple people familiar with the development said. The block deal has been launched, and the offer price range is Rs 1,911.5 per share to Rs 1,970.65 per share.

NLC India: The government is going to sell 5 percent shareholding in NLC India (base offer size), with an option to additionally sell another 2 percent shares (the oversubscription option) via offer-for-sale on March 7 and March 11.

Jupiter Wagons: The Ministry of Railways (Railway Board) has placed an offer to the company for manufacture and supply of 2,237 numbers of BOSM Wagons for a contract value of Rs 956.88 crore.

Hindustan Aeronautics: The state-run defence company has signed an amendment to the LCA (Light Combat Aircraft) IOC (Initial Operational Clearance) contract. The value of the contract has been revised from Rs 2,700.87 crore to Rs 5,077.95 crore.

GPT Infraprojects: The infrastructure company has bagged an order worth Rs 135 crore, from North Central Railway, Agra. This contract is in joint venture with GPT’s share being 51 percent.

Funds Flow (Rs crore)

Foreign institutional investors (FIIs) net bought shares worth Rs 2,766.75 crore, while domestic institutional investors (DIIs) purchased Rs 2,149.88 crore worth of stocks on March 6, provisional data from the NSE showed.

Stock under F&O ban on NSE

The NSE has added Manappuram Finance, and Mahanagar Gas to the F&O ban list for March 7, while retaining Zee Entertainment Enterprises on the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclsoure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.