The equity market ended Thursday's (February 9) volatile and rangebound session with moderate gains due to a lack of fresh triggers. However, it found some support as volatility eased.

Technology and select banking & financial services stocks helped the market close in the green, but gains were capped by selling in metal, pharma, select auto and FMCG stocks.

The S&P BSE Sensex rose 142 points to 60,806, while the Nifty50 climbed 22 points to 17,893 after taking good support at the 17,800 level for yet another session, forming a Doji pattern on the daily charts as the closing was near the opening levels, indicating indecision among bulls and bears about the future market trend. Hence, if the same gets held on to in coming sessions, then the possibility to move towards the psychological 18,000 mark is likely, experts said.

"We observe positive patterns like higher highs and higher lows were formed and the Nifty is now making an attempt to move into new higher high," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

Shetti further said the crucial area of 17,800 has been held on the upside in the last two sessions and this market action signal possibility of up move towards 18,050 and the next 18,200 levels in the near term. Immediate support is placed at 17,750-17,800 levels, he added.

The broader markets closed flat but the India VIX, the fear index, fell 4.08 percent from the 13.60 level, to the 13.04 level.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data, and not just of the current month.

Key support and resistance levels on the Nifty

As per the pivot charts, we have the key support level for the Nifty at 17,811, followed by 17,779, and 17,726. If the index moves up, the key resistance levels to watch out for are 17,916, followed by 17,948 and 18,000.

The Nifty Bank climbed 17 points amid the volatile session to end at 41,554, extending the uptrend for the third straight session and forming a small-bodied bearish candle on the daily scale. Overall, it has been consolidating for the fourth day in a row after a rally.

"It is facing minor resistance near its 20-day EMA (41,628) from the past four sessions and has been underperforming the broader market. Now, it has to continue to hold above 41,500 level, to make an up move towards 41,750 and 42,000 levels, whereas supports are expected at 41,250 level, then 41,000 area," Shivangi Sarda, Senior Executive | Analyst at Motilal Oswal Financial Services said.

The important pivot level, which will act as crucial support for the index, is placed at 41,335, followed by 41,245 and 41,099. On the upside, key resistance levels are placed at 41,626, followed by 41,716, and 41,861.

On a monthly basis, we have seen the maximum Call open interest (OI) at 18,000 strike, with 33.55 lakh contracts, which may be a crucial resistance level in coming sessions.

This is followed by an 18,500 strike, comprising 21.15 lakh contracts, and an 18,200 strike, where we have more than 18.74 lakh contracts.

Call writing was seen at 17,700 strike, which added 2.23 lakh contracts, followed by 18,100 strike which added 1.86 lakh contracts, and 18,200 strike which added 1.31 lakh contracts.

We have seen Call unwinding in 17,800 strike, which shed 2.44 lakh contracts, followed by 17,500 strike, which shed 57,600 contracts, and 17,600 strike, which shed 36,050 contracts.

On a monthly basis, the maximum Put OI was seen at 17,500 strike, with 36.93 lakh contracts, which can be a crucial support level for coming sessions.

This is followed by the 17,600 strike, comprising 29.95 lakh contracts, and the 18,000 strike, where we have 23.55 lakh contracts.

Put writing was seen at 17,700 strike, which added 5.10 lakh contracts, followed by 17,600 strike, which added 3.31 lakh contracts, and 17,400 strike which added 2.61 lakh contracts.

Put unwinding was seen at 16,800 strike, which shed 3.88 lakh contracts, followed by 17,100 strike, which shed 95,250 contracts, and 17,500 strike, which shed 65,550 contracts.

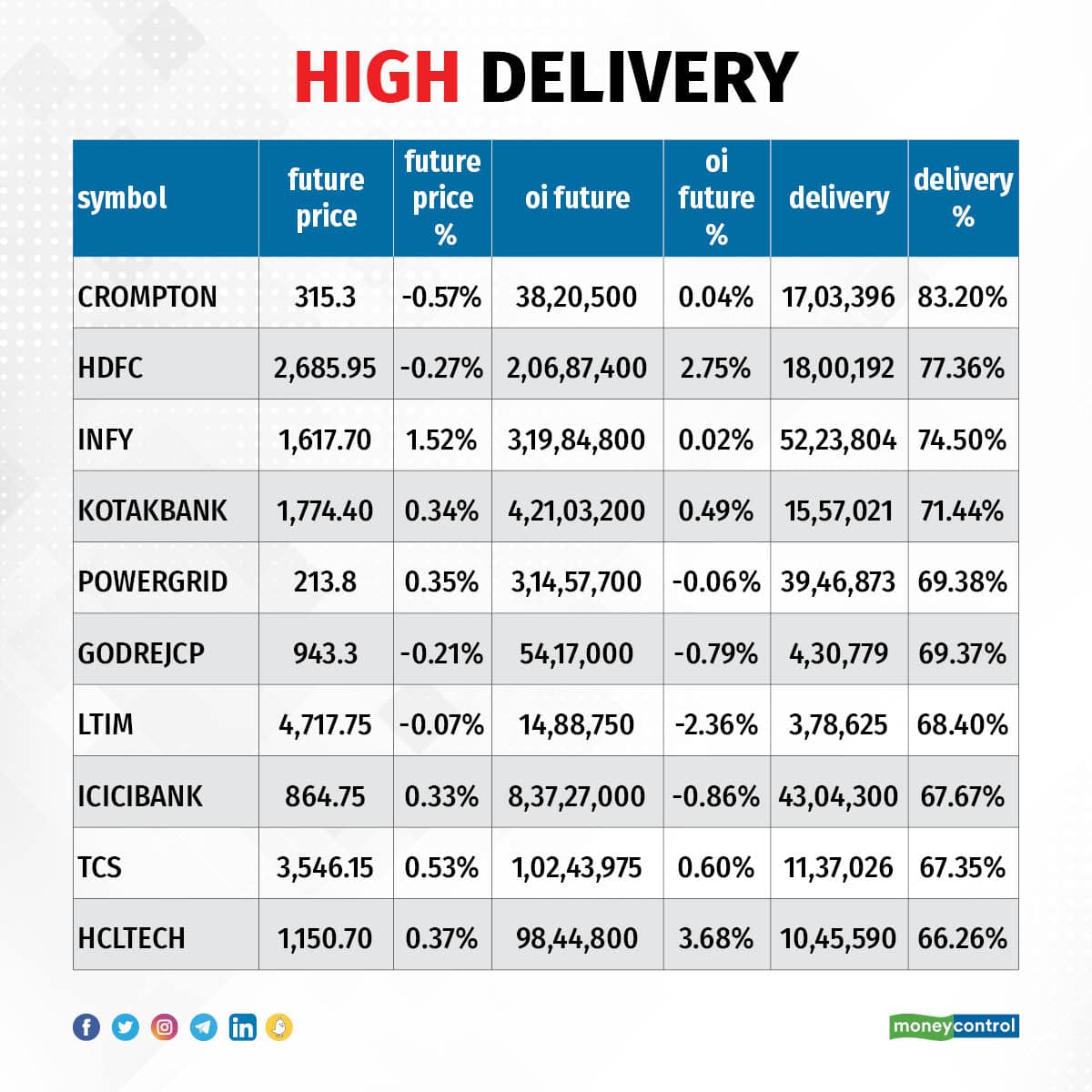

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. We have seen the highest delivery in Crompton Greaves Consumer Electricals, HDFC, Infosys, Kotak Mahindra Bank, and Power Grid Corporation of India, among others.

An increase in open interest (OI), along with an increase in price, mostly indicates a build-up of long positions. Based on the OI percentage, we have seen a long build-up in 43 stocks including Cummins India, Alkem Laboratories, Oberoi Realty, IRCTC, and Apollo Tyres.

A decline in OI, along with a decrease in price, mostly indicates long unwinding. Based on the OI percentage, 37 stocks saw long unwinding, including Honeywell Automation, Samvardhana Motherson International, Bajaj Auto, Siemens, and Max Financial Services.

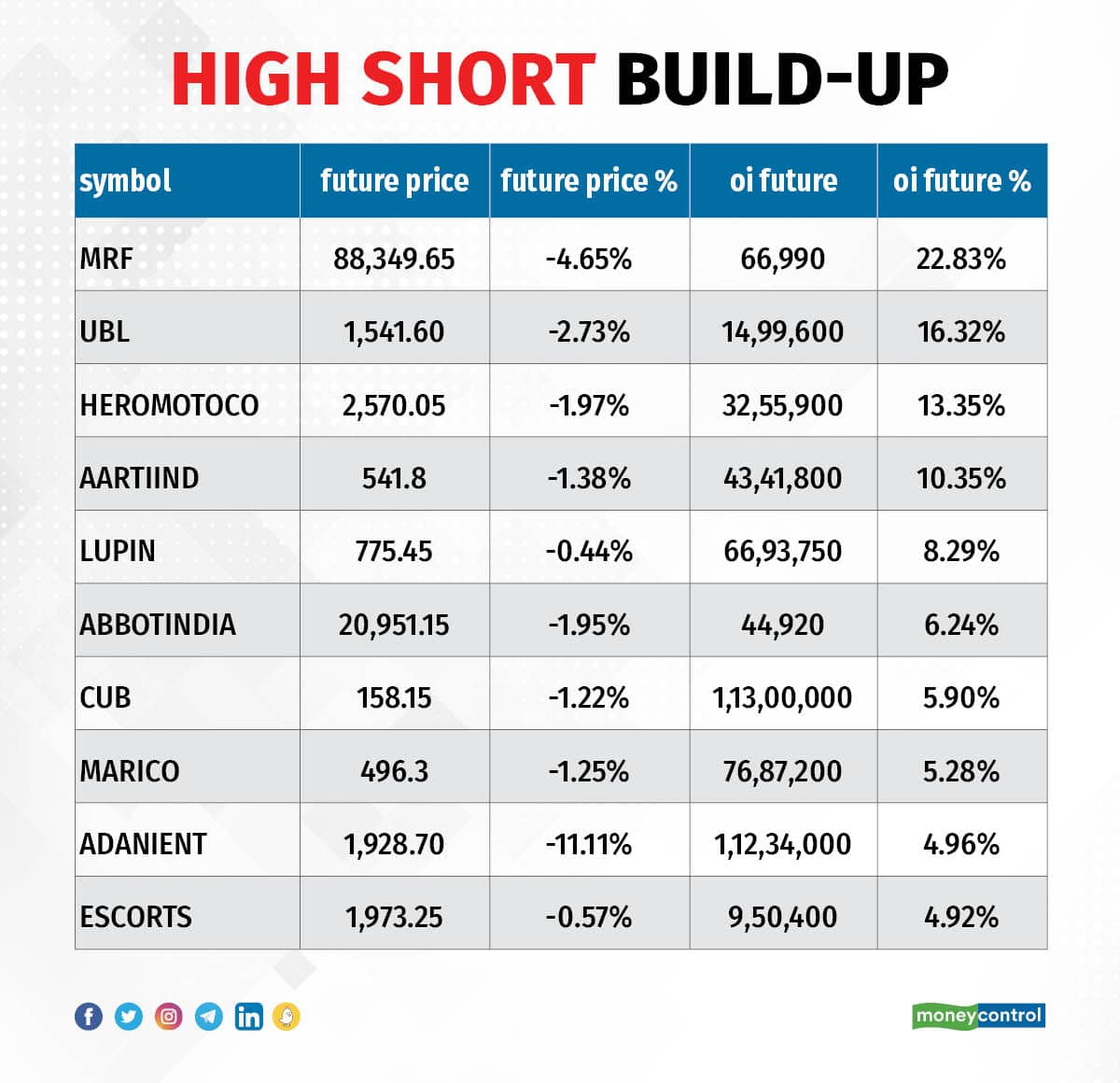

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI percentage, we have seen a short build-up in 56 stocks including MRF, United Breweries, Hero MotoCorp, Aarti Industries, and Lupin.

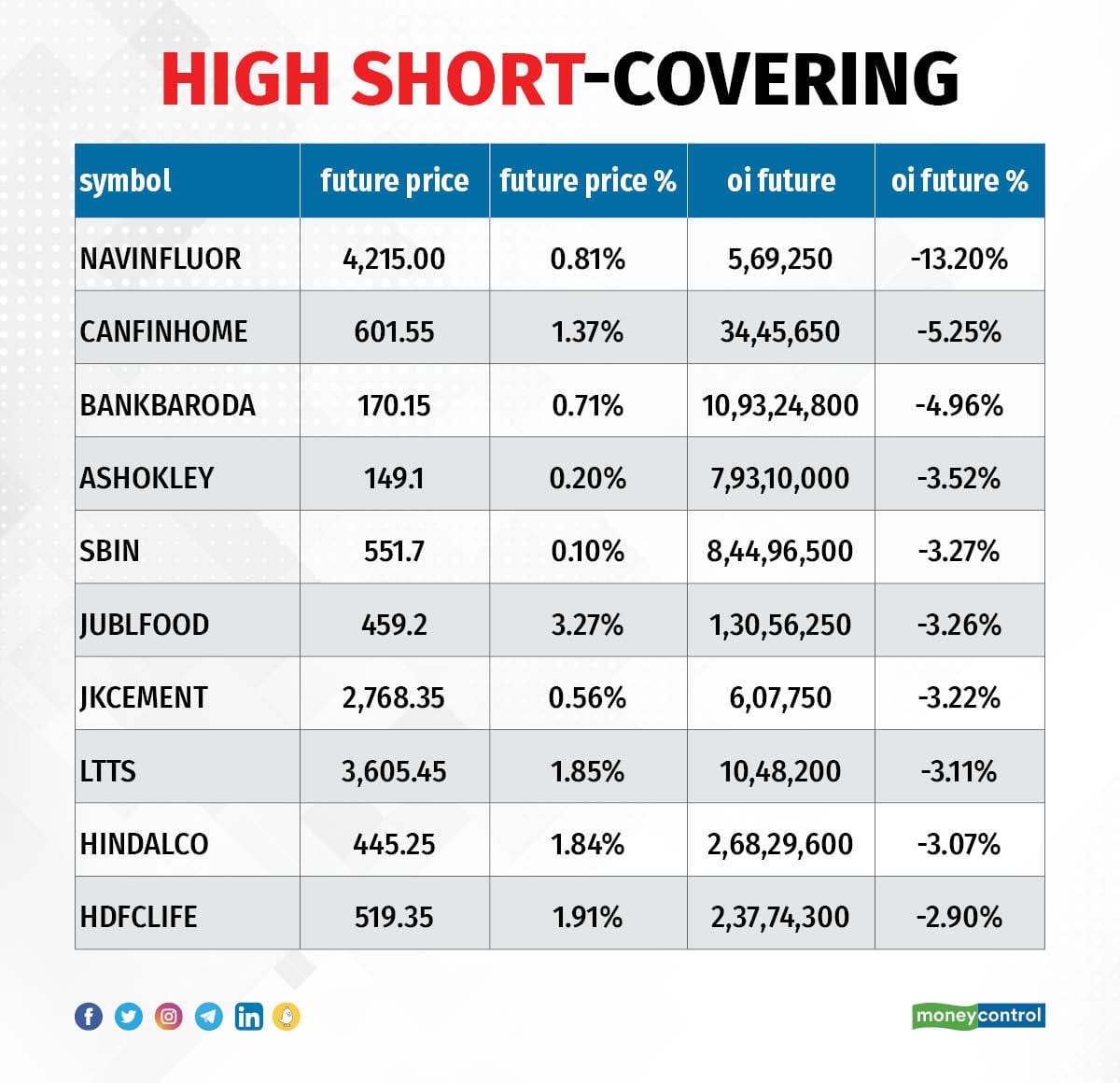

54 stocks witnessed short-covering

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI percentage, as many as 54 stocks were on the short-covering list, including Navin Fluorine International, Can Fin Homes, Bank of Baroda, Ashok Leyland, and State Bank of India.

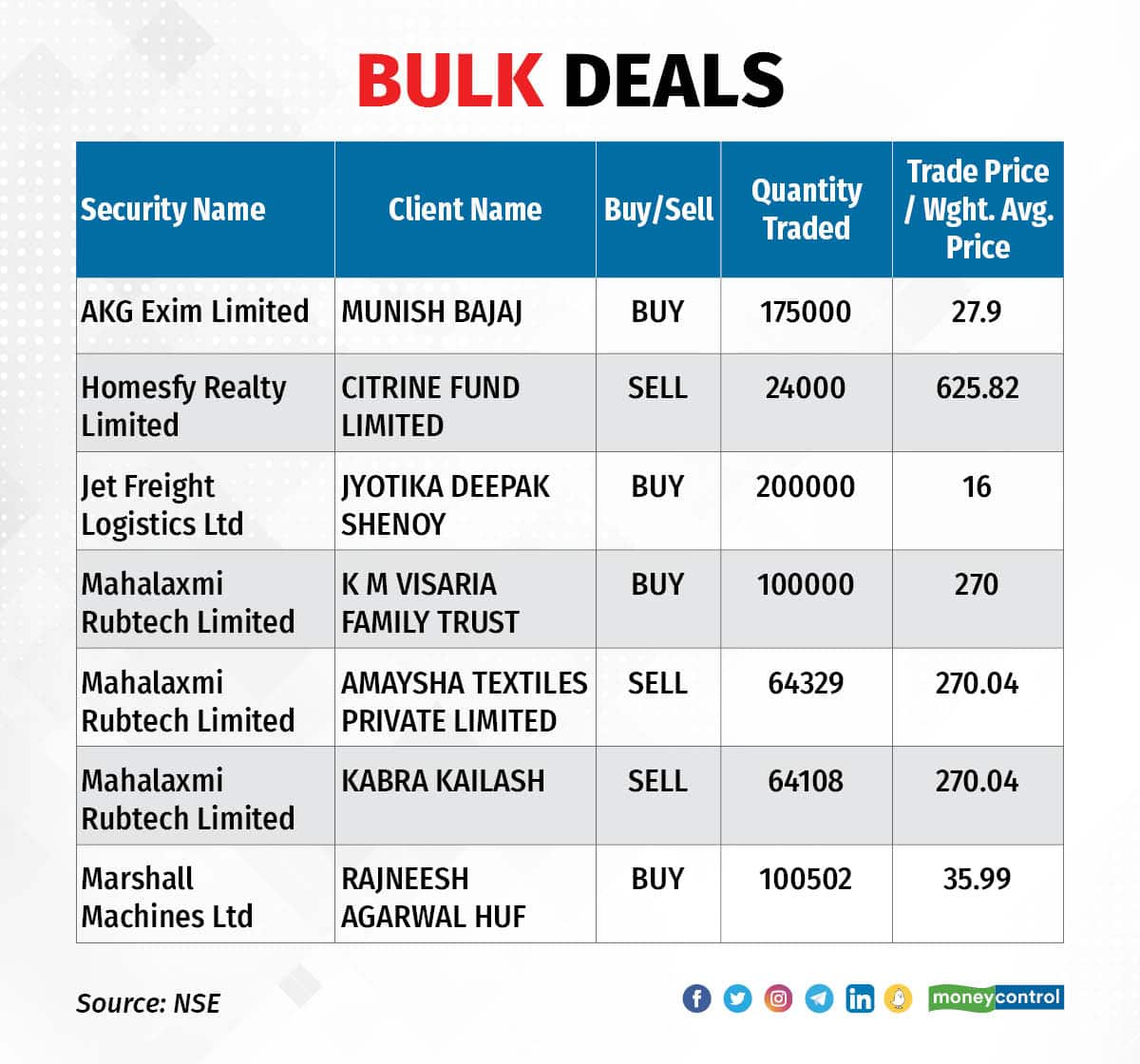

(For more bulk deals, click here)

Mahindra and Mahindra, ABB India, PB Fintech, Abbott India, Alkem Laboratories, Ashoka Buildcon, Astrazeneca Pharma, BEML, BHEL, Dilip Buildcon, Delhivery, EIH, Glenmark Pharmaceuticals, JK Lakshmi Cement, KFin Technologies, Lemon Tree Hotels, Metropolis Healthcare, NALCO, Info Edge India, and Oil India will be in focus ahead of quarterly earnings on February 10.

Stocks in the news

Life Insurance Corporation of India: The life insurer has reported a standalone profit of Rs 8,334.2 crore for the quarter ended December FY23, growing multi-fold compared to a profit of Rs 235 crore in the same quarter last year on the back of strong growth. Net premium income for the quarter at Rs 1.11 lakh crore increased by 14.5 percent over a year-ago period and first-year premium or new business premium increased by 11 percent YoY to Rs 9,725 crore for the quarter.

Zomato: The food delivery giant has posted a consolidated loss of Rs 346.6 crore for the December FY23 quarter, widening from a loss of Rs 63.2 crore in the year-ago period given the significantly higher expenses (up 51 percent). Consolidated revenue grew by 75.2 percent YoY to Rs 1,948.2 crore for the quarter, while at the operating level, the EBITDA loss of Rs 366.2 crore for the quarter narrowed compared to the EBITDA loss of Rs 488.8 crore in the corresponding period last fiscal.

Aurobindo Pharma: The pharma company has recorded an 18.7 percent year-on-year fall in consolidated profit at Rs 491 crore for the quarter ended December FY23, dented by weak operating margin performance. Consolidated revenue for the quarter at Rs 6,407 crore increased by 6.7 percent over a year-ago period with the US formulations business growing 9.3 percent, the Europe formulation segment showing a 0.4 percent increase and growth markets business rising 25.7 percent YoY. On the operating front, EBITDA fell 6 percent YoY to Rs 954.4 crore for the quarter with the margin declining 204 bps YoY to 14.89 percent due to higher spending on R&D.

Hindustan Petroleum Corporation: The oil marketing company has turned profitable with Q3FY23 net at Rs 172.4 crore against a loss of Rs 2,172 crore in the previous quarter, with better operating performance. Standalone revenue grew by 1 percent to Rs 1.09 lakh crore compared to the previous year. On the operating front, its EBITDA came in at Rs 1,671.7 crore for the quarter ended December FY23, against a loss of Rs 1,497.9 crore in the September FY23 quarter.

MTAR Technologies: The precision engineering solutions company has recorded a standalone profit of Rs 31.4 crore for the quarter ended December FY23, growing 136.2 percent over a year-ago period. Revenue from operations more than doubled to Rs 160.2 crore in Q3FY23, against Rs 78.1 crore in the same period last year. EBITDA at Rs 45 crore for the quarter grew by 97.4 percent over the corresponding period last fiscal, but the margin fell by 110 bps YoY to 28.09 percent on a significant increase in input cost.

United Breweries: The beer and non-alcoholic beverages maker has posted a loss of Rs 2.1 crore for the December FY23 quarter, against a profit of Rs 90.56 crore in the same period last year, impacted by weak operating performance and exceptional loss of Rs 33.12 crore. Revenue for the quarter at Rs 1,611 crore grew by 1.9 percent over a year-ago period. On the operating front, EBITDA fell 54 percent YoY to Rs 76.65 crore and the margin plunged 623 bps to 4.75 percent in the same period. Numbers missed analysts' expectations.

Voltas: The air conditioning and engineering services provider posted a consolidated loss of Rs 110.38 crore for the quarter ended December FY23, against a profit of Rs 96 crore in the same period last year, as there was an exceptional loss of Rs 137.39 crore related to provision arising out of cancellation of contract and encashment of bank guarantee. Revenue for the quarter grew by 12 percent YoY to Rs 2,005.61 crore with growth in unitary cooling products as well as electro-mechanical projects & services segments. EBITDA at Rs 76.37 crore for the quarter declined by 51 percent YoY with a margin contraction of 490 bps YoY.

Fund Flow

Foreign institutional investors (FII) sold shares worth Rs 144.73 crore, while domestic institutional investors (DII) offloaded shares worth Rs 205.25 crore on February 9, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The National Stock Exchange has retained Ambuja Cements and Indiabulls Housing Finance on its F&O ban list for February 10. Securities thus banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.