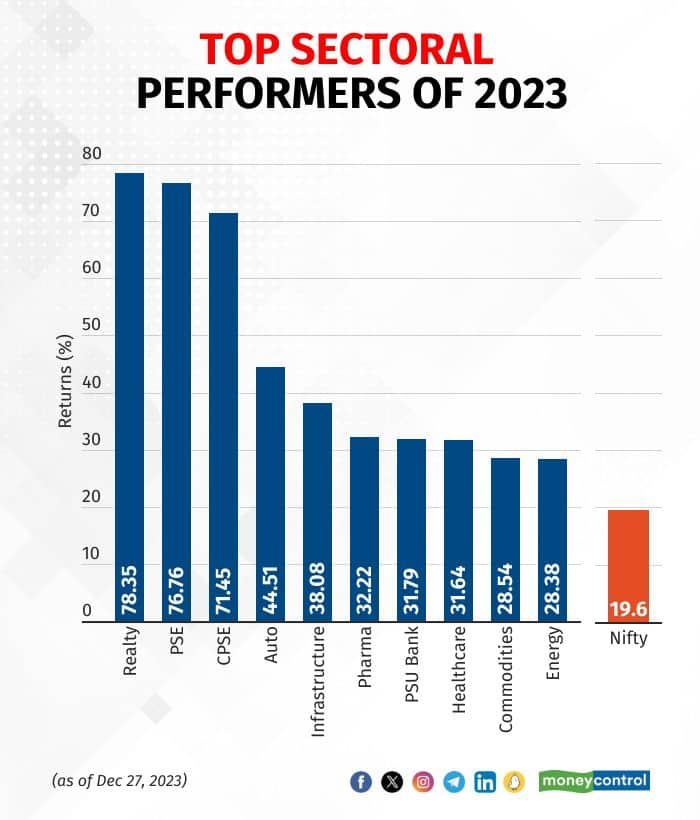

Real estate, PSUs and autos emerged as the top sectoral gainers of 2023 as pent-up demand, rising capital expenditure and a healthy order book bolstered their investment appeal.

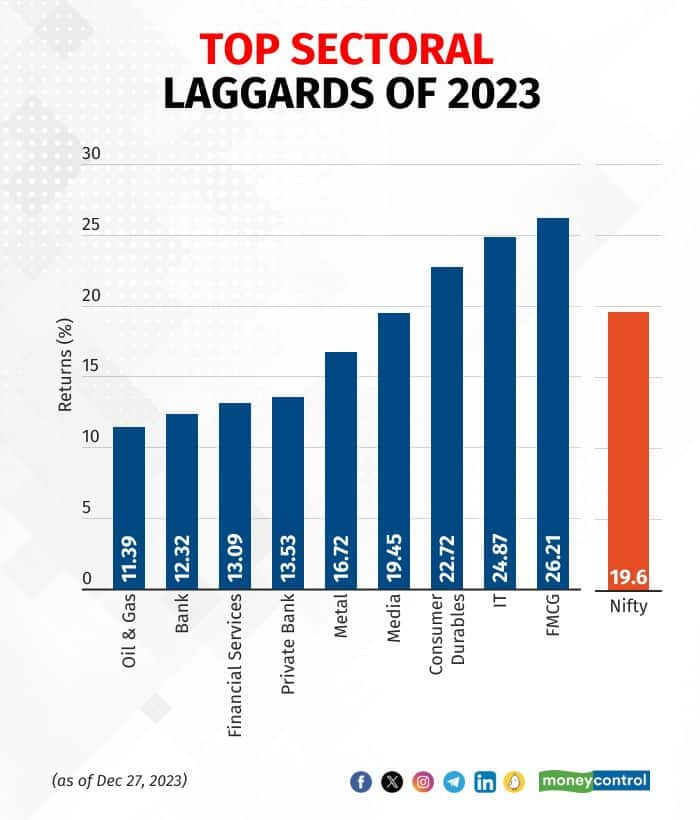

In contrast, oil & gas, private banks and metal sectors missed out on this year’s bull run, weighed down by the underperformance of index heavyweights and pressure on the margins front.

In the broader market, while the mid- and small-cap indices outperformed the benchmarks by a wide margin, there was no contest as to which sector 2023 belonged to.

UnReal Estate

As per analysts, this year marked the launch of a new supercycle for the realty sector, after the highs of 2008.

“2023 is on course to become one of the best-performing years in real estate sector across asset classes. Indian real estate market displayed exceptional resilience as optimism prevailed in domestic markets, despite volatility across the developed markets,” said Badal Yagnik, CEO of Colliers India.

Demand for commercial real estate is expected to match or even surpass the leasing records set in 2022. Domestic occupiers across diverse sectors such as technology, financial services, engineering, FMCG, and healthcare have ensured that the office market remains active.

The trend has been bolstered by the adoption of “office dominant-hybrid work” by corporates.

“Residential segment meanwhile performed significantly better than market expectations, drawing comfort from largely stable interest rates. Industrial & warehousing sector too is expected to put a commendable performance in 2023 led by strong growth in manufacturing output & expansion of logistics services,” he added.

Global brokerage firm Jefferies said 2023 has seen the listed developer space increase its risk appetite, with Oberoi Realty, DLF and Lodha expanding beyond their home turfs after a very long time.

“Some of these initial new project additions have been via partnership models, but we believe as deal competition rises, balance sheets will need to be deployed. Strong cash flow generation should continue in 2024, though part of the free cash flow (FCF) would incrementally go towards outright land buys for all developers, instead of largely deleveraging focus so far,” it added.

The Nifty Realty index has risen 90 percent since the March 2023 lows, as the RBI rate pause drove a broad-based rally in the sector.

“Valuations for the sector are now up to the prior Oct 2021 peak on a price-to-book (PB) basis and as such the room for stocks to disappoint is limited,” it added.

Meanwhile, PSUs in the power, utilities and railway segments rallied during the year led by a diverse set of factors, including the government’s thrust on capital expenditure, an increase in power demand and an uptick in renewable energy investments.

Not just that, public sector banks (PSBs) – long considered the poor cousins of their private sector peers – are well-poised for re-rating going ahead supported by earnings traction, improved loan growth, margin stability, and controlled credit costs.

Also Read: Public sector banks' total profit likely to touch Rs 1.50 lakh crore

“The PSU banks space is expected to continue its growth momentum moving forward. Banks remain well-poised to deliver a consistent RoA/RoE of 1%/15-16% with scope for re-rating,” Axis Securities said in a note.

Experts believe the overall PSU rally still has some legs.

Naveen Kulkarni, Chief Investment Officer at Axis Securities PMS, said 2023 will end on a very strong note with solid market performance backed by consistent improvement in the profitability of Indian corporates.

“Overall, it is a good time to take some profits in small caps and deploy in quality large caps and quality PSUs,” he told Moneycontrol.

The Laggards

Not just in India, the oil and gas sector is facing headwinds globally as well.

Data from industry associations and large energy conglomerates over the last decade shows a clear trend of steadily declining capex in the oil and gas upstream segment.

Global oil demand is projected to grow 0.9 mbpd (million barrels per day) in 2024 (after rising 2.4 mbpd in 2023) and will be evenly matched with incremental refinery capacity additions of 1 mbpd.

“We expect range-bound refining margins in 2024. Export duties should cap diesel spreads at US$20 for export barrels while Russian crude blending remains elevated, aiding refining profitability. Petrochemical margins languish at 12-year lows as China (40% of global demand) has witnessed weak demand and large capacity additions,” Jefferies noted.

Also Read: HSBC turns bullish on Indian oil refiners, raises forecasts

While oil marketing companies (OMCs) are currently in the green, making Rs1/8 per ltr on diesel and petrol, they remain vulnerable to any rally in crude as they will not pass on increases in pricing due to upcoming national elections in May, it added.

Given the macro environment and the state of consumer pricing for Indian oil and gas companies, a price range of $75-80 per barrel for crude is ideal to maintain and grow profitability for both upstream companies as well as OMCs, analysts said.

A bigger surprise this year was the severe underperformance of the Nifty Bank index.

Analysts attribute it to the underwhelming show of its biggest constituent – HDFC Bank.

“HDFC Bank's underperformance has been primarily due to concerns around the regulatory approvals relating to the merger and the bank's ability to maintain growth momentum, especially regarding deposits,” Dnyanada Vaidya, Research Analyst - BFSI, Axis Securities, told Moneycontrol.

“As the merger-related overhang gradually eases, with margins and RoAs slowly gravitating to normalised levels, we remain positive on the medium-to-long prospects of the bank and expect the stock to offer a healthy upside. Currently, valuations are attractive and below the historical average,” he added.

That said, the Street’s 2024 outlook for the banking sector remains positive.

India's robust economic and consumption activity is expected to support credit growth, aided by the uptick in capex in sectors like housing and infrastructure.

“However, with RBI pointing to the need to caution on unsecured personal loans, banks will adopt a more cautious approach to lending in the retail segment. Also, rising funding costs will push them to select and price credit appropriately to defend margins. We see banks having 15-16 percent growth in credit over FY24-26 and the scope for private banks to gain share will be less than in the past,” Jefferies added.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!