West Texas Intermediate oil hit $95 a barrel for the first time since August 2022 after stockpiles at the largest US storage hub dropped to critical levels.

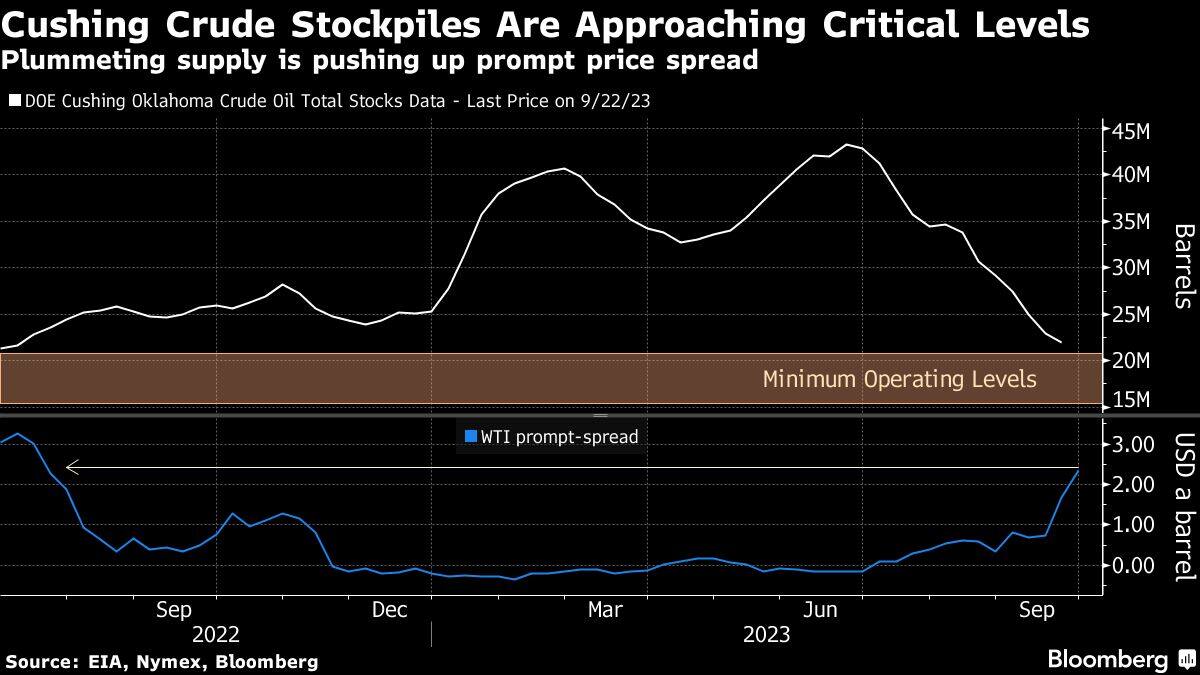

The US benchmark popped above the threshold after jumping 3.6% on Wednesday, its biggest gain since early May. Inventories at Cushing, Oklahoma — the delivery point for the US benchmark — dropped just below 22 million barrels, the lowest since July 2022 and close to operational minimums.

“My fear in this market is we have de-stocked so much inventory,” Amrita Sen, co-founder and head of research at consultant Energy Aspects, told Bloomberg TV. “Right now, what’s going on in the US — Cushing is dry.”

Overall US crude stockpiles fell more than expected, according to official data released Wednesday, providing evidence of how rapidly the market is tightening due to supply cuts from Saudi Arabia and Russia. WTI has jumped by around a third since the end of June, and is on track for the biggest quarterly gain since early 2022, fueling inflation and causing fresh headaches for central banks.

Earlier this month, OPEC forecast a deficit of as much as 3 million barrels a day of crude in the fourth quarter. With demand in the US and China proving resilient, many in the market now see $100 oil as inevitable, even as the dollar rallies and worries about high global interest rates persist.

“It’s only a matter of time before Brent breaks $100 a barrel,” said Warren Patterson, head of commodities strategy at ING Groep NV. “However, we believe any breakout will be relatively short-lived, given the growing pressure that will likely be put on OPEC+ to ease supply cuts.”

That physical tightness is being reflected in oil’s futures curve. WTI’s prompt spread has surged to $2.44 a barrel in the bullish backwardation structure from just 61 cents in the middle of last week. Options trading is also showing concerns about bigger price swings.

Stockpiles at Cushing have dropped for seven straight weeks and many traders consider them to already be at the lowest levels that allow the the tanks to operate normally. Last-minute supplies from the hub are becoming increasingly expensive and American crude is getting too pricey for overseas buyers.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.