All that glitters is not gold (or silver) - the Shakespearean expression is true literally – prices of gold and silver have crashed both in the domestic and international markets over the last four months. The reason: investors fled to other assets like the dollar and bonds as they offered better return prospects. Analysts, on a consensus, forecast gold and silver prices to fall further.

“Gold is no longer considered a safe-haven asset as the hawkish Fed rhetoric smouldered its yielding nature. Silver, too, underwent a significant decline due to slowdown in the Chinese economy, which dented industrial demand and application of this white metal. As a result, investors turned towards government securities after yields and the dollar index touched yearly highs,” said Deveya Gaglani, Research Analyst – Commodities, at Axis Securities.

Furthermore, he added that gold is likely to trade in the range of Rs 55,500 (support)-58,200/10 grams (resistance) and a further 3 percent correction could be on cards if dollar index sustained above 107 levels.

For silver, the near-term support was placed at Rs 65,000/kilogram and resistance at Rs 70,000/kilogram. A breakdown below the support zone, Gaglani added, could push prices by 5 percent to Rs 62,000/kilogram.

On the other hand, Naveen Mathur, Director – Commodities & Currencies at Anand Rathi Shares and Stock Brokers, said that a sharp up move across precious metals is limited. “We anticipate spot gold (current market price: $1,822 per troy ounce) to trade in the range of $1,800-$1,835 in the near-term, while spot silver (CMP: $21.15) to trade between $19.8-$21.75 per troy ounce,” he added.

One troy ounce is roughly 31 grams.

In the past four months, spot prices of gold have fallen eight percent to Rs 56,446 per 10 grams, while silver spot prices declined 13 percent to Rs 67,177 per kilogram, as per data on MCX.

ALSO READ: Gold and silver prices turn negative, dollar near six month high

Overseas, too, prices of gold and silver skid by 24 percent in four months to $1,836 per troy ounce and $21 per troy ounce, respectively.

The reaction follows a three percent rise in the US dollar index to the 106 mark (a 10 month high) and 70 basis points (bps) climb of yield on 10-year notes (bps) to 4.8 percent during the same period.

Weaker rupee a bane for gold, silver

That apart, analysts also pointed out that the Indian rupee movement would be a crucial factor to watch as it has a direct impact on prices of precious metals.

The domestic currency’s value has depreciated two percent in the span of 4 months to Rs 83 per dollar.

Since India is one of the leading importers of gold and silver, when that dollar strengthens or rupee weakens, it forces the country to shell out more money.

Recent data suggests that the value of inbound gold shipments grew 40 percent year-on-year (YoY) to $4.9 billion in August 2023, as against $3.5 billion in the year-ago period.

ALSO READ: Standard Chartered doesn’t see Rupee cross 84 even if dollar climbs

Can the festive season pull gold, silver out of doldrums?

Mathur of Anand Rathi anticipates festive demand in the upcoming Diwali season to be weak. Gold prices, he said, were already 11-12 percent higher as compared to last year, which could limit retail demand in India.

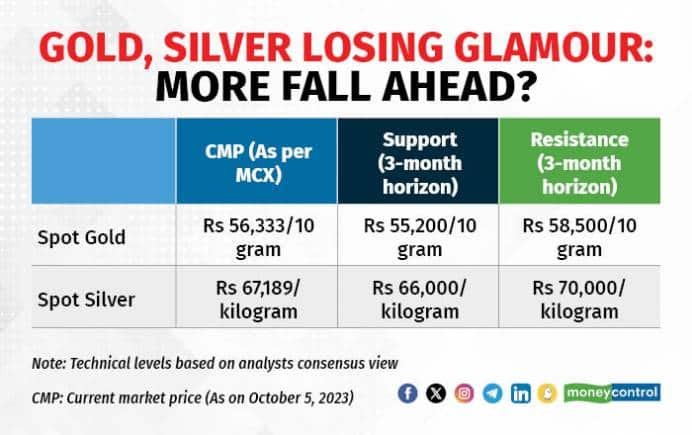

“Consumers may prefer to limit quantities with similar budgets being set this year. On MCX, gold is likely to trade in the range of Rs 55,200 – 58,500 per 10 grams in December futures contract for the current month,” he added.

Gaglani of Axis Securities too said that the festive season would fail to enthuse the bullion market as it is an international commodity. Other factors like the movement in dollar index, interest rates, and geopolitical tension would continue to impact prices of precious metals.

Differing from the consensus view, Hareesh V, Head of Commodities at Geojit Financial Services said that the appeal towards gold and silver might increase from here on due to economic turmoil in China and weakness in their equity markets.

READ MORE: Indian Metals & Ferro Alloys zooms 12% as govt vows to pay Rs 417-cr damages

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.