Ace investor Sunil Singhania-owned Abakkus acquired a 1.74 percent equity stake in TTK Healthcare via open market transactions on March 24. This resulted in a massive 13 percent rally in the stock price.

Abakkus has bought a total of 2.47 lakh equity shares in a stock which has been in an uptrend since March 2020 barring intermittent correction and consolidation.

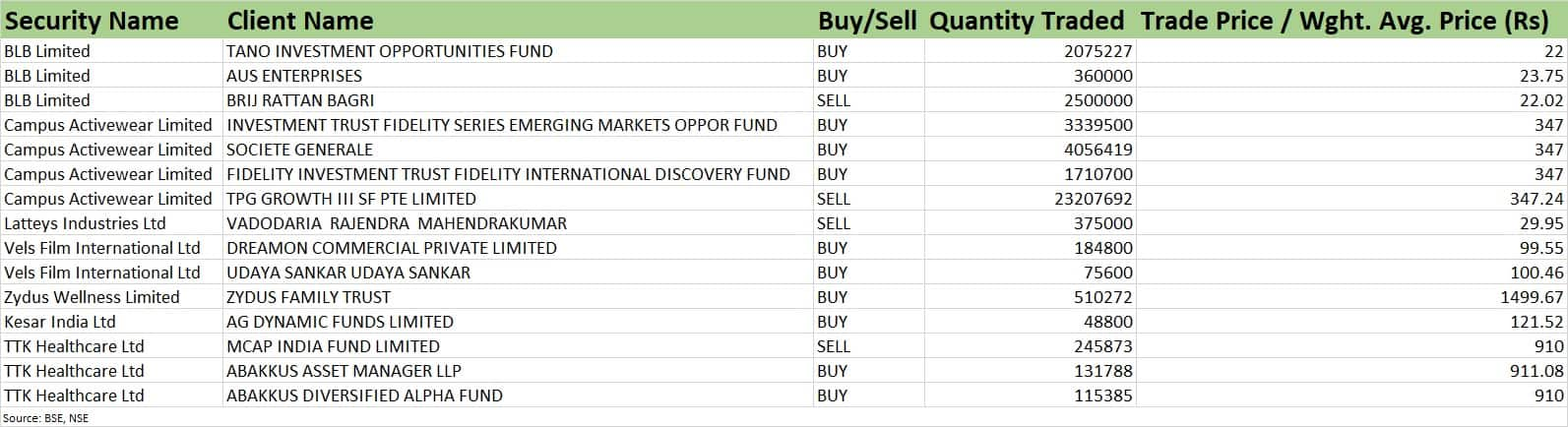

Asset management firm Abakkus Asset Manager LLP itself bought 1.31 lakh equity shares of TTK Healthcare at an average price of Rs 911.08 apiece, while its Abakkus Diversified Alpha Fund has purchased 1.15 lakh shares at an average price of Rs 910 per share on the BSE, as per bulk deals data available on the exchange.

The total value of this 1.74 percent stake is Rs 22.5 crore.

However, investor MCap India Fund, managed by Gurgaon-based private equity firm MCap Fund advisors, was the seller in a bulk deal, offloading 2.45 lakh equity shares in TTK at an average price of Rs 910 per share.

As of December 2022, MCap India Fund held 3.10 lakh shares or a 2.2 percent stake in TTK.

This deal could be a reason behind a strong rally in the stock price as the overall equity market was subdued. TTK Healthcare shares surged 13 percent to close at Rs 1,022.70, which is 12 percent higher than the bulk deal price.

The stock has been in an uptrend since March 2020, rising 292 percent from the COVID low, outperforming the Nifty Pharma which has been in consolidation mode since October 2021 after a rally from March 2020. Nifty Pharma index since COVID lows gained 86 percent.

Among other bulk deals, AG Dynamic Funds bought 48,800 shares in Kesar India at an average price of Rs 121.52 apiece.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.