Krishna Karwa

Moneycontrol Research

Highlights:

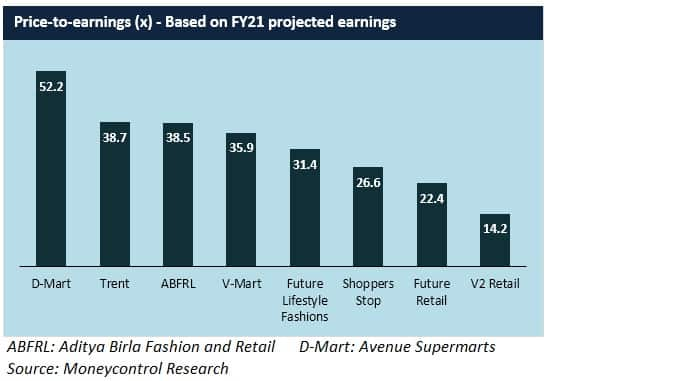

- V2 Retail trades at a steep discount to its peers

- Network expansion and growing discretionary spends will aid revenue growth

- Working capital optimisation and private label sales hold key to margin accretion

- Competition and high advertisement spends could impact earnings

----------------------------------------------------

V2 Retail reported a mixed set of numbers in Q3 FY19. While robust topline and bottomline traction was observed, operating margin dipped sharply year-on-year (YoY). A reasonable valuation, aggressive network augmentation, strong fundamentals, supply-chain optimisation initiatives and growing demand in tier II/III/IV cities (particularly ahead of the upcoming general elections) make us bullish on the stock.

The retailer caters mainly to aspirational buyers in tier II/III and semi-urban areas in India. It operates 74 stores spanning 8.75 lakh square feet of retail space (in 17 states and 69 cities), primarily in northern and eastern states. Its product portfolio includes apparel and lifestyle products.

Q3 analysis

Positives

- Store additions and demand (pertaining to festivities and weddings) aided sales growth

- Same-store sales growth for Q3 was 9 percent

Negatives

- Gross margin contracted because of pricing pressure

- Operating margin declined substantially owing to higher employee costs (associated with new stores, promotional activities and ESOP benefits to the top management)

- Interest expenses rose significantly

Observations

Revenue drivers

- By FY20-end, store count is expected to cross the 100 mark. As a result, the retail area is anticipated to rise to over a million sq ft by March 2020 from 9.36 lakh sq ft by FY19-end

- To supply apparel to mom-and-pop stores in smaller towns, a B2B (business-to-business) platform may be launched. The company may also come up with its own website

- Discretionary spends in smaller Indian cities are on an upswing because of rising incomes and greater brand awareness

- Since price-sensitive buyers are the company’s target audience, turnover will be predominantly volume-driven

Margin drivers

- Dependence on external warehousing is likely to reduce since a distribution centre at Bengaluru is already operational, whereas a new one will be set up in Kolkata in due course

- Going forward, store expansion will be cluster-based to save logistical costs

- The share of private labels to annual sales is estimated to increase to 30-35 percent over the next 2-3 years from 15-20 percent as of Q3 FY19-end

- Free cash flows have been positive in recent years. Consequently, capex may be funded through internal accruals

- Working capital cycle is slated to improve on the back of better inventory management and vendor consolidation

Risks

- Stiff competition from unorganised and regional players

- Inability to normalise marketing expenses over a period of time

Outlook- Overall numbers for FY19 will be subdued because of an extremely weak Q2 performance

- The stock trades at a steep discount (14 times FY21 projected earnings) to its peers. This makes it a good value buy

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.