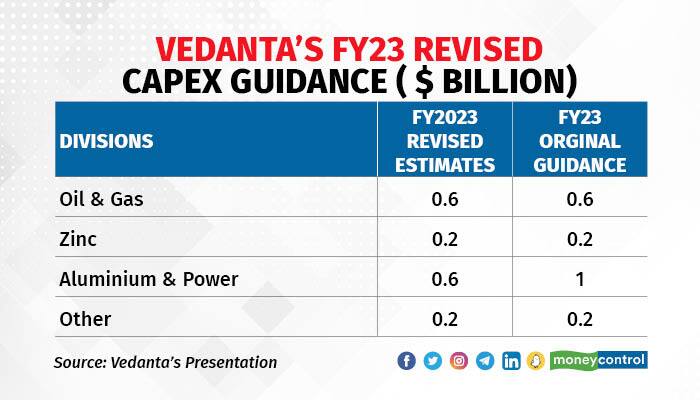

Vedanta has scaled back its financial fear 2023 guidance by 20 percent to $1.6 billion, compared to the $2 billion planned earlier. The company has trimmed the capital expenditure (capex) plans for the aluminium and power division by almost 40 percent to $0.6 billion from $1 billion envisaged at the start of the financial year. However, it kept the capex guidance steady for other divisions such as oil & gas, and zinc, among others.

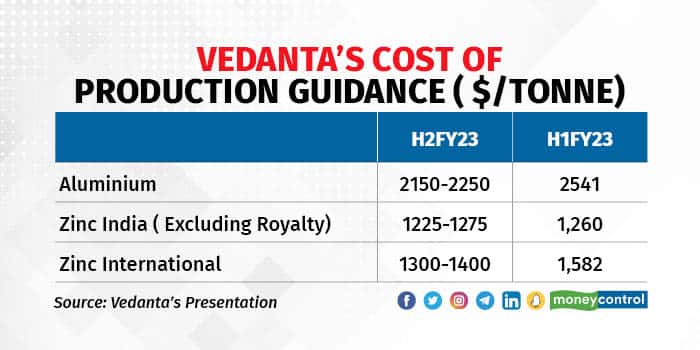

Vedanta also sees lower cost of production (CoP) from aluminum, and zinc (India and international businesses), as compared to the CoP witnessed in the first half of the financial year. Depletion of higher cost alumina, power cost reduction and better coal linkages were cited as some of the reasons for the lower cost of production for aluminium by the management of the company.

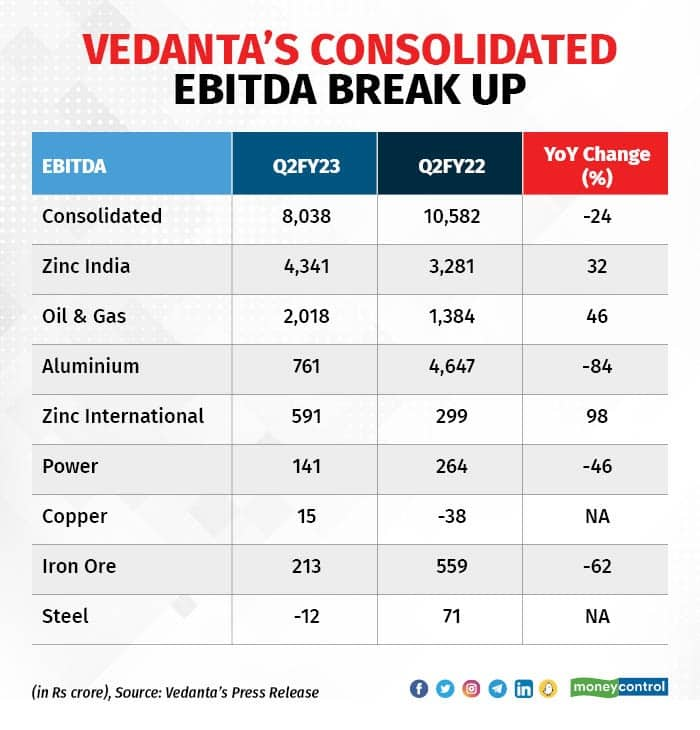

Vedanta’s Q2 EBITDA decreased by 24 percent YoY to Rs 8,038 crore on account of input commodity inflation and lower output commodity prices, partially offset by improved operational performance, hedging gains and foreign exchange gains, said the CFO in an earnings concall. The company reported 84 percent YoY decline to Rs 761 crore in the aluminium division, 46 percent drop in power division and 62 percent decline in iron ore division. It also posted a net loss for the steel division.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.