Sun Pharmaceutical Industries is expected to report muted earnings growth in Q2 FY24 as a moderation in sales of the blockbuster cancer drug Revlimid along with pressure on the drugmaker's base generics portfolio due to compliance issues at its Halol and Mohali plants are likely to weigh on its US performance. However, some of that moderation is likely to be offset by industry-beating growth in the domestic market. The drugmaker will announce its July-September earnings on November 1.

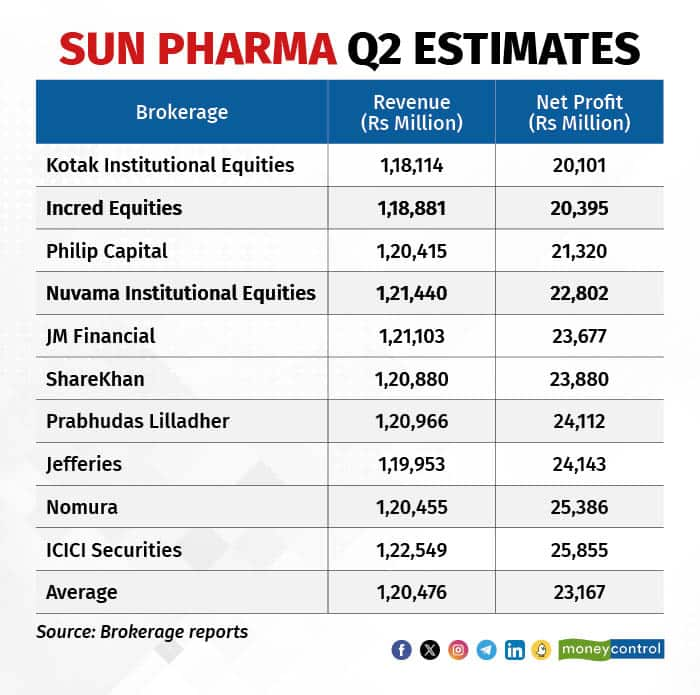

According to a poll of brokerages collated by Moneycontrol, the drugmaker is expected to report a net profit of Rs 2,316.70 crore, reflecting a mere 2.5 percent increase from Rs 2,260.17 crore recorded in the year-ago period. Revenue is expected to grow 10 percent on year to Rs 12,047.6 crore as compared to Rs 10,952.28 crore in the base period.

Among the brokerages polled by Moneycontrol, Kotak Institutional Equities had the lowest growth projections for Sun Pharma while ICICI Securities estimated the highest figures.

Sequentially, overall sales are likely to remain flattish due to lower Revlimid contribution and minimal sales from Mohali.

US growth to moderate

Brokerage firm Kotak Institutional Equities expects US sales for Sun Pharma to come at $409 million, down 13 percent sequentially. The US revenue is likely to be aided by a 2 percent sequential sales growth for the company's arm Taro Pharma, which will somewhat offset the 19 percent sequential decline in the ex-Taro business, the firm stated in a note.

Aside from that, prolonged regulatory snags at the Mohali and Halol plants will also drag US sales growth for the drugmaker. However, the company's speciality business is estimated to grow 19 percent, as per Philip Capital which will also make up for some decline in US generic sales.

"Sun Pharma is increasing its contribution towards speciality drugs where it faces lesser competition and can command premium prices," brokerage firm ShareKhan highlighted in its note.

Another brokerage Jefferies also stated that speciality sales will be a key factor that can trigger an earnings beat or miss for Sun Pharma in Q2.

Industry-beating growth in domestic market to lift earnings

Despite weakness across the domestic pharma market on account of lower offtake in acute sales amidst a sporadic monsoon and a slower uptick in viral infections, Sun Pharma managed to outperform the industry in Q2. As against the 4.5 percent growth in domestic pharma sales over Q2, Sun Pharma's sales within the Indian market are likely to have grown 8 percent over the period.

While growth momentum for most companies slowed down in the domestic pharma market in Q2, Sun Pharma continued to shine thanks to its chronic therapies portfolio.

On the other hand, KIE also anticipates Sun Pharma's EBITDA to decline 8 percent on year to Rs 2,950 crore, with a margin of 25 percent in Q2FY24. "We bake in 290 basis points sequential decline in EBITDA margin (down 420 bps on year) for Sun Pharma in Q2FY24 driven by higher research and development costs (6.8 percent of sales) and lower US sales," the firm mentioned in its report.

Prabhudas Lilladher also feels the company's outlook on overheads and margins will remain the key monitorables in the Q2 earnings call.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.