YES Bank share price hit 5 percent upper circuit on BSE on November 10 after CARE upgraded the bank's debt instruments rating.

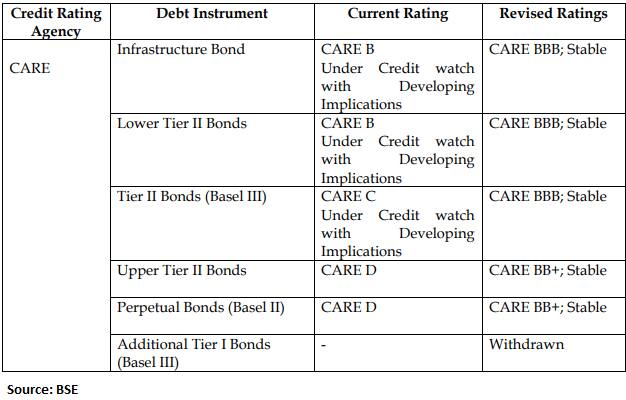

CARE Ratings have revised its rating on private lender YES Bank's debt instrument. The rating agency has revised the bank's infrastructure bonds rating to 'CARE BBB' from previous 'CARE B'.

Also, CARE revised its outlook to 'Stable' from previous "Under Credit watch with Developing Implications" on the above-mentioned instruments. It has also given 'CARE BB+' rating each on YES Bank's Upper Tier II Bonds and Perpetual Bonds (Basel II) from previous 'CARE D'.

The stock was trading at Rs 13.54, up Rs 0.64, or 4.96 percent at 11:07 hours. It has touched an intraday high of Rs 13.54 and an intraday low of Rs 13.54. There were pending buy orders of 15,803,330 shares, with no sellers available.

The scrip also witnessed spurt in volume by more than 2.33 times and was trading with volumes of 38,503,192 shares, compared to its five day average of 17,622,667 shares, an increase of 118.49 percent.

According to Moneycontrol SWOT Analysis powered by Trendlyne, FII / FPI or Institutions are increasing their shareholding with book value per share improving for last 2 years with growth in net profit with increasing profit margin (QoQ).

Moneycontrol technical rating is bullish with moving averages and technical indicators being bullish.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own, and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.