Nobody was expecting a stellar September quarter but India Inc. managed to post a mixed bag with no major negative surprises which helped D-Street climb the wall of worries and hit fresh record highs in October and November.

The 2QFY18 earnings season is well past the half-way stage, with 34 Nifty companies have already released their results until November 2, 2017. These companies comprise 72 percent of estimated PAT for Nifty and 50 percent of India’s market cap.

Sales, EBITDA and PAT for the 34 Nifty companies have grown 10.8%, 10.8% and 6.3% versus expectations of 16.3%, 15.1%, and 18.8%, respectively, Motilal Oswal said in a report.

The divergence is owing to disappointing numbers from IOC and Axis Bank. For Nifty ex OMCs, sales, EBITDA and PAT grew 10.3%, 10.8% and 5.6% versus expectations of 12.4%, 10.7% and 8.9%, respectively, it said.

Analysts see December or January quarter to be a defining quarter for Indian markets. The earnings growth which is still languishing in single digits thanks to demonetisations and the implementation of the goods & services tax (GST) could see a double-digit growth in FY18.

“There were no expectation from September quarter numbers as it will first quarterly number post GST implementations. Earnings have been a mixed bag so far for the September quarter of FY18,” Sandeep Raina, Associate Director, Edelweiss Investment Research told Moneycontrol.

“Higher earnings will translate to new highs, thus we expect FY18 to clock in earnings growth of 15-20 percent,” he said.

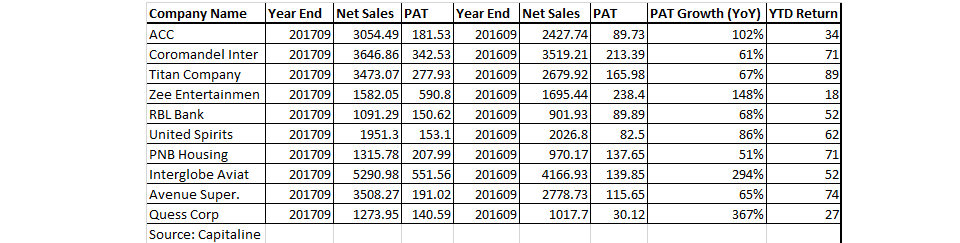

We have collated a list of ten stocks which have reported a growth of over 50% YoY in net profit for the quarter ended September 30. The minimum profit is Rs50 crores. The list given below is for reference only, and are not recommendations:

ACC: Net profit jumps 2-fold to Rs 181 crore

Cement maker ACC Ltd reported over two-fold jump in its consolidated net profit to Rs 181.53 crore for the third quarter ended September 30, driven by increased productivity and cost optimisation.

During the quarter, ACC's cement sales stood at 5.96 million tonnes (MT), up 17.55 percent, compared to 5.07 MT. The company's total expenses were rose by 5.17 percent to Rs 2,877.00 crore as against Rs 2,735.57 crore.

Most brokerage firms maintain a buy rating on ACC post results. Global brokerage firms such as CLSA and Citigroup have a buy rating on the stock while UBS maintains sell.

CLSA upgraded the stock to buy from outperform and raised its target price to Rs2150 from Rs2050 earlier. The blockbuster quarter was led by 18 percent volume growth. The global investment bank hiked CY17-19 net profit estimate by 6-7%.

Coromandel International: Net profit surged by 61% YoY

Coromandel International reported 4 percent YoY growth increase in revenues to Rs36.5bn - nutrient and other allied products segment reported flat growth and crop protection segment grew 11 percent YoY.

Even as fertiliser sale volumes grew only 2 percent on a YoY basis, there was a sharp surge in nutrient and other allied products segment EBIT margins by ~530bps (450bps in Q1FY18) to 14.8 percent driven by higher phosphoric acid production, increased contribution by value-added segment and lower raw material costs.

The EBITDA and PAT surged 48% and 61% YoY. Factoring in the quarter performance, we raise our FY18E-FY19E EPS to estimate by 10% and 9% respectively on improved margins in fertiliser business and better profitability in value-added segments,” Edelweiss Securities said in a report.

“Factoring the quarter performance, we upgrade our numbers on improved margins in fertiliser business along with better profitability in value‐added segment. We value Coromandel at 20x FY19E EPS giving us a target price of Rs559,” it said.

Titan Company: Net profit rose by 67% YoY

The Jewellery-to-watch maker reported robust performance for the quarter ended September 2017 as consolidated profit showed a whopping 67.4 percent growth, driven by jewellery business.

Revenue from operations during the quarter grew by 29.6 percent year-on-year to Rs 3,473 crore. Jewellery segment, which contributed 79 percent to total revenue, has registered a solid 37 percent growth at Rs 2,748.20 crore on year-on-year basis, with its EBIT (earnings before interest and tax) growing 66.4 percent YoY.

Most brokerage firms maintain buy or outperform rating on Titan but raised its target price by up to Rs907. Global investment bank Macquarie revised its target price to Rs 907 from Rs 700 per share.

It has also raised FY17-20 earnings estimate by 17-18 percent owing to higher jewellery sales and margin. "We believe higher valuation will sustain on potential market share gains," it added.

ZEE Entertainment: Q2 net profit jumps 148%

Zee Entertainment Enterprises' consolidated profit grew by a whopping 147.8 percent year-on-year to Rs 590.80 crore, largely led by proceeds from the sale of sports broadcasting business and other income. Profit in the year-ago quarter stood at Rs 238.4 crore.

The company has earned an exceptional gain of Rs 134.61 crore as the Group has concluded closure of its second phase of a transaction for disposal of sports broadcasting business to Sony Pictures Networks India.

Macquarie and IDFC Securities maintain an outperform rating on ZEE while UBS maintains a neutral rating. Macquarie maintains an outperform rating on the stock with price target of Rs 615.

Given the huge cash pile, the bolt-on acquisition strategy is giving Zee a foothold in niche segments, said the note. Despite ongoing investments, ZEE will continue to deliver 30 percent margins. Macquarie expects EPS to grow at a CAGR of 21.4 percent over FY17-20.

RBL Bank: Net profit jumps 68% in Q2

RBL Bank reported a 68 percent jump in second-quarter net profit at Rs151 crore against Rs90 crore in the year-ago period. The Net interest income (interest earned less interest expended) was up 39 percent year-on-year (y-o-y) at Rs 420 crore.

Motilal Oswal is of the view that RBL is well positioned to report strong balance sheet growth, backed by the recent capital raising. "We expect the margins and fee income profile for RBL to improve, which should drive RoA expansion over the next two years," it said.

United Spirits: Net profit rises 86% in Q2

United Spirits reported a net profit of Rs 153 crore for the quarter ended September, which translates into an increase of 86 percent mainly due to higher sales of premium brands and exceptional items.

Gross margins improved by 559 bps driven mainly by price increases, productivity initiatives, and operating model changes. The company said despite the implementation of GST which has resulted in stranded taxes, it has been able to deliver a robust underlying gross margin, said a report.

United Spirits reported strong earnings but analysts retained their target price for the stock on volume concerns. Macquarie maintained its underperform rating with price target of Rs 1,933 per share.

"September quarter numbers were significantly ahead of estimates driven by a higher gross margin but market share loss in Maharashtra is a concern and volume loss was on account of higher pricing, it said.

GST was positive for the company as some of the local taxes getting offset in the GST regime boosted margins, Macquarie said.

Morgan Stanley maintains an Overweight rating with price target of Rs 2,900. The previous quarter showed strong results in a difficult operating environment.

The management reiterated medium-term guidance of double-digit revenue growth, said the note.

PNB Housing: The net profit rose by 51% in Q2

PNB Housing Finance reported a 51 percent increase in net profit for the second quarter ended September 30, 2017, at Rs. 208 crores compared to Rs 138 crore reported in the corresponding quarter last fiscal.

The Net interest income (NII) for the quarter under review increased 69 percent to Rs. 386 crore (Rs 228 crore). For the six months ended September 30, PNB Housing Finance net profit grew 68 percent to Rs. 393 crore (Rs 234 crore). The net interest income recorded 67 per cent growth to Rs. 730 crore from Rs. 438 crore.

InterGlobe Aviation: Net profit zooms 294% in Q2

Budget carrier IndiGo’s parent InterGlobe Aviation reported a 294 percent increase in the net profit of a Rs551.55 crore. The airline had reported a net profit of Rs139.85 crore in the same period a year ago.

Total revenue rose 27.2 percent to Rs5,505.56 crore from Rs4,166.93 crore a year earlier. IndiGo, which has bought more than 400 A320neos, has seen the planes suffer engine snags and grounding, as also delays in plane deliveries, said a report.

IDFC Securities expects IndiGo’s yields/gross spreads to remain stable over the next two years, led by high industry load factors and 15 percent fuel consumption savings using the A320neos.

“We expect 29% earnings CAGR over FY17-19 with robust free cash generation. IndiGo trades at 8.8x FY19E EV/EBITDAR. We value IndiGo at 9.8x FY19E EBITDAR, a ~10% premium to global peers, because of IndiGo’s higher growth, superior leverage, and better returns. It maintains an Outperformer rating with a target price of Rs1,449,” it said.

Avenue Supermarts: Net profit up 65.2% in Q2

Avenue Supermarts, which owns and operates retail chain DMart reported a net profit for the July-September quarter of Rs. 191 crore, registering a year-on-year increase of 65.2 per cent.

This was led by 66 percent year-on-year decline in interest expenses and increase in other income to Rs. 21.2 crore in the quarter versus Rs. 8 crores in the first quarter of 2018.

Goldman Sachs initiates coverage on Avenue Supermarts with a buy rating and a target price of Rs1586. The company is well placed to benefit from tax reforms as grocery market share shifts to the organized sector.

Avenue Supermarts is set to grow EBIT by 13x in 10 years, aided by this high growth, low margin and high return strategy.

Quess Corp: Net profit jumps 367% in Q2

Integrated business and human resource service provider Quess Corp saw a 367 percent growth in net profit for the quarter ended September 30, 2017. The company posted a profit after tax of Rs 141 crore for Q2 FY18 as compared to Rs 30 crore in the same quarter last fiscal.

Also, Quess Corp has signed definitive agreements to acquire 70 percent equity in Vedang Cellular Services Private Limited with an investment up to Rs 40 crore as per an announcement on the exchanges.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.