Despite constituting only 25 percent of all listed companies back in July 2023 when the market was valued at Rs 300 trillion, smallcaps contributed as much as 50 percent of the total marketcap gains in the race to Rs-400 trillion marketcap. On April 8, smallcaps companies accounted for Rs 69 trillion in the overall pie. Together, smallcaps and midcaps contributed 44 percent to the market gains over the past nine months and accounted for 35 percent of the overall marketcap pie as on April 8.

Breakdown of Rs 100 lakh crore market cap addition.

Breakdown of Rs 100 lakh crore market cap addition.

The increasing clout of smallcaps is due to the phenomenal run up in prices seen in this segment of the market. While there has been buoyancy in the market over the past nine months owing to strong corporate earnings, improved high-frequency indicators, there has been a strong divergence in the performance of smallcaps and largecaps because of the nature of fund flows.

While foreign investors have been in withdrawal mode, retail investors have been the biggest drivers of the market. This has caused largecaps, which is the playing field for foreign investors largely, to lag in performance. Smallcaps on the other hand have seen retail investors flocking to them, and their performance has only drawn in more participants perpetuating the uptrend.

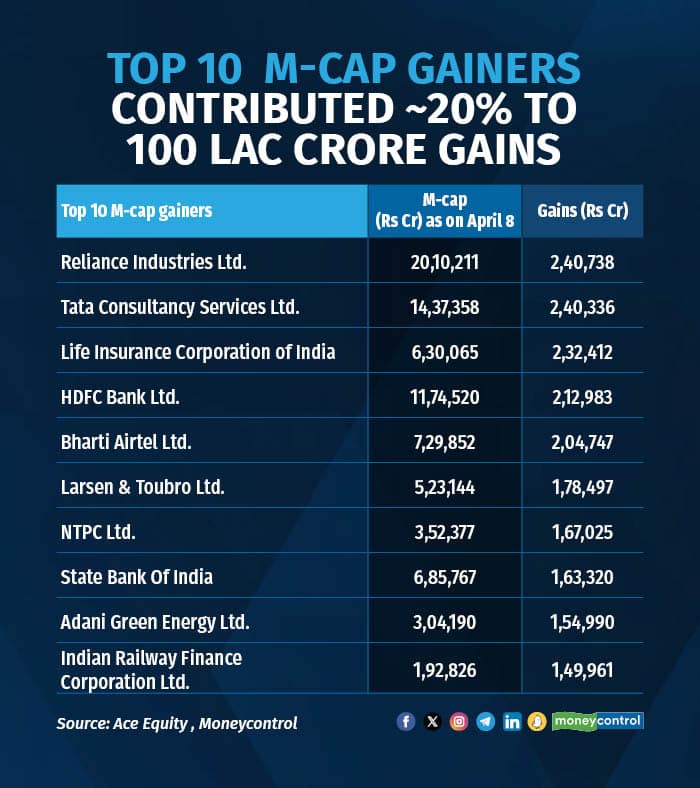

Top 10 companies whose market cap surged the most, contributed almost 20 percent to the Rs 100 trillion gain.

Reliance Industries was the top contributor to the market cap addition with a Rs 2.40 lakh crore market cap gain in the nine months. TCS, LIC, HDFC Bank and Bharti Airtel are the stocks that registered over Rs 2 lakh crore market surge in the last nine months.

Top 10 Market Cap companies that contributed the most to Rs 10 lakh crore gains

Top 10 Market Cap companies that contributed the most to Rs 10 lakh crore gains

Indian Railway Finance Corporation emerged as a surprise winner among the large contributors as the stock contributed over Rs 1.49 lakh crore in the 9 months. The company raced to a market cap of Rs 1.92 lakh crore in April. The stock zoomed over 340 percent in the last 9 months, as the company rode the wave in railway and PSU stocks due to government investments in the sector.

Zomato is another company that gained Rs 1.04 lakh crore market cap in the time period. The food delivery and quick commerce company’s total market cap reached Rs 1.69 lakh crore by April. Zomato shares rallied over 160 percent in this period.

Hindustan Aeronautics also registered above Rs 1 lakh crore gain as the company’s total market cap reached Rs 2.39 lakh crore. HAL stock advanced nearly 90 percent between July and April.

23 companies have added more than Rs 1 lakh crore to the Rs 100 lakh crore market cap addition.

23 companies have added more than Rs 1 lakh crore to the Rs 100 lakh crore market cap addition.

In total, 23 stocks saw a market cap gain over Rs 1 lakh crore in this period.

On the opposite end of the spectrum, HUL and ITC were among the companies that saw their market cap erode. HUL’s market cap declined by Rs 1 lakh crore and ITC by Rs 40,291 crore.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.