Shares of private lender IndusInd Bank Ltd. crashed 27 percent in trade on March 11, after the bank reported discrepancies in its derivative portfolio. The bank's stock recorded its biggest ever single day fall.

During an internal review of processes relating to parts of its derivatives portfolio, IndusInd Bank has estimated an adverse impact of 2.35 percent on its networth as a result of some discrepancies in these account balances, a company filing said on March 10.

This could potentially impact its profit by around Rs 1,500 crore, according to a person familiar with the matter. The final hit may be higher as an external review is underway, Moneycontrol earlier reported.

“I think general reserves cannot be touched, and we’ll have to take it to the P&L,” chief executive and managing director Sumant Kathpalia of the bank said during an analyst call.

The review was undertaken following RBI's directions on investment portfolio of lenders, issued in September 2023, relating to 'Other Asset and Other Liability' accounts of the portfolio.

At close, IndusInd Bank shares ended 27.06 percent down at Rs 656.8 on NSE.

Also Read | IndusInd Bank may take Rs 1,500 crore charge on derivatives portfolio adjustment

"The bank has also, in parallel, appointed a reputed external agency to independently review and validate the internal findings," the IndusInd Bank statement said.

The hit will have to be reversed through income statement, mostly through NII, and will be done in Q4FY25E. The gap came up in an internal review, and the bank appointed an external auditor in Q3FY25, whose report will be out by end-March 2025, Nuvama Institutional Equities stated.

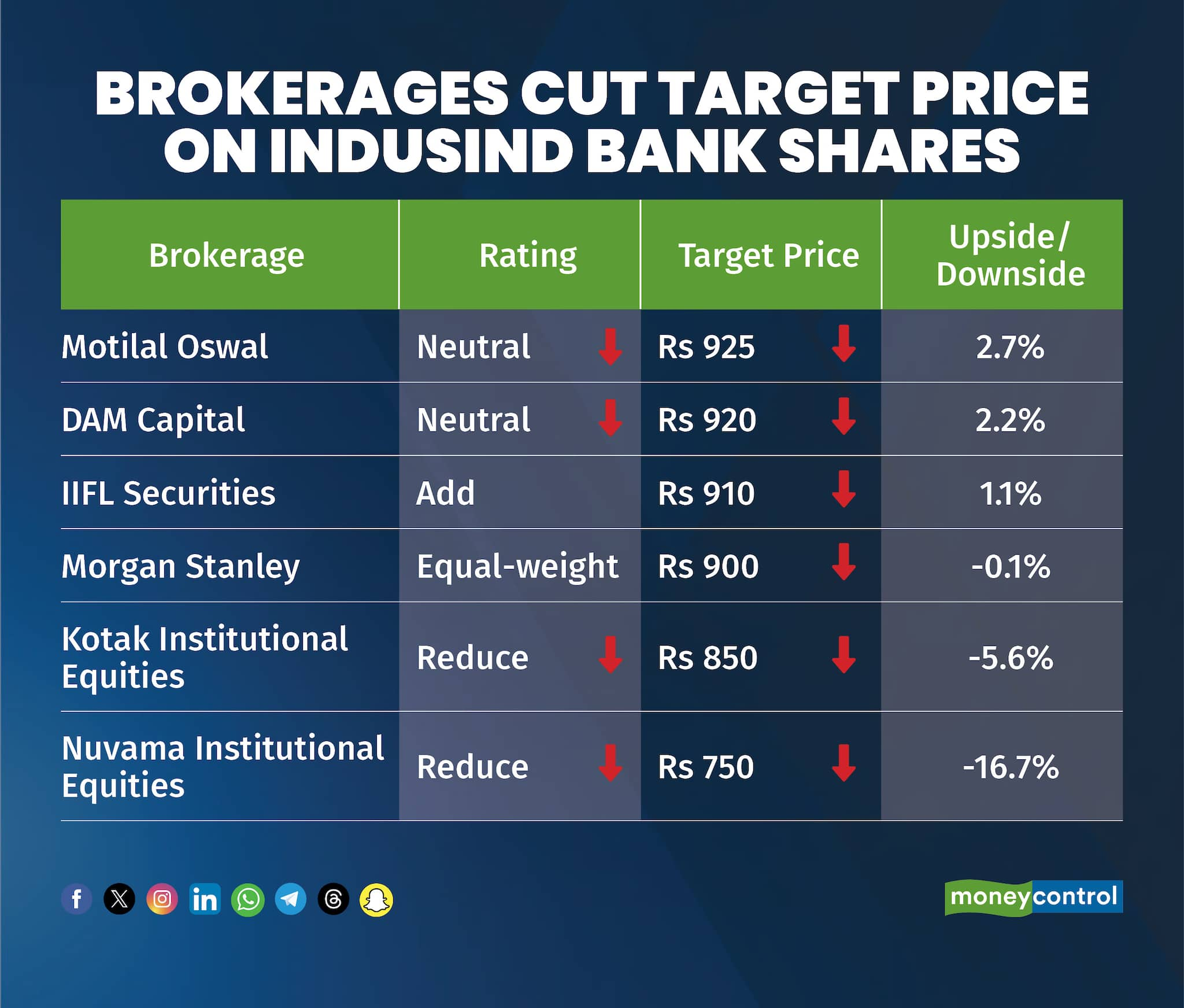

"The time line is discomforting: the CFO resigned just before the Q3 earnings, the CEO recently got a one-year extension instead of three and now a derivatives-induced dislocation. We believe IndusInd Bank’s credibility and earnings shall be impacted," said the brokerage. The broking house downgraded the stock to 'reduce', cutting its target price to Rs 750 per share.

IIFL Securities, on the flip side, maintained its 'add' rating, but cut its share price target to Rs 910 per share, down from Rs 970 earlier. The brokerage believes that the resultant impact will likely to be routed through P&L, potentially leading to a loss in Q4FY25.

The bank's microfinance slippages expected to rise further QoQ, and NIMs likely to contract in Q4. As a result, IIFL Securities estimates a ~35bps CET1 hit, but proforma CET1 ratio of 14.8 percent should not necessitate a capital raise.

The Reserve Bank of India is "not comfortable with my leadership skills" of running IndusInd Bank, Kathpalia said during an analyst call on March 10.

His remark came after the RBI last week approved the re-appointment of Kathpalia as MD & CEO of the private lender for one year instead of three years that IndusInd had applied for.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.