Krishna Karwa

Moneycontrol Research

Garware Wall Ropes (GWR) (market cap: Rs 2138.49 crore) provides specialised solutions to players in the cordage and infrastructure industry across the globe. The company’s innovative and customised product offerings find an application in fisheries, agriculture, shipping, sports, aquaculture, coated fabrics, and geosynthetics.

Continued impetus towards increasing the share of margin-accretive and niche products, backed by a positive demand outlook from foreign markets (for aquaculture, fishing nets, ropes) and local customers (for geosynthetics, agriculture nets, defence), puts GWR in a sweet spot.

The company reported a good set of numbers in the recently concluded quarter, as seen below:-

The revenue decline was attributable to GST-induced disruptions in domestic business (52 percent of FY17 revenue) and lower realisations in exports market (due to currency appreciation). Focus on value-added products, however, aided margin growth.

How are things likely to pan out in future?

GST normalisation

GWR's subdued sale volume in Q2FY18 is likely to be one-off in nature. A reduction in tax rate on fish nets (25 percent of FY17 revenue) from 12 percent to 5 percent, coupled with a revival of domestic sentiment, should result in ebbing of erstwhile headwinds.

Good export traction

Demand for GWR’s aquaculture solutions (fish farming cages) and X2 ropes (used in water transport, fishing, shipping, oil exploration) has been robust internationally. Chile and Norway are the new aquaculture markets under consideration (GWR is well established in Canada and Scotland already).

Domestic industry prospects

In India, the use of technical textiles has been gaining momentum. GWR aims to capitalise on this trend to capture a higher market share (particularly in fields with a low competitive intensity such as geosynthetics, agriculture, and defence).

Portfolio premiumisationIn the defence space, GWR expanded its product range from camouflage nets to inflatable tents, surveillance balloons, PVC-coated water storage tanks, and aerostats. In the agriculture segment, the company’s product line-up now includes insect protection nets, shade nets, and hail protection nets.

Valuation

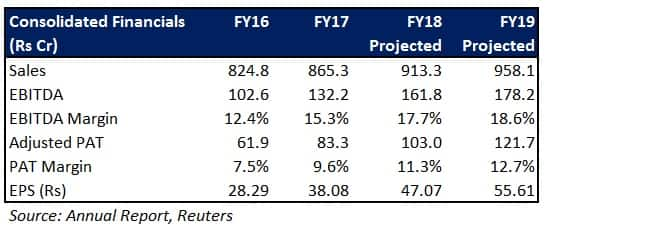

In spite of working capital blips in the near-term (due to GST and export-related formalities) and crude price fluctuations, GWR’s valuation seems inexpensive at 16.2x FY19 projected earnings. The company beckons attention given its strong technical expertise and ability to deliver healthy return ratios.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.