It is shaping up to be another forgettable day for Adani Group investors, with flagship Adani Enterprises shares plunging more than 11 percent on February 22, continuing its downward journey. Adani Ports was down 6 percent in the afternoon amid market-wide selling.

At the opening bell, Adani Enterprises declined sharply, opening with a bearish gap down. The open interest rose 8 percent, while rollover rates hit 71 percent, the highest they've been this year. This means more traders are taking bearish positions while those already holding the position are continuing with it to the next expiry.

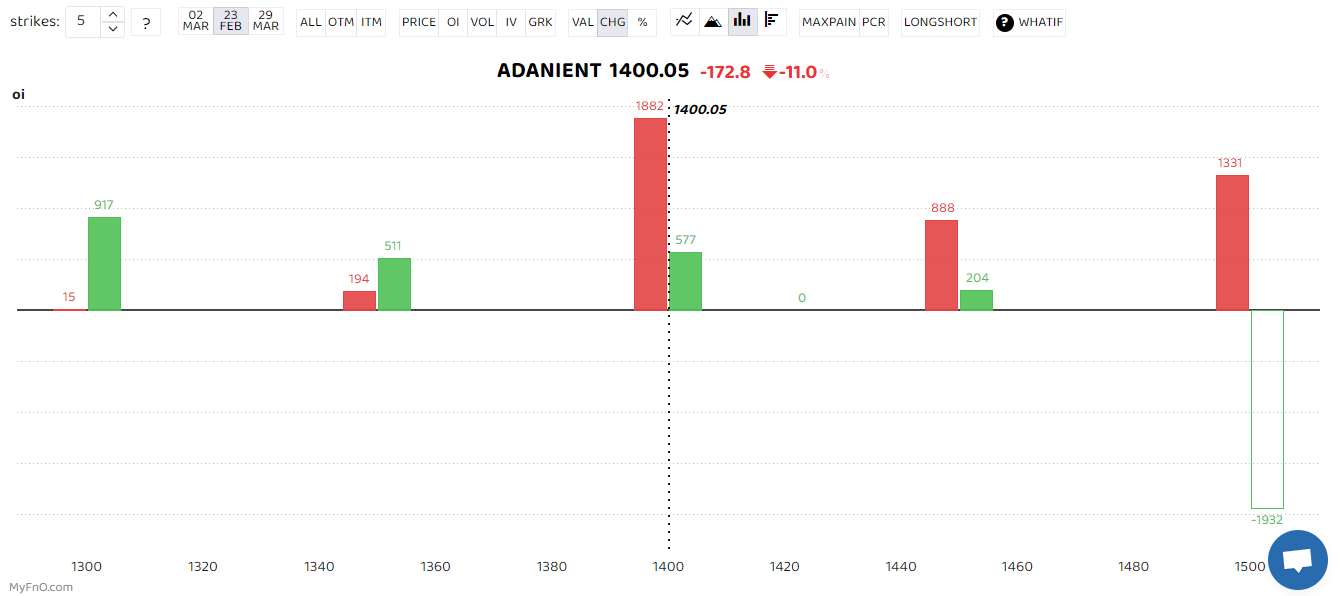

Bars reflect changes in OI during the day. The red bars show call option OI and the green put option OI.

Bars reflect changes in OI during the day. The red bars show call option OI and the green put option OI.

On the weekly expiry, Call writing was seen at 1400 strikes, while put writers were shifting lower with most of them positioning themselves at 1,300 strike. On February monthly expiry, 1400 has seen both call and put writing.

Also read: Rs 3.5 lakh crore of investor money gone: What's spooking Street?

Adani Ports also came under selling pressure, as the stock broke below the 20-day moving average. Open interest climbed 6 percent, while rollover was at the highest level in the week.

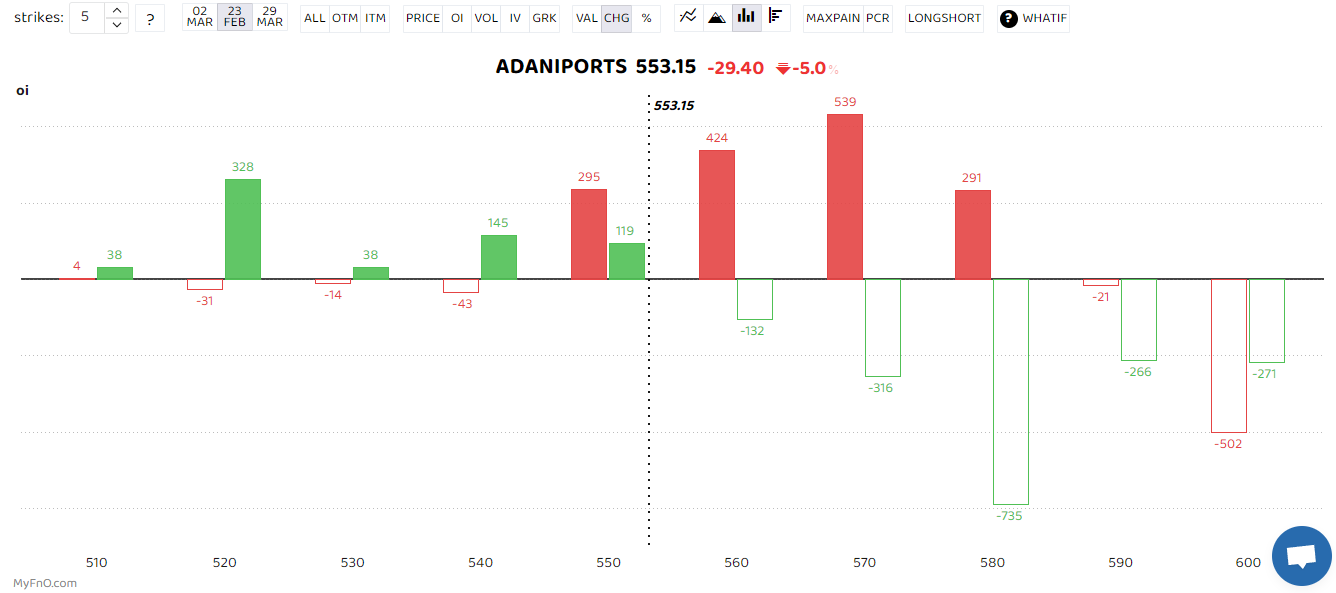

The stock also saw a lot of unwinding at higher levels as traders shifted their positions lower. Fresh call writing was seen at 570 to 590 strikes, while 520 saw fresh put writing.

Bars reflect changes in OI during the day. The red bars show call option OI and the green put option OI.

Bars reflect changes in OI during the day. The red bars show call option OI and the green put option OI.

MC A10 Index – a sentimeter of Adani Group stocks – was down over 8 percent. Most Adani Group stocks were locked in lower circuit limits with no buyers in sight.

At 1.35 pm, Adani Enterprises was trading 10.13 percent down on the National Stock Exchange at Rs 1,411.95 and Adani Ports was down 5 percent at Rs 553.55.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.