Chennai Petroleum Corporation share price tumbled 16 percent intraday on January 27 after the company reported its Q3 numbers.

The company reported a Rs 556.44 crore loss in the December quarter due to lower refinery run and tax expenses. CPCL had reported a Rs 290.58 crore profit in the same period a year ago.

Revenue from operations fell to Rs 11,458.32 crore in the third quarter of the current fiscal from Rs 11,965.01 crore in the previous quarter of the last fiscal.

While fall in international oil prices meant the cost of materials consumed fell by over 35 percent to Rs 5,470.08 crore, CPCL’s excise duty payout almost doubled to Rs 5,578.39 crore.

"The demand for fuel products was lower during the first half-year due to COVID related lockdown, resulting in lower crude thruput (refinery run). The capacity utilisation gradually improved during the current quarter (October-December),” the firm said in notes to the accounts.

The stock was trading at Rs 100.25, down Rs 19.20, or 16.07 percent. It touched an intraday high of Rs 104.40 and an intraday low of Rs 97.35.

The scrip witnessed a spurt in volume of more than 1.44 times and was trading with volumes of 184,355 shares, compared to its five day average of 101,426 shares, an increase of 81.76 percent.

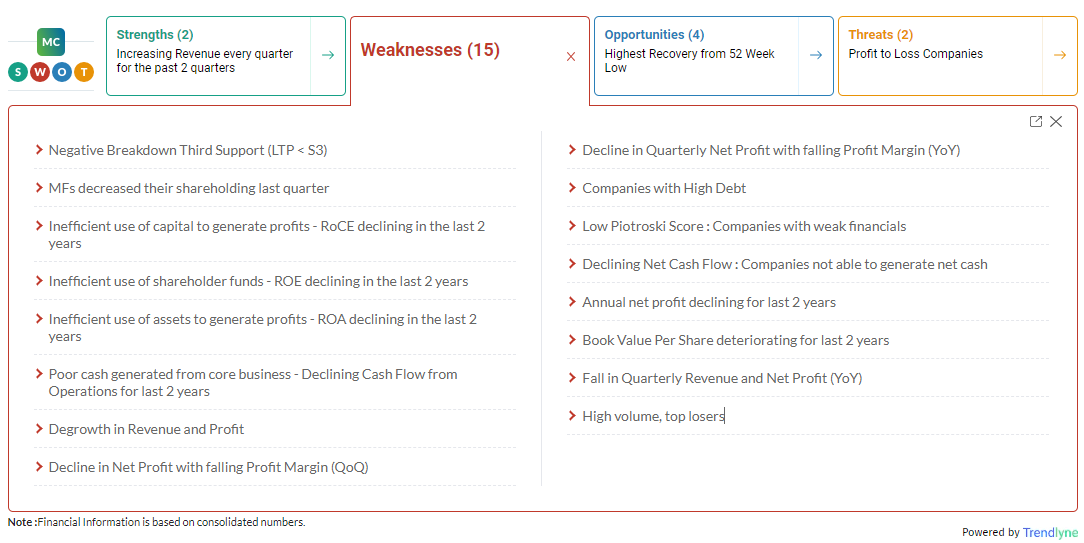

According to Moneycontrol SWOT Analysis powered by Trendlyne, the company has high debt. The book value per share has been deteriorating from the last two years. MFs have decreased their shareholding last quarter. The company is also inefficient in using shareholder funds with ROE declining in the last 2 years.

However, Moneycontrol technical rating is neutral with moving averages and technical indicators being bearish.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own, and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.