The broader indices hit all-time highs and performed in line with the main indices due to a strong monsoon, expectation of uptick in demand due to the festive season, and data points indicating a rate cut by the US Fed in its upcoming policy meet.

This week, the BSE Sensex rose 1,707.01 points, or 2.10 percent, to finish at 82,890.94, while the Nifty50 index added 504.35 points, or 2.02 percent, to close at 25,356.50.

Among the broader indices, the BSE Smallcap index rose 2 percent, the Largecap index added nearly 2 percent, and the Midcap index jumped 1.5 percent.

On September 12, the Nifty50 and BSE Sensex hit record highs of 25,433.35 and 83,116.19, respectively.

On the sectoral front, except Oil & Gas (down 2.6 percent) all other sectoral indices ended in the black with Nifty FMCG, Nifty Information Technology, and Nifty Media indices gaining nearly 3 percent each.

During the week, foreign institutional investors (FIIs) bought equities worth Rs 15,199.6 crore, while domestic institutional investors (DIIs) bought equities worth Rs 2,444.19 crore. FII equity purchases so far this month stood at Rs 16,600.88 crore, and DIIs picked up equities worth Rs 7,990.18 crore.

"Indian markets overcame last week’s negative sentiments triggered by the SEBI deadline for FII disclosures and recession fears in the US. Initial cautiousness among market participants was also influenced by a slew of macro-economic data points like US inflation and jobless claims, and domestic inflation and manufacturing data. Comments from the Bank of Japan (BoJ) about a potential rate hike if inflation remains elevated added to the caution," said Vinod Nair, Head of Research, Geojit Financial Services.

"Despite volatility, DII and FII flows remained positive as a strong monsoon and expectation of uptick in demand during the festive season drove investor sentiment. US inflation eased marginally, and the job market continued to see a cooling off. Indian inflation largely remained steady, while the July IIP (Index of Industrial Production) saw an uptick. The markets hit a new high also because optimism over rate cuts globally (the ECB and the US Fed) has provided a positive impetus across markets.

"Going ahead, the markets will be focussed on the upcoming FOMC (Federal Open Market Committee) meeting next week. The domestic market will also be influenced by corporate earnings, which are expected to improve in Q2 on a QoQ (quarter-on-quarter) basis," he added.

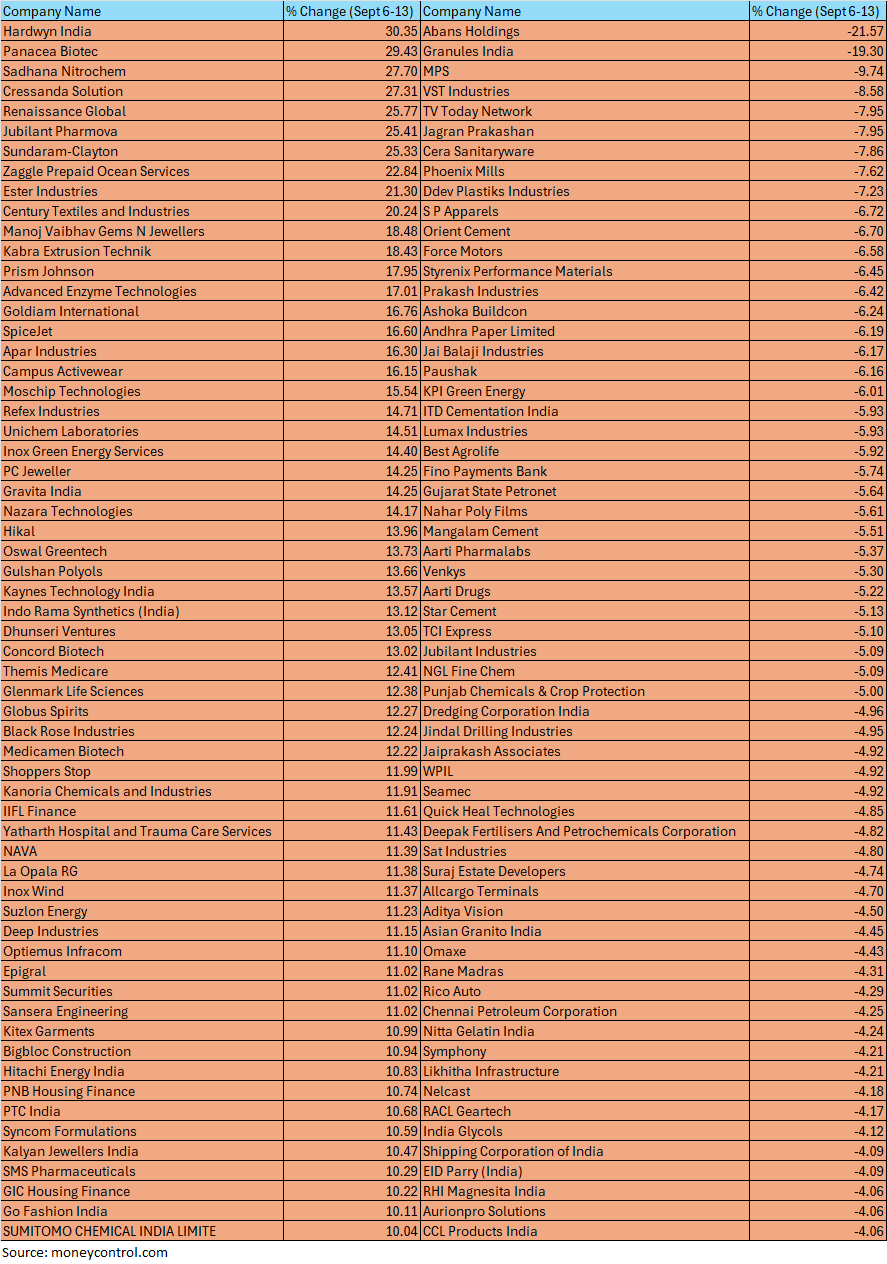

On the BSE Smallcap index, Hardwyn India, Panacea Biotec, Sadhana Nitrochem, Cressanda Solution, Renaissance Global, Jubilant Pharmova, Sundaram-Clayton, Zaggle Prepaid Ocean Services, Ester Industries, and Century Textiles and Industries rose between 20-30 percent.

On the other hand, Abans Holdings, Granules India, MPS, VST Industries, TV Today Network, Jagran Prakashan, Cera Sanitaryware, Phoenix Mills, and Ddev Plastiks Industries fell between 7-21 percent.

The short-term market is positive but due to temporary overbought conditions, we could see range-bound price action in the near future. For now, 25,225-25,000 / 82,500-82,000 would be the key support zones, while 25,500-25,700 / 83,500-84,000 would be the crucial resistance areas for the bulls. However, below 25,000 / 82,000, an uptrend would be vulnerable.

For the Bank Nifty, as long as it's trading above its 50-day SMA (simple moving average), or 51,350, the bullishness is likely to continue and could move up to 52,250-52,700. But if it drops below its 50-day SMA, traders may prefer to exit long positions.

Jatin Gedia, Technical Research Analyst at Sharekhan by BNP ParibasThe price action is along expected lines and can continue over the next couple of trading sessions. The undertone is bullish, and it is likely to resume its upmove once the consolidation phase is complete. The upside is likely around 25,500-25,700, while support is in the zone of 25,200–25,150.

Positive crossover on the daily and hourly momentum indicators supports the upmove in the case of Bank Nifty. The level of 52,000 is acting as a stiff resistance and a move beyond it could lead to a rally towards 52,500–52,600. The support zone is 51,500– 51,400.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.