In times of gold rush, it is best to be in the pick and shovel business. Nowhere is this more apparent than in the BSE Auto index, where auto component makers have been comprehensively outperforming their consumer-facing peers in recent times.

Accelerated shift towards electrification, tougher emission and safety norms and lingering shortages in the global supply chains have forced the domestic auto industry to enhance investments in the sector, with auto ancillaries being the clear beneficiaries.

While car companies are slugging it out in the hyper-competitive consumer market, their suppliers are quietly boosting their investment profiles by expanding their capacities and diversifying their offerings.

Reflecting the increased traction in the space, Indian auto component firms signed M&A and JV deals worth Rs 6,300 crore in the last three months, compared to Rs 6,945 crore in entire 2022, as per Grant Thornton estimates.

This deal street buoyancy is being reflected on Dalal Street as well.

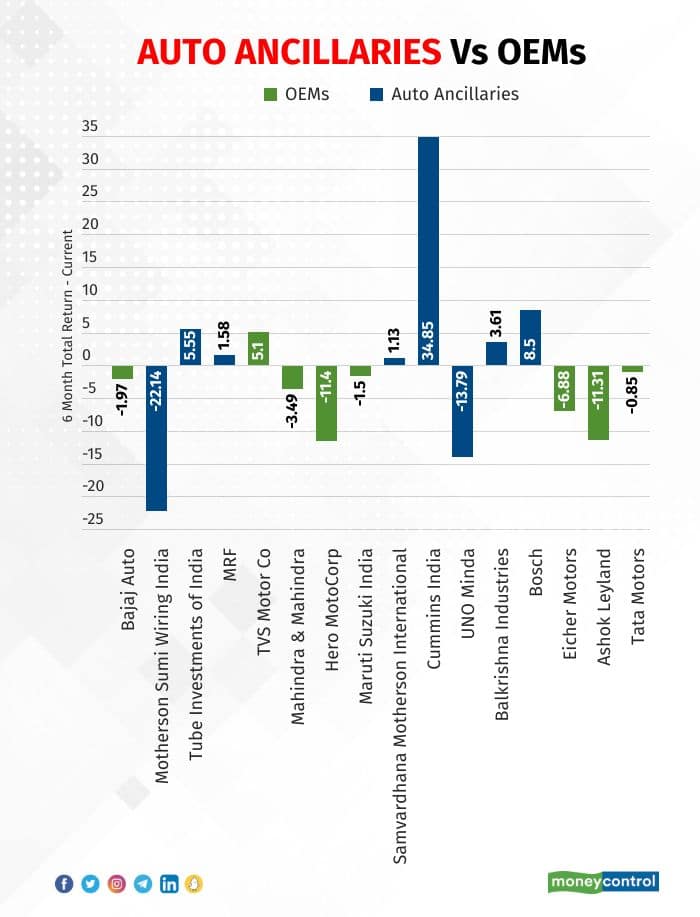

Over the past 6-month period, auto component stocks have clearly outshined the OEMs. In fact, barring TVS Motor, none of the OEMs in the BSE Auto index have managed to post gains.

On a YTD basis as well, the top performer in the BSE Auto index has been Cummins India with 20.69 percent returns, followed by Tata Motors (13.13 percent), Samvardhana Motherson International (12.14 percent) and Bosch (8.58 percent).

In a recent report by Motilal Oswal, 13 out of 14 auto component firms had buy/neutral ratings. Only MRF had a sell call.

The auto components industry is looking to clock double-digit growth next fiscal as well, aided by robust demand from both domestic and export segments.

According to the Automotive Component Manufacturers Association of India (ACMA), the industry turnover is projected to grow 10-15 percent in FY24. The sector is expected to close this fiscal with 15 percent growth. It had expanded by 23 percent in FY22 to post a turnover of USD 56.5 billion.

HDFC Securities expects auto ancillaries to benefit from lower input costs, even as demand headwinds can be a cause for concern.

“Auto ancillary companies within our coverage are likely to benefit from softening input costs and reduced energy costs for companies with exposure to Europe. For tyre companies, we expect margins to improve QoQ due to softening input costs (natural rubber price is down 10 percent QoQ and crude is down 9 percent) although demand remains weak,” it said in a recent report.

Overall, companies in its coverage universe are expected to post 4 percent earnings growth QoQ, largely due to softening input costs.

In fact, most analysts have highlighted the twin advantage of price hikes and decline in raw material basket cost as a key driver of profitability for auto ancillaries.

Which means that while auto OEMs are straining to negotiate pricing pressures, fickle consumer tastes and monsoon vagaries, ancillaries can expect a comparatively smoother ride in the near term.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.