Ashok Leyland share price touched 52-week high of Rs 133, adding 9 percent in the early trade on February 2 on the back of January sales numbers and government announcement on vehicle scrappage policy.

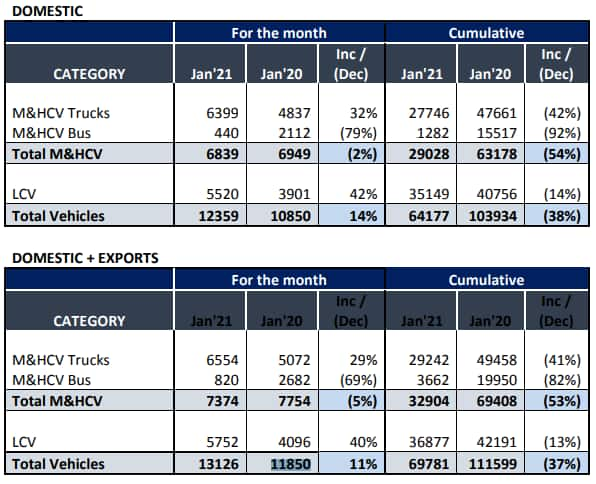

The company in the month of January 2021 has posted 11 percent jump in its total sales at 13,126 units against 11,850 units in January 2020.

The light commercial vehicle sales were up 40% at 5,752 units versus 4,096 units and total M&HCV sales were down 5% at 7,374 units versus 7,754 units.

Morgan Stanley has kept overweight call on the stock and raised the target price to Rs 155 from Rs 63 per share.

There is an all signs point to an M&HCV upcycle and stock is pricing in CV normalization.

Driven by the Budget-led infra push & better pricing, earnings face upside surprise, while scrappage policy could add upside, reported CNBC-TV18.

Finance Minister Nirmala Sitharaman in her Union Budget 2021 speech proposed the voluntary scrappage policy to replace personal vehicles older than 20 years and commercial vehicles older than 15 years.

The move is expected to be positive for the auto sector as it would support vehicle sales, especially commercial vehicles in the long-run.

At 09:17 hrs Ashok Leyland was quoting at Rs 129.85, up Rs 7.80, or 6.39 percent on the BSE.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.