The share price of Adani Enterprises, the ports-to-power conglomerate Adani Group flagship, slipped further on February 27 to inch closer to its 52-week low of Rs 1,017.

As of 1.30pm, the stock traded down about 12 percent from its previous close. However, some buying was seen at lower levels and the stock price pared losses by a couple percentage points by 1.45pm.

The stock has lost two-thirds of its value since the explosive short seller report was released on January 24. Hindenburg Research accused Adani Group of fraud, stock manipulation, and accounting anomalies, and the group denied every allegation. From its 52-week high of Rs 4,189.55 hit in December 2022, Adani Enterprise has lost about three-fourths of its value.

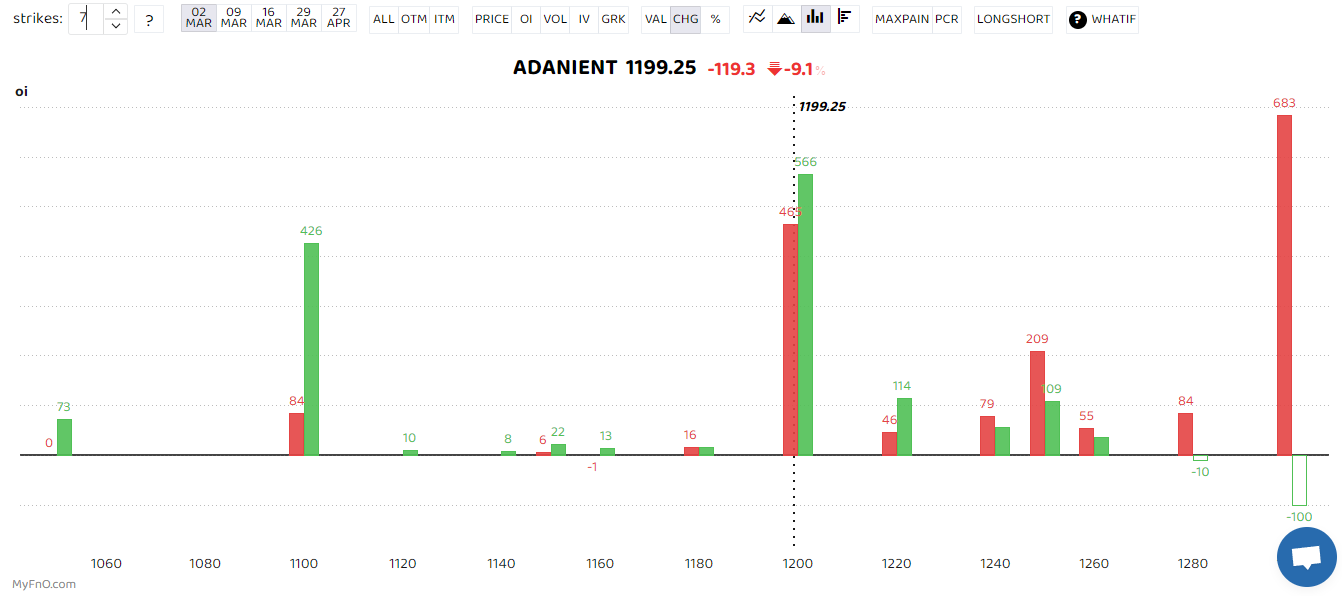

In the options market, bulls and bears were fighting out at 1,200 levels. Some put writing was seen at 1,100, meaning it is emerging as a local support area. The 1,300 level, on the other hand, has large call positions as it remains a resistance for the stock.

Bars reflect changes in OI during the day. The red bars show Call option OI and the green Put option OI.

Bars reflect changes in OI during the day. The red bars show Call option OI and the green Put option OI.

Other Adani Group stocks were also down in the dumps. Adani Green Energy, Adani Power, Adani Total Gas, and Adani Transmission continued to be locked at respective lower circuits. They were also joined by Adani Wilmar and NDTV that also fell 5 percent. ACC and Ambuja Cement – two value stocks from the group - were also trading with 3-5 percent cuts.

Sameet Chavan, Chief Analyst-Technical and Derivatives, Angel One said Adani Group stocks are certainly an avoid at this juncture.

"Due to recent fiasco, the long-term structure has damaged and considering the sell off with huge volumes, the recovery is unlikely in not only few weeks but few months as well," he added. "Whenever such big fall comes; prices tend to slip into a long slumber phase. In between, small piece of news flow may provide some momentum but largely speaking, this entire group is not going to do much."

Also read : Shankar Sharma on Adani, risks to India's growth and next big market trigger

Thanks to the incessant selling, the group’s valuation also plunged below Rs 7 lakh crore for the first time since August 2021.

This comes amid the commencement of Adani Group’s charm offensive with fixed-income investors in Asia this week in a bid to stem the fallout.

(Sunil Shankar Matkar also contributed to this story.)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.