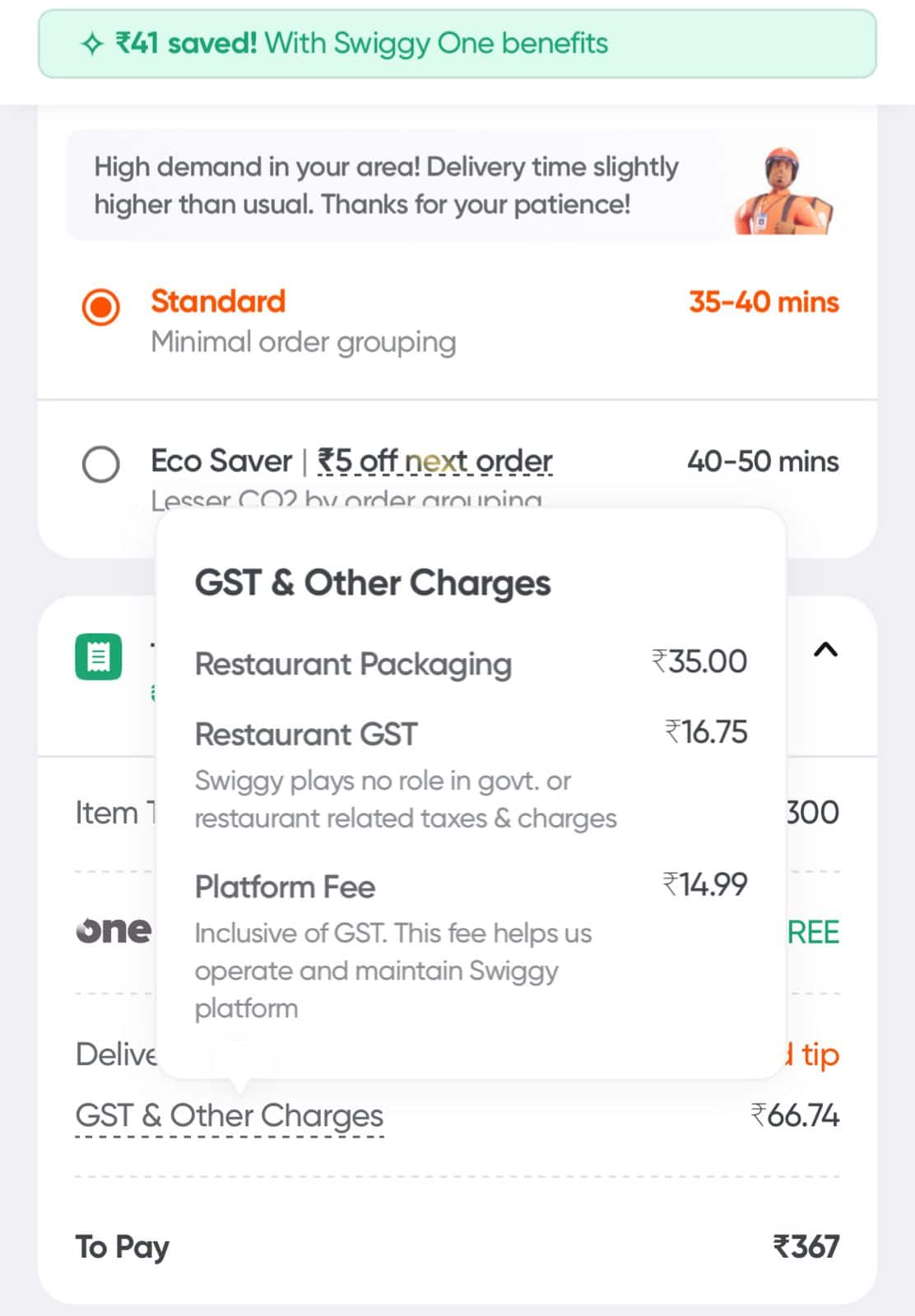

Food delivery platform Swiggy has increased its platform fee for the third time in the last three weeks to Rs 15 per order, marking its steepest hike yet as it looks to ride the surge in demand during the festive season and shore up its bottom line.

The move comes weeks after Swiggy had briefly raised the fee to Rs 14 on Independence Day, before settling back at Rs 12. Now, with order volumes peaking again, the Bengaluru-based firm has pushed the levy to Rs 15.

The platform fee is an additional charge levied by both Zomato and Swiggy on every order, over and above other line items such as delivery charges, GST, and restaurant fees. Notably, the fee is not uniform across cities and days, and often varies based on demand levels.

Swiggy's hike follows that of rival Zomato, which has also raised its platform fee to Rs 12 to capitalize on the festival season rush.

At Swiggy’s present order volumes — estimated at over 2 million orders per day — the higher fee translates to up to Rs 3 crore in daily revenue, compared to around Rs 2.4 crore when the fee was at Rs 12. That’s an additional Rs 54 crore per quarter and Rs 216 crore annually if the rate sustains.

Swiggy did not respond to queries sent by Moneycontrol.

Platform fees, first introduced in April 2023 at just Rs 2 per order, have steadily risen over time. They have largely remained above Rs 10 since both Swiggy and Zomato experimented with higher charges around New Year’s Eve last year.

Typically, both companies test higher fees on high-demand days and, if order volumes remain unaffected, roll them out more broadly.

The latest hike comes at a time when Swiggy is under pressure to control losses. On July 31, the company reported that its net loss widened nearly 96 percent YoY to Rs 1,197 crore in Q1 FY26, up from Rs 611 crore a year earlier. Losses in the previous quarter had already stood at Rs 1,081 crore. Much of this drag has been attributed to heavy investments in Instamart, its quick commerce unit.

Revenue from operations in Q1 rose 54 percent YoY to Rs 4,961 crore, up from Rs 3,222 crore a year ago, and 12 percent higher than Rs 4,410 crore in the March quarter.

Rival Zomato has also increased its platform fee to Rs 12 per order during the festival season. At its scale of 2.3–2.5 million daily orders, that would yield an additional Rs 3 crore each day, and Rs 45 crore per quarter.

The Gurugram-based firm has been aggressively testing ways to boost profitability, even as it saw its Q1 FY26 net profit drop 90 percent YoY to Rs 25 crore, though revenue jumped over 70 percent to Rs 7,167 crore.

With both food delivery giants battling thin margins and rising costs, the platform fee — though a small line item for customers — has quickly become a crucial lever to improve financial health at scale.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!