Note to readers: #HowTo is a series of articles designed to give you an edge in matters of competitiveness, upskilling/reskilling and knowledge gathering. It will bring in the most relevant voices on a subject, so that you benefit the most in your business or career.

Guy Kawasaki has a 10/20/30 rule for preparing pitch decks to be shown to investors. He says a pitch should have only 10 slides, shouldn’t last more than 20 minutes, with fonts not smaller than 30 points on any slide.

The renowned Silicon Valley venture capitalist and author believes that people find it tough to comprehend more than 10 concepts in a meeting, and hence the attempt to limit the number of slides. Present those slides in 20 minutes even if you are given a 60-minute slot and use the rest of the time for deliberations. Most presentations use a 10-point font for text and squeeze in as many details onto the slide as possible. Avoid this, says Kawasaki, as the audience reads faster than the presenter if the slides are text heavy.

The ideal pitch-deck presented to an investor should be clear and compelling. Let’s take a closer look at what a good pitch deck should look like. It’s not necessary that one has to follow all market rules to the dot, even if it’s coming from someone like Kawasaki, though his ideas offer a good thumb rule.

First and foremost, the pitch deck should outline the mission:

– What’s the problem that the start-up is intending to solve?

– What’s the value proposition?

The potential market size, addressable opportunity, positioning and segmentation are also key components. The slides should also vary in content according to the nature of the funding round – seed, Series A, Series B, etc. In the seed round, the focus should be more on the basic idea of the start-up and the team.

Sanjay Mehta, founder of VC firm 100X.VC, says that for a seed-funding round, the founder should list why customers would want to use the product more than any other similar product in the market. “It should be a painkiller that sells by itself. The product should fill a vacuum and exhibit potential for non-linear growth.”

The other aspect that should find a slot in the pitch deck is

– Why is this the right time to build a start-up?

– Is there an economic impetus for the launch?

– Are there incentives or tailwinds that can propel the sector that the founder is getting into?

– Do you have the enabling technology or the ability to do the necessary tech disruption?

There should even be a cultural acceptance in some cases, where reprogramming of consumer behaviour is required.

There has to be a mention of why isn’t everyone working on the idea that you have pitched for.

“What’s your moat? What’s the unfair advantage that you will have over competition? How’s the barrier to entry created? These are aspects to be addressed in the pitch deck,” says Mehta.

Further, one should clearly indicate the capital required to scale, projection for 18-24 months, unit economics, metrics to measure the traction, identify competency gaps and a hiring plan. The deck should also talk about a monthly rolling business plan at the seed stage, along with how the product or service will be consumed and details of distribution and sales channels.

Adds Mehta, “Raising a seed round is a function of convincing an investor that the idea has the potential to raise Series A funding. So, the founder needs to plan accordingly.”

If content is king, who’s the queen

Neeraj Tyagi, founder of WeFounderCircle and an angel investor, says there are some functional aspects that one needs to take care of while preparing a pitch deck. If content is king, then visual is the new queen, he says.

Like any other communication document, pitch deck is a story-telling tool. So, follow the classic creative strategy, make it more visual to grab the investor’s attention and support it with lot of data. “There should not be more than 2-3 bullet points on each slide,” says Tyagi.

Focus on a great beginning to your presentation

“I am a firm believer of putting a snapshot slide of the start-up’s journey within the first three slides,” says Tyagi. Try to cover all that you have achieved till now and how exciting things look from here on. Most founders make the mistake of focusing too much on explaining the problem statement and market size. “We need to understand that most times investors are already aware of these data points. So, quickly move to the solution part and how you are going to execute it,” says Tyagi.

Customise your story

Different investor profiles have different trigger points. It’s extremely important to understand what your investor is looking for. Some give importance to scale and execution and are not worried about cash burn. Others get impressed with the cash flow management. “Try to research their investment thesis and pattern of investing,” says Tyagi.

Length of the pitch deck

The ideal pitch deck must stick to 11-12 slides, says Tyagi. Also, create a 2-page teaser deck if you are planning to share an idea with an investor for the first time. Keep the detailed deck for a later date. This is a great tool to engage any potential investor, as there are higher chances that they will read it sooner than a longer deck.

Says Smriti Tomar, founder of fintech start-up Stack Finance, “There are so many resources available out there on making the ‘best’ pitch deck that it can become overwhelming to understand what is right for you and what’s not. My suggestion is to go with one mantra – keep it simple.”

Start gathering all relevant content, structure it into a story and design it to make it aesthetically pleasing but not complicated. The pitch deck should have a one-liner about what you do, the solution to the problem outlined, the product-market fit, the unit economics, market size and competition, says Tomar. The deck should talk about the company’s vision, hiring plans and the funds needed, along with some projections.

“The thumb rule is to have 10-15 slides for your main deck. See to it that the presentation does not exceed 20 minutes,” she says.

Know your audience

Akshat Singhal, founder & CEO of Legistify, a tech-enabled legal concierge platform for mid-market and large enterprises, says it’s always an advantage to know who your audience is. “The Japanese were the first to work on this minutely. Legend has it that before any meeting they would know your dress preferences, food preferences, eccentricities, your political inclinations, how you prefer to be greeted, etc. The more knowledgeable you are about your investors before-hand, greater are the chances of matching their frequency. Know them as humans and not just designations, which in most cases will be fancy. This will help you to find common ground, to give you a good start, says Singhal.

In an investor pitch there usually is a team to whom you will be presenting. “You have to know who are the ones that actually matter, who makes the decisions and who has the decision makers’ ears. This narrows your Target Audience, and then you go all out to woo them,” says Singhal.

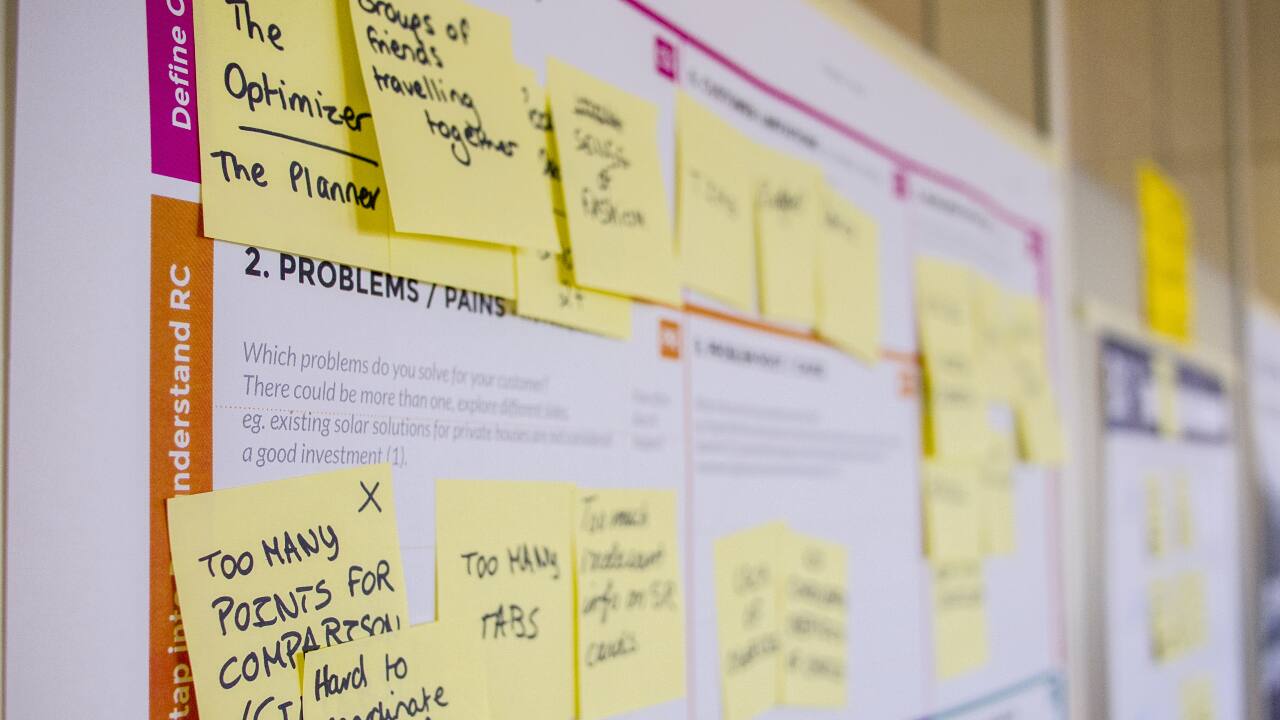

Plan in such a way that each slide takes the story forward. Avoid going back and forth. (Representational image: Daria Nepriakhina via Unsplash)

Plan in such a way that each slide takes the story forward. Avoid going back and forth. (Representational image: Daria Nepriakhina via Unsplash)

The presentation

● Keep the message clear: No other thing kills a presentation more than confused messaging. All of your slides should communicate and support the central idea(s). Your business concept should be clearly communicated and amply supported throughout the presentation.

● Keep the slides simple and appealing: Avoid being verbose or having too many graphics as they spoil the show. Clear, uncluttered pointers with complimenting visuals and graphics, are all you need. “Take each point at a time and explain in detail. You should know which points to devote more time to and which are self-explanatory or the audience is already knowledgeable about. So, just run through them and pick those which you feel could add to the audience’s knowledge,” says Singhal.

● Keep it short and simple: As they say ‘Brevity is the soul of wit’. Well, here too brevity might just win you the day. “Just understand that yours is not the only presentation that this team has seen during the day, there have been a few before you and there will be more afterwards. So, try to say more with less. Ideally, 10-12 slides should do the job for you, lesser the better,” says Singhal.

● Flow and milestones: Each slide must take the story ahead from the previous one, seamlessly. The flow should be continuous and smooth. Avoid going back and forth.

● Demonstrate the power of your idea: Use data, anecdotal customer/early backer stories and moments of truth to convey the viability or bankability of the idea. Commission research on your idea, product or solution and then share empirical evidence to support your investor pitch.

● Focus on investor returns: Instead of “Why you should invest your millions in my business or business idea”, it should be about “How my business idea will transform your millions into billions”. Always remember that customer orientation works and nobody is here for charity or as a good Samaritan. Know that investors are very intelligent and successful people who want to ride on your success; in short, these people know their onions.

After taking the audience through the whole story of your business idea, the final slide should be a concise and powerful sum-up of whatever you have just said or tried to say in the presentation in 4-5 bullet points, i.e. the ‘Power Points’ of the presentation.

Formatting tips

As for formatting, try to avoid clutter by not having too many graphics. Fonts should be the same throughout. If two fonts are used, then use one for the body and another for text. But try to avoid even that, if possible. The colour themes and layouts should be consistent. Also, try to keep an appendix ready with informative data, graphs and other reference material, to support your points in case some investor has a query.

There’s nothing like a Perfect Pitch Deck

Ajay Bulusu, cofounder of NextBillion.ai (a Singapore-based tech start-up), says there is nothing like a perfect pitch deck. But depending on the stage of your fund-raise, a few things have to be kept in mind. During the early stages, investors are purely betting on the team. So, make sure to have your team slides right up there. Investors always look at macro trends than micro details early on and bet on large markets. eg: 10-minute delivery, crypto, NFT, etc., are currently hot. So, if you are in a hot space, funding generally becomes a little easier.

Nandini Mansinghka, CEO & co-founder of Mumbai Angels, an angel investing platform, says the founder needs to focus on aspects of the business that will stick with prospective investors. Keep it chronological. Be clear about your company’s history. Mention the motivation for starting your business, who your target audience is, if you have an investor or multiple investors, why you’ve named your business a certain way, etc. It must convey the ‘why’. Why this product or solution? Identify a clear need in the market and why someone would pay you to solve that problem. Your understanding of the market has to reflect in your pitch deck. It has to include an all-important and realistic assessment of the market you are entering. It should also highlight what the competition is like in that particular space and how you intend to price your product or solution and the revenue model associated with it. Have two different decks, one containing the description of the company and another one for a deep dive into the financials, she says.

After all that effort if the answer is a ‘no’, don’t get dejected. There’s always another investor waiting.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!