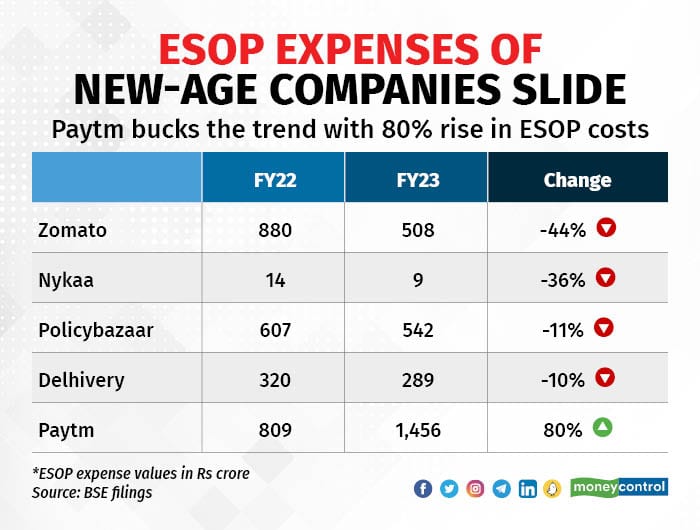

Employee stock option (ESOP) expenses of listed new-age companies came down significantly in FY23 at a time when the market turned tougher for loss-making tech outfits, according to data filed by the firms on the exchanges. Zomato's share-based payment expenses declined by the most, at 42 percent. Nykaa brought down such costs by 36 percent, while Delhivery and Policybazaar saw smaller drops of 10 percent and 11 percent, respectively.

Fintech major Paytm was the outlier of the pack as its ESOP expenses rose 80 percent from Rs 809 crore in FY22 to Rs 1,456 crore in FY23. Its net loss amounted to Rs 1,776 crore for the financial year, narrowing from Rs 2,396 crore a year earlier.

This rise in ESOP cost came even as the company’s share prices continued to face the brunt of losses, and ended FY23 at Rs 637 apiece, which was 70 percent below its initial public offering price of Rs 2,150.

The fintech unicorn aims to become "free cashflow positive in the near future," chief executive Vijay Shekhar Sharma said in a letter to shareholders in May. "This has been possible by disciplined resource allocation and focusing on what has become our core revenue and growth driver – payments and financial services distribution business," he said.

New-age companies like Paytm, Zomato, Delhivery and others have faced a lot of criticism in the past couple of years for making large ESOP grants to their top brass just before IPOs, which have since weighed on the profitability horizons of the firms. As ESOPs are typically structured to vest over a period of 4-5 years, these grants will continue to have a bearing on the financials over the next couple of years.

While Zomato’s ESOP expenses dropped 42 percent from Rs 880 crore in FY22 to Rs 508 crore in FY23, the company’s management said in an earnings call recently that the downward trend could reverse in the future.

Moneycontrol earlier reported that ESOPs given to Zomato co-founder and CEO Deepinder Goyal cost the company Rs 143 crore in the second half of FY23 even as the company is trying to convince public market investors of imminent profitability.

Venture capital backers of such new-age companies say that such ESOP grants to founders are required to keep them interested in running the ship, given that their shareholdings are diluted to a large extent due to successive rounds of fundraises.

“If the dilution was a result of competitive raising, there could be a more sympathetic view… Maybe some amount (of ESOPs to founders) is justified, such as 1-3 percent of the company,” Info Edge founder Sanjeev Bikhchandani said last year. Info Edge was one of the first backers of Zomato and Policybazaar and still retains significant holdings in the two companies.

Meanwhile, Policybazaar saw its ESOP costs fall only 11 percent to Rs 542 crore in FY23, but it is also the closest to profitability in the loss-making pack, being the only one to have a loss figure in single-digit crore (Rs 9 crore) during the period.

Logistics tech firm Delhivery, which is reeling from a drop in revenues due to a slowdown in the e-commerce sector, saw its share-based payment expenses slide a similar 10 percent to Rs 289 crore during the period. Its losses narrowed marginally from Rs 1,081 crore in FY22 to Rs 1,008 crore in FY23.

Beauty products marketplace Nykaa is the least ESOP spender among the lot – as it is majority owned by the promoter family who are ineligible to get share-based remuneration. However, the e-commerce platform also brought down its ESOP costs by 36 percent from Rs 14 crore in FY22 to Rs 9 crore in FY23.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.