Orios Venture Partners, an Indian technology venture fund, on May 23 advised its portfolio startups to become conservative in hiring as it said the capital will be constrained for the startup ecosystem amid the bearish mood of investors.

“We can't say how long it will last but it's prudent to factor this (capital constraints) in for the rest of 2022 and possibly the first half of 2023 this situation will continue,” the venture capital (VC) company told startup founders in a letter.

“Become conservative with hiring. Take in only essential people and negotiate on salaries. This is important,” the VC said.

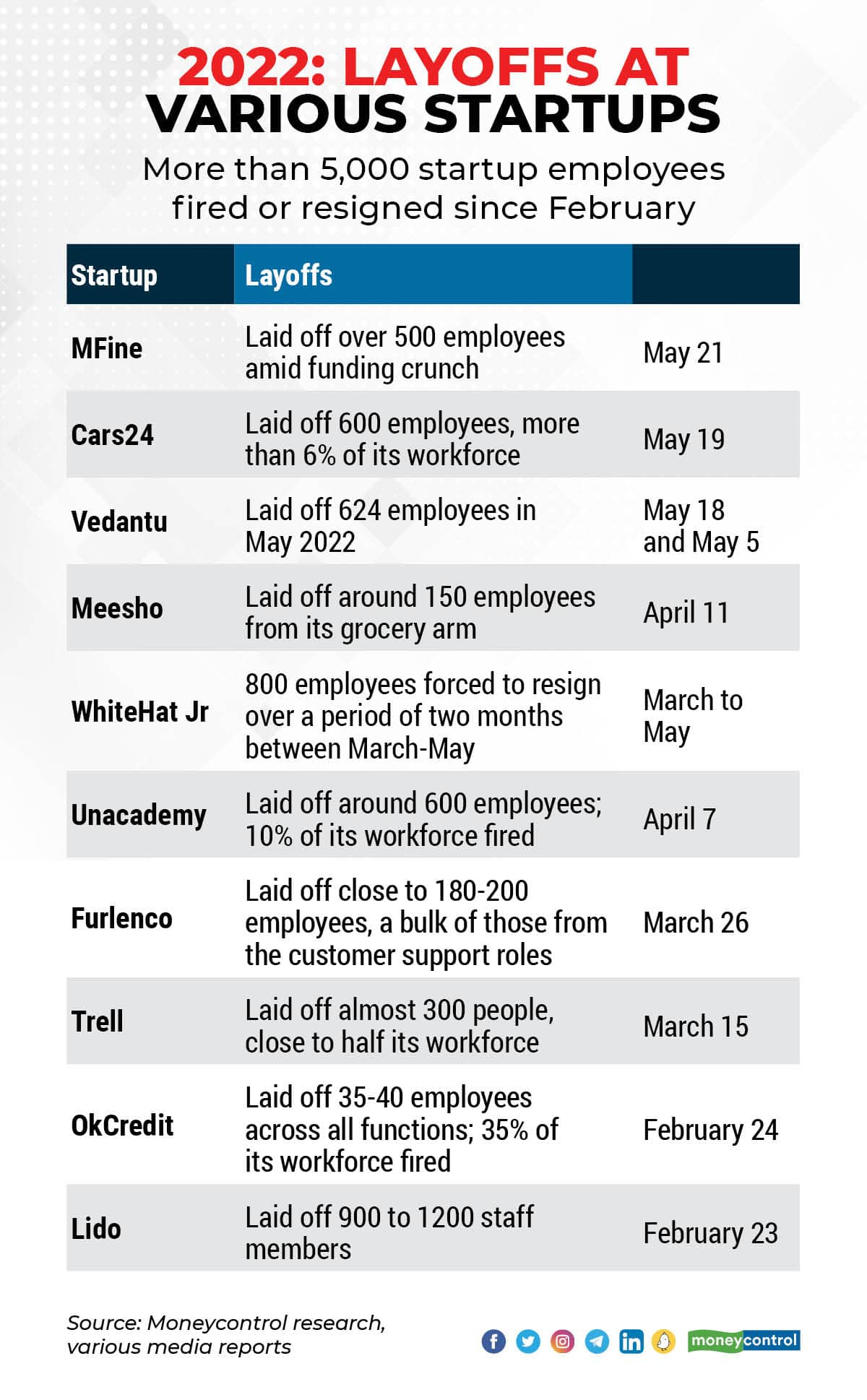

The VC’s comments on hiring come at a time when well-funded startups in India have laid off thousands of employees citing a funding crunch and a dip in demand after two consecutive years of hypergrowth. According to data compiled by Moneycontrol, so far in 2022, startups have laid off over 5,000 employees, with more than 2,000 layoffs happening just in the last week.

Moreover, the letter follows a report by business analytics company CB Insights that projected venture funding to Asia-based startups to fall 31 percent sequentially in the April-June quarter of 2022. It also showed that venture funding to Asian startups fell 36 percent in the first quarter of the calendar year 2022 on a quarter-on-quarter (QoQ) basis.

Further, the report suggested that mega-rounds to Asia-based companies will fall 25 percent sequentially in associated funding.

According to Orios Venture Partners, the reason behind the funding crunch are overall weak global cues, hard lockdowns faced by a major supplier, China as it continues to battle covid, and sanctions on Russia due to the Ukraine war, among others. In addition, Russia has blocked the Black Sea, preventing Ukraine, a major supplier of Wheat from exporting. All these factors have contributed to the shortage of supplies and price hikes.

“In such times, cash is king,” the VC firm said and asked founders to try and generate margins from sales as that will result in more cash.

Orios also suggested startups to have a relook at the burn and finding ways to optimize it, by reducing customer acquisition cost (CAC), and fixed costs, among other things, if there is room for that.

The VC further suggested that companies should reassess their working capital, and try to reduce it by negotiating with sellers and buyers.

The fund also suggested founders consider borrowing as an alternative method of raising capital. “A good debt-to-equity ratio is always healthy, more so in these times where equity capital is constrained. Negotiate and shop around to get competitive interest rates,” Orios said.

The VC firm suggested employees who earn more than Rs 60 lakh a year to consider taking a part deferment in salary.

Orios Venture Partners also advised founders of its portfolio companies to close deals with investors and avoid waiting for better offers as there might not be any.

“If you have term sheets from investors, don't hold out for better deals and close them asap. The next deal may be a worse deal or no deal at all,” the VC fund said.

In the letter, the VC fund said that the rest of 2022 looks like a period of headwinds for capital availability. They explained that VC and Initial Public Offering (IPO) capital would be scarce. Orios has backed companies like IPO-bound Pharmeasy, Druva Software, Mobikwik, Zostel, and Ola among others.

Last week, in a similar letter to its portfolio founders, marquee Silicon Valley startup incubator Y Combinator said the economic situation does not look good and advised startup founders to take money from investors even on terms of their previous rounds, if available.

The world is now facing galloping inflation, the most seen in 40 years and hence, central bankers are raising interest rates. According to the VC fund, due to the increased interest rates, investors reduce deployment to public markets and allocate their money to bonds; and leverage becomes costlier, driving down stock markets.

Orios believes this, in turn, affects IPOs. With an effect on IPOs, VC and PE investors do not realise returns which has a knock-on effect on their further deployment, as per the VC fund.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.