Country's largest lender, the State Bank of India (SBI) has waived off charges on funds transfers made via RTGS and NEFT for its YONO, internet and mobile banking customers from July 1. The bank will also give free access to IMPS for the same set of customers from August 1.

“One of our bank’s core strategies is to provide convenience to customers and encourage them to take the digital route for transferring funds. In sync with our strategy and government of India’s vision to create a digital economy, SBI has taken this step to promote the use of YONO, internet banking and mobile banking for doing NEFT and RTGS transactions without incurring any cost,” said PK Gupta, MD (Retail & Digital Banking), SBI.

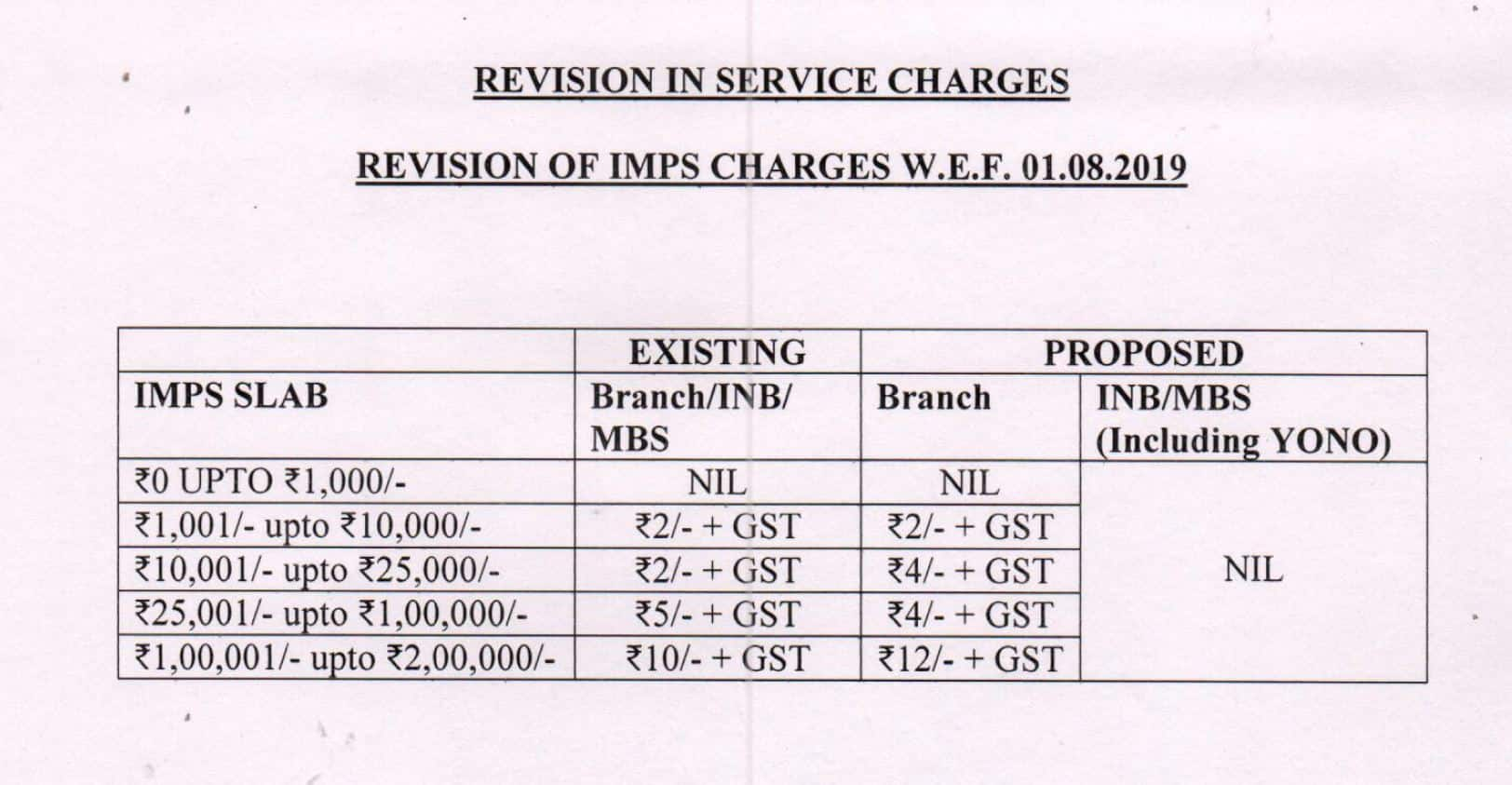

The complete list of revised IMPS charges, as stated in the release, are given below:

SBI had more than six crore internet banking customers and 1.41 crore mobile banking customers, as on March 31. Its mobile app YONO has about one crore users. The move is aimed at attracting more customers to these digital platforms.

For customers transacting through branch banking, RTGS and NEFT charges were reduced by 20 percent across all slabs, the bank said in a statement.

The move comes after the Reserve Bank of India (RBI) decided to do away with charges on RTGS and NEFT transactions from July 1 and asked lenders to pass on the benefit to its customers.

The real-time gross settlement (RTGS) system is used for large-value instantaneous fund transfers, while the national electronic funds' transfer (NEFT) system is used for fund transfers of up to Rs 2 lakh.

Currently, the bank charges a fee ranging between Rs 2 to Rs 12 per transaction for customers accessing IMPS from branches. This fee will continue to be applicable after August 1 as well, according to SBI's website.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.