As the Q2 results season is drawing to a close, we are back with another series of chemical stock picks with strong numbers and interesting business models. In this edition, we focus on Sadhana Nitro Chem ltd (SNCL, market cap: Rs 995 crore).

BriefSNCL is a chemical intermediate manufacturer that primarily makes Meta Amino Phenol (MAP), Aniline 2,5- Disulphonic acid and Colourformer ODB2.

Of these, MAP makes up the lion's share of the company's sales (71 percent). The company caters to end markets like paper, pharmaceutical, agro chemicals, thermal dyes, aerospace, dyes and hair dyes.

A majority of SNCL's revenue comes from exports (76 percent) and its major clients are L’oreal, Huntsman Advanced Materials, Tejin and Bayer Crop Science.

Turnaround in businessSNCL’s business witnessed a turnaround in the last couple of years after having reported losses for many years. Earlier, the company’s performance was weighed down by international competition, unfavorable product prices, a paucity of working capital funds and a leveraged balance sheet.

In FY18, its sales jumped 86 percent, aided by both favourable prices and a favourable volume mix. Higher capacity utilization and better operating leverage helped the company improve its EBITDA by almost three times.

Q2 results: sequentially high gross margins maintained

In the quarter under review, SNCL's sales improved 28 percent on quarter, aided by both elevated spot prices of MAP and higher capacity utilization (60-70 percent).

In the last one year, its sales have surged by five times and its cost of materials has only increased by about three times. News flow suggests that prices of MAP have increased by about 70 percent in the calendar year so far.

The rest of the sales improvement delta can be explained by higher production volumes.

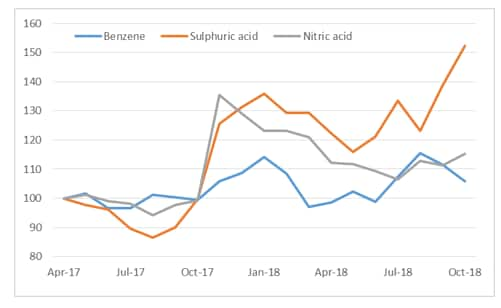

Further, prices of raw materials, especially those of sulphuric acid, have increased by about 50 percent in the last one year. The company's EBITDA margin stabilized to around 50 percent in the quarter under review.

Its profit before tax, however, surged by 60 percent sequentially on account of lower interest expenses. Net profit growth was relatively lower at 29 percent on quarter as the company started paying full taxes.

It is noteworthy that till Q1 FY19, SNCL was not paying full taxes because it was carrying forward its losses from earlier years.

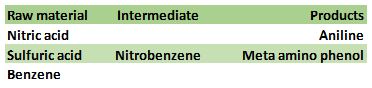

Nitrobenzene value chainSNCL’s expertise lies in a niche segment of the nitrobenzene value chain, for which it sources raw materials like benzene, nitric acid, caustic potash, sulphur based chemicals and iron powder.

Historically, volatility in basic chemical prices has been a key operational risk for the company. However, it manufactures the main intermediate, nitrobenzene, to meets its requirement.

This is a key positive for the company as not only does it aid margins but it also insulates the company from the sourcing risk. It is noteworthy that nitrobenzene imports have increased significantly in the last couple of years.

Table: Value chain

Source: www.sunsirs.com, Moneycontrol Research

Market dominant position in the segments of operationsSNCL claims to have a 90 percent market share in the domestic MAP market and is among the largest suppliers in the international market. MAP is used as an ingredient for hair dye colorants, stabilizers for plastic processing and tracer dyes.

Table: Capacity expansion plan

Given the improved demand for MAP and Aniline 2,5 Disulplionic acid, the company is increasing its capacity by 50 percent for each, which would be completed by the end of FY19. After the expansion, the net capacity of MAP is expected to be more than 3,000 tonne.

Secondly, SNCL has restarted production of CoIourformers (ODB2), which in turn is used as an input for coating of thermal paper. The company intends to raise its ODB2 capacity to 500 tonne per annum.

Thermal paper is a growing segment wherein a specific coating is used to facilitate inkless printing. It is used in healthcare (ECG, ultrasound printouts) and retail (point of sale receipts) and is gaining ground due to better accuracy and faster service.

The company estimates expansion projects to cost around Rs 65 crore, which would be funded through internal accruals.

ProspectsCurrently, SNCL is a key beneficiary of supply-demand imbalance in the MAP market. A shutdown of facilities in China on account of pollution norms enforcement have been the key trigger.

The company has used the resultant cash flows to deleverage its balance sheet and fund its expansion plan.

A key business risk for the company comes from the limited barriers to entry in the products under operation. It is witnessing supernormal profits for manufacturing a product derived from the nitrobenzene value chain.

However, there are already a few other strong players in the nitrobenzene or aromatic chemical segment that can look at this opportunity if the supply-demand imbalance persists.

To provide context, globally, more than 95 percent of nitrobenzene is used for the production of MDI, which in turn is used to make poly urethane (used as foams, footwear, insulation). However, a persistent supernormal profit can prompt many chemical entities to look at the MAP opportunity.

Back in India, GNFC is among the major producers of nitrobenzene, with an installed capacity of 47,250 tonne, much larger than SNCL’s own need. While the bulk of GNFC's capacity is used in-house for manufacturing derivatives like Aniline, it sells about 3,000 tonne to other entities.

Having said that, the size of opportunity is not huge enough (around Rs 2,000 crore) to attract any global/regional major. As far SNCL is concerned, its diversification into various end-market applications holds promise and helps it to move beyond the commodity play. Consolidation into the growing thermal paper business is also a positive.

The stock is trading at a multiple of 9.1 times the company's estimated earnings for FY19 earnings and majorly prices in near term growth prospects, wherein volume growth is expected to be the key driver.

The company’s product diversification plan is crucial for the re-rating, in our view.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.